CAISO asked FERC on Tuesday to approve its tariff revisions implementing an extended day-ahead market (EDAM), as well as revisions to its existing day-ahead market that also would apply to the new regional market (ER23-2686).

The EDAM has been in discussion for several years. The proposal would make the ISO’s day-ahead market available to participants in the Western Energy Imbalance Market (WEIM).

The proposed revisions, called the Day-Ahead Market Enhancements, are meant to better align day-ahead market outcomes with real-time conditions, which has proven more difficult because of the growth in intermittent resources and more common extreme temperatures as a result of climate change.

“Filing the EDAM tariff with FERC is an important milestone for the CAISO and our partners across the West,” CAISO CEO Elliot Mainzer said in a statement Wednesday. “EDAM and the day-ahead market enhancements will build on the success of the Western Energy Imbalance Market and go even further in lowering costs and improving reliability for electricity customers throughout the region. I am grateful for the strong engagement and participation from the diverse group of stakeholders who worked tirelessly to help shape and refine these tariff provisions.”

CAISO estimates the EDAM will save between $100 million and $1 billion annually, which comes on top of benefits already produced by the WEIM. (See West Could Save $1.2 Billion a Year in CAISO EDAM.)

The EDAM represents the most significant market enhancement for CAISO and the West since the WEIM was established in 2014, the ISO told FERC. The proposal will enhance reliability, cut costs to ratepayers, optimize generation dispatch across a broader footprint and help participants and states achieve clean energy policies.

Any participants in the WEIM can join the EDAM, with PacifiCorp having said it plans to. (See PacifiCorp to Join EDAM, Final Plan Released.)

Market Enhancements

The proposed Enhancements would establish two new products: imbalance reserves and reliability capacity. Both products are aimed at cutting the “load imbalances” between day-ahead market outcomes and the real-time market.

“Two sets of forecasts drive the net load forecast: the gross forecast of load and the production forecast from wind and solar resources,” the filing said. “Unless these forecasts for the day-ahead market perfectly match the forecasts for the real-time market, an imbalance is unavoidable.”

Net load imbalances are to be expected, but they have grown in recent years as increasing intermittent resources and extreme weather make grid conditions the next day more difficult to predict.

CAISO relies on its out-of-market residual unit commitment (RUC) process to adjust the load forecast and thus avoid being short of the online capacity and ramp capability needed to maintain reliability.

Under the Enhancements, the ISO would procure imbalance reserves up and down to meet the range of expected imbalances between the day-ahead and real-time net load forecasts. It also would procure reliability capacity up in the same way it procures RUC capacity for the same reason currently, and procure reliability capacity down to address scenarios in which the day-ahead market awards too much energy relative to the forecast.

Imbalance reserves would be flexible reserve products to cover uncertainty in the net load forecast and real-time ramping needs not covered by hourly day-ahead market schedules. Any resources-procured imbalance reserves would have to submit economic bids in the real-time market for its awarded capacity range.

Reliability capacity would meet the positive or negative differences between cleared physical supply in the integrated forward market and the load forecast. It is similar to the RUC process, but it also could deal with situations when actual demand exceeds the forecast, while RUC does only the opposite.

“With the bidirectional reliability capacity product, the CAISO will replace the existing unidirectional RUC capacity product it procures today with the reliability capacity up product as well as the ability to procure decremental capacity with the reliability capacity down product,” the ISO said in its filing.

Suppliers for both products would provide bids for both up and down products. Each bid would have a single price/quantity pair, with imbalance reserves having a $55/MWh cap and reliability capacity bids at $250/MWh.

EDAM Tariff

The EDAM offers a voluntary regional day-ahead market by using the ISO’s current day-two market with targeted adjustments that recognize the unique challenges and needs of the WEIM balancing authorities that might participate and other market participants. The new marker would include the Day-Ahead Market Enhancements.

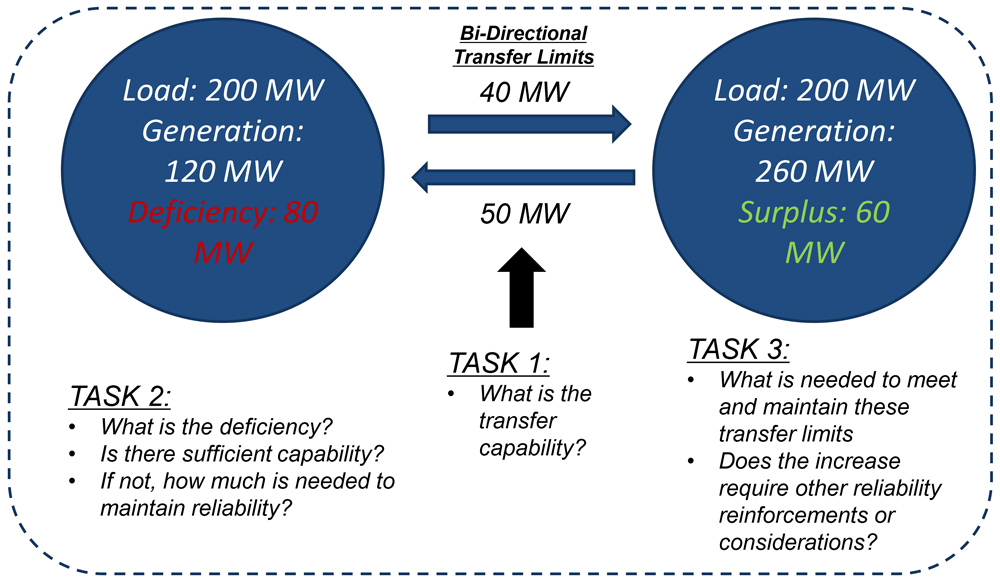

“For the balancing authorities that join, the extended day-ahead market will settle all loads and resources in the day-ahead timeframe and all imbalances between day-ahead positions and the real-time market,” CAISO said. “The extended day-ahead market will optimize the transmission and resources offered into the market to identify the most efficient resource commitments and energy transfers to meet forecasted demand across the footprint.”

Like WEIM, entities participating in the EDAM would have to show they meet readiness criteria to ensure the ISO and participants are prepared for the operation of the day-ahead market in each balancing area. The proposal also has transitional measures to insulate participants from adverse impacts when the market goes live.

The new market would provide legacy transmission contracts and transmission ownership rights in an EDAM balancing area with a scheduling priority and settlement process consistent with existing mechanisms in the ISO’s tariff while making the flow capability available to the entire market.

Another similarity with WEIM is that every balancing authority in the EDAM would have to go through a process ensuring it has enough resources to meet demand, with those that pass being pooled together for the regional real-time market, and those that fail getting a chance to cure that in the integrated forward market.

The EDAM also would take into account the fact that some of the states covered have greenhouse gas regulations, but others do not, by requiring bidders outside of them wishing to sell into such states to include an adder for emissions costs.

The process for joining the EDAM would be based on that for WEIM, with implementation agreements, onboarding cost recovery mechanisms and onboarding processes before participation begins.

CAISO told FERC it could reject the EDAM and still approve the Enhancements, but the latter are needed to approve the EDAM. The new market needs the changes to manage the increasing system variability and uncertainty around the West, but the Enhancements would benefit CAISO’s own markets enough to warrant their approval alone, the ISO argued.

The ISO asked FERC for an order by Dec. 21 and asked for an extension of the due date for comments to 30 days after its filing, with replies to be due 20 days after that.