The Biden administration announced Thursday that it will auction approximately 3.7 GW worth of offshore wind energy leases in the Gulf of Mexico on Aug. 29, its first in the Gulf.

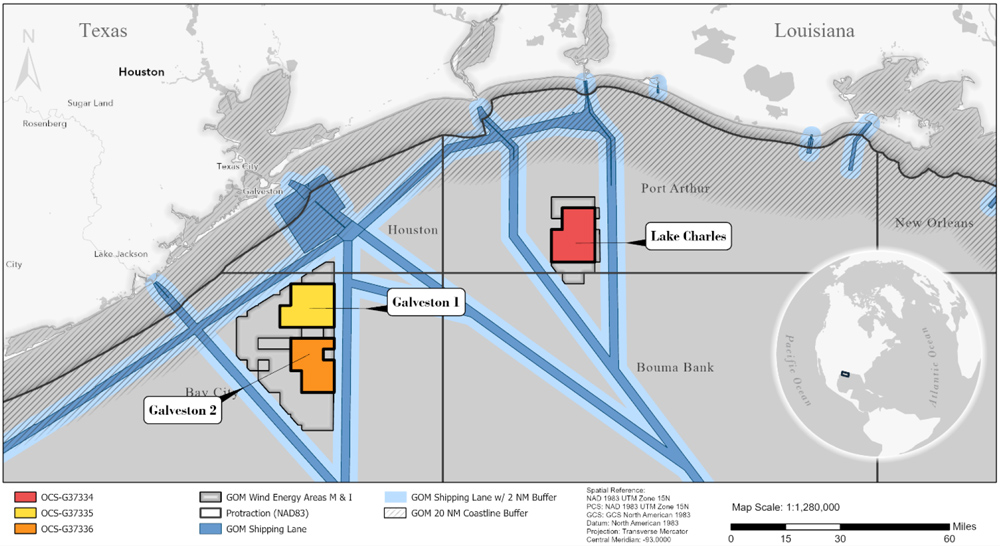

The Interior Department’s Bureau of Ocean Energy Management is responsible for selling the OSW leases, which comprise over 300,000 acres of federally owned waters, including a plot offshore Lake Charles, La., and two offshore Galveston, Texas.

The Interior Department announced in February it would make the leases available for sale. (See Interior Proposes 1st Lease for Offshore Wind in Gulf of Mexico.) A list of eligible bidders and stipulations is in the Final Sale Notice.

“The Gulf of Mexico is poised to play a key role in our nation’s transition to a clean energy future,” said BOEM Director Elizabeth Klein, adding that, “today’s announcement follows years of engagement with government agencies, states, ocean users and stakeholders in the Gulf of Mexico region.”

Reactions

President Joe Biden on Thursday touted the administration’s OSW efforts at a shipyard in Philadelphia, while his administration released a fact sheet touting its progress on the economy and clean energy.

“We’re going to the Gulf,” President Biden said at the “steel-cutting” ceremony for the Acadia, the first U.S.-built subsea rock installation vessel for wind turbine foundations. The $246-million vessel is being built for Great Lakes Dredge & Dock Corp.

The opening of OSW auctions in the Gulf is a key moment for Biden and his “Bidenomics” agenda, which emphasizes both climate action and domestic manufacturing, since the administration wants to deploy 30 GW of OSW by 2030.

Liz Burdock, CEO of the Business Network for Offshore Wind, celebrated the event alongside Biden. “The Biden-Harris administration is helping make offshore wind a reality by bringing certainty to the permitting process, making investments in ports and transmission and incentivizing domestic manufacturing,” she said.

“It was great to be with so many offshore wind leaders today as President Biden recognized the significant milestone this vessel construction represents for the U.S. supply chain, which comes amid a flurry of actions from BOEM in recent weeks to advance projects through the permitting process,” she added.

“As President Biden made clear today during his trip to visit the Acadia vessel in the Philadelphia shipyard, America’s historic investment in clean power is bringing manufacturing home,” said Josh Kaplowitz, vice president for OSW at the American Clean Power Association.

Helen Rose Patterson, senior campaign manager for OSW at the National Wildlife Federation, also commended the lease, but added, “we look forward to working with the Interior Department, wildlife experts and companies to ensure that potential offshore wind projects avoid, minimize and mitigate impacts to migratory birds, marine mammals, sea floor habitat, and deliver benefits to coastal communities.”

The National Ocean Industries Association (NOIA), which represents both OSW and fossil fuel companies, said, “with the introduction of offshore wind in the Gulf Coast, numerous local companies will now have the opportunity to actively participate in the construction of new wind projects closer to home.”