An offshore wind trade association last week summarized a recent record of remarkable progress in the young U.S. industry but added a caveat: There are severe economic threats to its continued momentum, with project delays and supply chain disruptions likely to continue.

The second-quarter report by the Business Network for Offshore Wind (BNOW) covers a period that contained a major milestone: The first “steel in the water” for the nation’s first two commercial-scale OSW projects — South Fork Wind and Vineyard Wind — following a decade of development work.

The report notes several other measures of progress:

-

- An 18% increase in OSW goals backed by legislative or regulatory directive, which reached 42.8 GW nationwide;

- The formation of a domestic supply chain; the first U.S.-made substation, monopile and export cables installed in U.S. waters; and groundbreaking on a component steel facility in Baltimore;

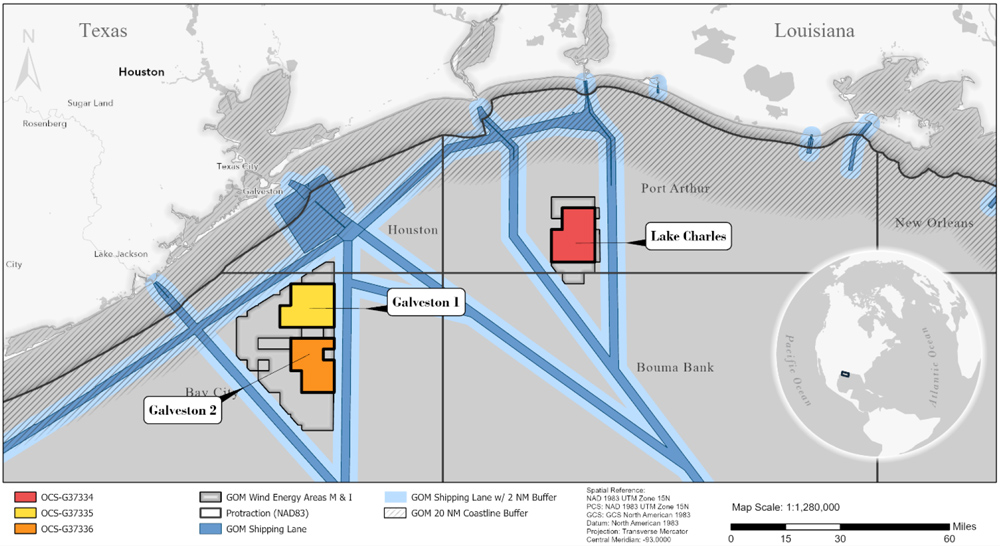

- Louisiana undertaking negotiations for wind farms in state waters, which is expected to be a faster development process than in federal waters;

- Total market investment reaching $21.6 billion, compared with $5 billion in 2021;

- The fleet of specialty vessels built or retrofitted in U.S. shipyards reaching 36, double the number in 2021;

- A total of 1,478 contracts awarded, 272% more than in January 2021; 64% went to U.S. companies and 90% went to companies with a U.S. footprint; and

- 29 ports are under development for manufacturing, marshaling and maintenance.

But then there are the headwinds.

The early wave of OSW projects is concentrated between southern New Jersey and southern Massachusetts, and one after another, developers in that region are saying they no longer can proceed with the projects under terms agreed to years ago because of soaring costs.

The 1,200-MW Commonwealth Wind project has reached an agreement to terminate its power purchase agreements, and the 1,200-MW SouthCoast Wind project is seeking to do the same, both in Massachusetts.

In June, developers of New York OSW projects totaling 4,200 MW told state regulators they may not be able to obtain financing without inflation adjustments.

Projects in New Jersey and Connecticut have sought concessions, as well.

BNOW called this “the duality of the industry” in its report: great strides forward, and a fallback to reassess finances. The trade organization said U.S. and foreign analyses suggest the cost structure has increased at least 20% in the past two years. It expects to start seeing project delays as a result.

In announcing the report, founder and CEO Liz Burdock highlighted the promise of longer-term growth as a new industry takes shape onshore to support the work planned offshore.

“Thanks to supportive federal and state policies, we are seeing unprecedented growth in the U.S. offshore wind supply chain across the nation,” she said Thursday in a news release.

“New contracts are signed daily with a vast majority going to small- and medium-sized American companies creating thousands of new jobs. With $7.7 billion in new U.S. offshore wind investments since the Inflation Reduction Act was signed into law, this is just the beginning. We will see many more factory openings, port revitalizations and vessels under construction in the years to come.”