Thursday’s ISO-NE Consumer Liaison Group meeting was largely a forum on the merits of energy storage and fossil-fuel generation and a critique of ISO-NE for continuing to power the grid with one instead of advancing the other.

The tone was due in no small part to the meeting being held in Peabody, Mass., where a controversial gas-fired peaker plant was recently built near environmental justice communities.

Two older gas- and oil-burning units stand near the new one.

Peabody resident Susan Smoller, a representative of Breathe Clean North Shore, asked: “What is the plan to replace these peakers with batteries and renewables?”

She called on ISO-NE to be sure the higher-emissions fuel — oil — is not used in the older units if gas is not available and urged that demand peaks be reduced so the Massachusetts Municipal Wholesale Electric Co.’s new 55-MW peaker plant is never turned on.

“In the least, let’s make sure that it is the last new fossil fuel infrastructure built in Massachusetts,” she said to applause from some of the 200-plus attendees.

“It’s ISO New England that holds the power to decide when our peakers run, and what they burn,” Smoller said.

Other speakers drilled down on the idea that ISO-NE favors fossil fuel interests.

“Every time we come and ask for a just transition, we hear these arguments that ‘ISO has to be neutral; we can’t take a political stance on one form of energy over another,’” another speaker said. “ISO is already deciding what fuels are present on our grid and picking fossil fuels. My question is, how do we fix this? Do we need to change the tariff? Do we need to abolish [the] ISO itself?”

Another speaker paraphrased a prior statement by ISO-NE that it would prioritize grid reliability and proper market function as the clean energy transition moved forward.

“I’d like you to reverse that,” he said — make preserving conditions for life on planet Earth the priority rather than keeping the lights on and the capitalist free markets functioning.

“What we really want to hear is that your heart is in saving life — not in the lights coming on every time someone wants to make an egg,” he said.

ISO-NE Vice President Anne George pushed back on almost every point.

“Reliability also affects lives,” she said to the last critic.

ISO-NE’s mission and vision statements show its commitment to a successful transition to a clean energy future, George said, but “we have to do it in a reliable way.”

Some of her other rebuttals:

- Anyone can participate in the wholesale market ISO-NE operates, if they meet reliability standards.

- The RTO is independent and is not beholden to fossil fuel interests.

- It agrees climate change is a threat and will use its tools to facilitate the energy transition.

- The RTO lacks authority to make the changes suggested at the meeting.

- It has advocated putting a price on carbon and embedding that into the wholesale electricity market to make renewables more competitive, but the RTO has found little support for such a move.

- ISO-NE provides the “huge” value of an independent body to oversee the market.

The transition of the market toward renewables will not be as rapid as critics are calling for, George said.

“It is not going to happen overnight, and it is not something we are dragging our feet on.”

Energy Storage

The variable nature of the wind and solar power the clean energy transition — at least in its early stages — will rely heavily on makes a fallback power source indispensable.

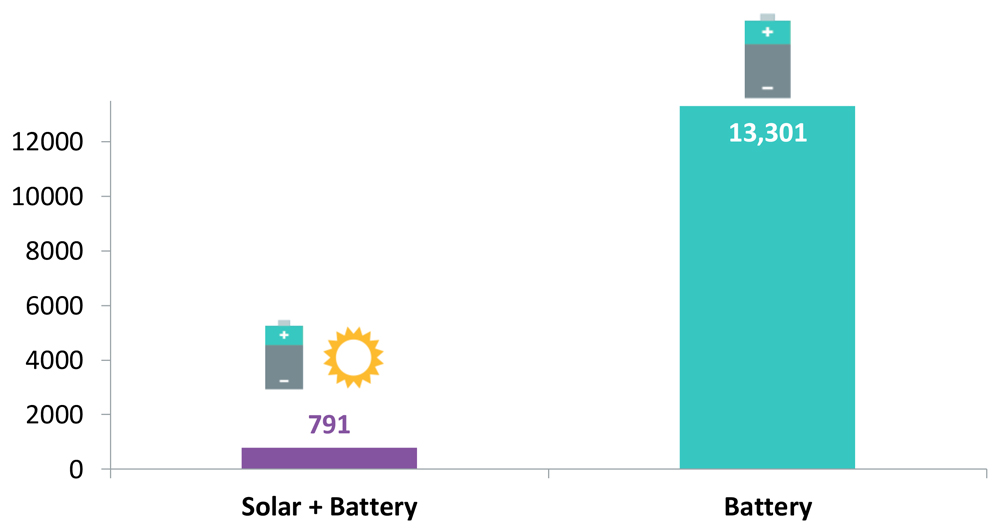

A major theme of Thursday’s meeting was using energy storage rather than fossil-fired peakers to meet that critical need.

Rosemary Wessel, founder of No Fracked Gas in Mass, and Chris Sherman, a vice president at Cogentrix, related their collaboration in western Massachusetts.

Wessel listed the health problems in neighborhoods surrounding two Cogentrix peakers in the heart of Pittsfield.

Sherman recounted the company’s decision to retire both, and to retire a third peaker in West Springfield, Mass.

The West Springfield site, with its three interconnections, will host a 45-MW/180-MWh battery energy storage system. The site could host as much as 100 MW, but 45 MW is what Sherman could convince the company and its investors to back.

Colette Lamontagne of National Grid said the utility has installed five storage systems in Massachusetts as demonstration projects and a nonregulated affiliate is developing renewable power generation.

Storage will be useful in easing the peak-demand transmission bottlenecks likely to arise as communities ramp up their use of electricity, she said, and provide a less expensive, more flexible alternative to building a new substation.

Jason Houck of Form Energy described the Massachusetts-based company’s pre-commercial efforts to develop longer-duration storage.

Sen. Joe Manchin and Energy Secretary Jennifer Granholm joined Form Energy in Weirton, W.Va., on May 26 to break ground on its first factory. At least 750 people are expected to eventually work there, fabricating iron-air batteries.

Form plans to build a 1.5-MW/150-MWh system in Minnesota next year for Great River Energy as a pilot project, then two 10-MW/1,000-MWh systems for Xcel Energy in 2025, one each in Minnesota and Colorado.

Both areas are seeing wind power replace coal power, Houck said, and have weather extremes, all of which creates the demand for storage.

An audience member at Thursday’s meeting asked him why Form Energy was not putting the projects in Massachusetts.

“We’d love to,” Houck said. “It comes down to the market structure. It’s a regulated market.”

It is easier to work under the other states’ integrated utility model, he added.

“In New York, New England, other markets, the utilities no longer own assets and don’t do planning; who do we partner with? In this region, the ISO has not historically played a role in commercializing new technologies.”

Priya Gandbhir, senior attorney at the Conservation Law Foundation, made a similar point about ISO-NE.

“We need the ISO to reform its market structure and prioritize getting clean energy up and running. We need the ISO to stop [looking] at the problem of how to fit clean energy resources into its existing market structures and rather to prioritize the just transition to our clean energy future.”