ISO-NE projects an approximate 47% decline in gas generation for the year 2032 compared to current levels but expects coal and oil generation to increase by 45% to meet winter peak loads, the RTO told its Planning Advisory Committee on Tuesday.

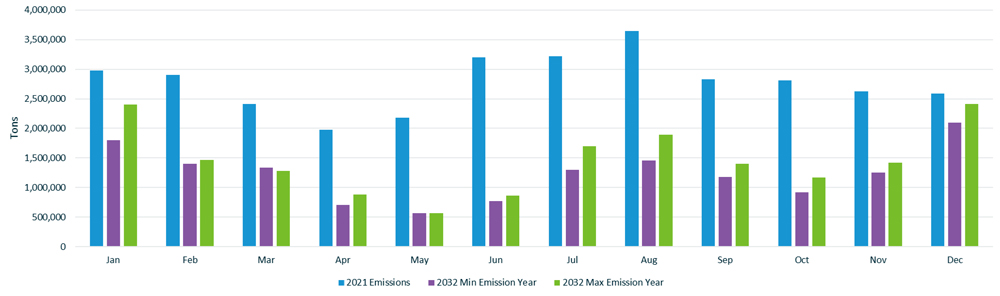

Despite the expected winter increase in coal and oil generation, ISO-NE anticipates emissions declining across all months by 2032, with the largest emissions reductions coming in the spring, summer and fall. ISO-NE projects annual emissions being nearly half of 2021 levels, declining from about 30 million tons of carbon per year to 16 million tons.

These findings are part of the RTO’s ongoing Economic Planning for the Clean Energy Transition pilot study. The study takes into account the increase in peak load due to electrification projected by ISO-NE’s 2023 Capacity, Energy, Loads and Transmission report. (See ISO-NE Increases Peak Load Forecasts.)

“Additional PV and wind resources beyond what is already in the model may help alleviate demand for dispatchable generation, but the needed volume of energy is significant,” said Benjamin Wilson of ISO-NE. “Some additional energy storage will likely be needed to shift the energy from when it is produced to when it will be needed.”

Wilson said the results indicate overall lower production costs and locational marginal prices due to the influx of zero-marginal-cost energy resources replacing gas generation.

“The system may experience an increase in reliance on stored fuels (LNG, oil, and coal) in the winter despite the new wind, solar and energy storage resources,” Wilson added.

The results contain limits: The study did not model generator outages and includes generators that did not receive capacity supply obligations in the latest Forward Capacity Auction and may retire prior to 2032. This includes the Merrimack Station, the last coal-fired generator in New England. The study also assumes continued operations of the Everett LNG import terminal for 2032.

“A reduced LNG capacity would lead to an increased demand on other stored fuel resources,” Wilson said.

Transmission Planning

Also at the PAC, Dan Schwarting, manager of transmission planning at ISO-NE, presented initial high-level takeaways from the RTO’s 2050 Transmission Study, looking at meeting the transmission needs of the region for 2035, 2040 and 2050. ISO-NE expects a draft of the study to be ready to present to the PAC in November.

Schwarting told the committee early results indicate relatively small reductions in the projected 2050 winter peak load are associated with outsized reductions in transmission costs.

A 10% reduction of ISO-NE’s initial 57-GW winter peak “snapshot” for 2050—which represents the electrification of nearly all the region’s heating using existing technology—would be associated with a roughly one-half to one-third reduction in transmission costs, Schwarting said.

Despite uncertainty in predicting future load concentrations and generator locations, Schwarting said some high-likelihood upgrades could be pursued in the near term, including increasing capability for north-south transfer and Boston imports.

“Investment in addressing these concerns may be prudent regardless of exact generator locations and load distribution,” Schwarting said.

To meet the future needs for north-south transfers and Boston imports, Schwarting laid out four potential pathways: prioritizing rebuilds of existing lines, building new 345-kV overhead transmission, building new HVDC transmission lines or building an offshore grid that would enable power transfer between states and regions.

“In many parts of New England, addressing concerns by rebuilding existing lines for higher capacity is clearly more cost-effective and feasible,” he said, adding that using this approach to address all regional needs could end up being more expensive than the alternatives, and this path could not scale up to meet a 57-GW peak demand.

Schwarting highlighted some potential benefits of an offshore grid, including the ability to move power between interconnection points when capacity is not taken up by wind power.

“For example: In summer daytime peak snapshots, wind is assumed to be at 5% output. The remaining 95% of cable capacity is available to transfer power from one point of interconnection to another,” Schwarting said. “Beyond what is modeled in the 2050 Transmission Study, these grids could be expanded to include wind farms connecting to New York, PJM or other neighboring areas.”

Schwarting emphasized that providing a full cost/benefit analysis of an offshore grid is beyond the scope of the study, which will look only at approximate costs and a limited set of benefits.

“While significant research and development towards offshore transmission has been performed in Europe, meshed offshore HVDC systems are not yet in use commercially,” Schwarting added, noting the National Renewable Energy Laboratory is conducting a two-year study into Atlantic offshore wind transmission that will consider the potential for an offshore grid.

Asset Condition Projects

Eversource, National Grid, and Avangrid presented on several asset condition projects totaling over $100 million:

-

- Eversource expects to spend about $31 million on structure replacements and optical ground wire installations on one 115-kV line and two 345-kV lines in Connecticut, citing age-related issues including woodpecker damage, cracking and splitting, and damaged insulators and deteriorated steel hardware. The expected in-service dates for the projects range from late 2024 to early 2025.

- National Grid proposed spending about $6 million to replace five 69-kV and six 115-kV Oil Circuit Breakers at the Northboro Road Substation in Northboro, Mass.

- Avangrid increased its cost estimate for its 115-kV Derby Junction to Ansonia Line Rebuild Project, proposing to spend $71 million to rebuild the line, nearly doubling the cost compared to its 2021 estimate of the rebuild. The company said the rebuild would extend the life of the line by at least 50 years.