Virtual power plants can economically replace many of the country’s 217 GW worth of peaking power plants, which emit pollution like nitrous oxide and are often located in population centers, the Clean Energy Group (CEG) said in a webinar Thursday.

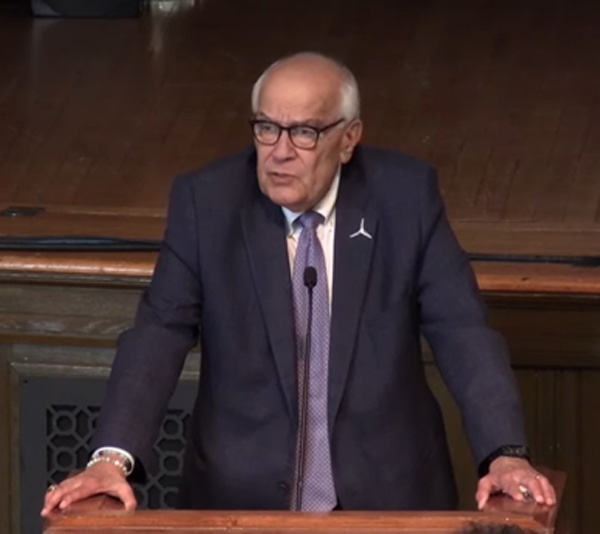

VPPs are portfolios of distributed energy resources that include resources like demand response, rooftop solar, smart water heaters, plugged-in electric vehicles, batteries and other resources that are controlled by utilities or independent aggregators, said Brattle Group Principal Ryan Hledik. He authored a study released earlier this year finding VPPs were the cheapest option for resource adequacy. (See Brattle Group Finds VPPs Cheapest Alternative for Resource Adequacy.)

“The idea with a virtual power plant is that a utility or an aggregator will control those distributed energy resources,” Hledik said. “And then ultimately, the control of those resources is done in an orchestrated, managed way to provide benefits to the power system.”

Using the pre-existing resources is cheaper up front than installing peaking power plants or energy storage systems, and it helps cut emissions. Those benefits are split between the firm running the VPP program and its customer participants, Hledik said.

VPPs are gathering momentum because many of the costs of the DER technologies they rely on are coming down, and the expectation is that this will continue over the long run. The Inflation Reduction Act provides incentives for many of the resources, while policies like FERC Order 2222 require markets be open to aggregations of DERs.

The industry spent $120 billion on capacity that was needed to maintain resource adequacy in the last decade, and most of that went to natural gas plants, though in recent years batteries have seen an uptick in investment, said Hledik.

Brattle’s analysis found that a utility with about 1.7 million customers could use a 400-MW VPP to maintain reliability. The VPP in that scenario would help lower load in both summer and winter, and be dispatched in seven months for a total of 63 hours, up to seven hours at one time, said Hledik.

While some utilities have adopted VPPs already, with the Upper Midwest’s Otter Tail Power and Vermont’s Green Mountain Power being listed as examples on the webinar, others are more cautious about relying on VPPs for the same level of reliability as power plants or grid-scale batteries.

“A lot of times we do encounter utilities or system operators who don’t yet trust the ability of VPPs to operate and perform the way a gas peaker might or utility-scale battery might,” Hledik said. “Just pushing the button and getting it to run is a little different when you think about the fact that there are customers on the other end of this.”

That kind of resistance can be overcome by doing pilot programs and seeing other utilities already successfully relying on VPPs, he added.

The shift to VPPs from gas-fired peakers can have major health benefits because some 154 GW of the power plants are in urban areas, and 32 million Americans live within three miles of one and their NOx emissions, said CEG’s Shelley Robbins.

“Because of the way they run, you pretty much can’t capture that NOx,” said Robbins. “Because they don’t run at a baseload level, the systems that capture pollutants don’t work on these plants.”

NOx is a small particle that easily gets into the entire body through the lungs and is associated with conditions such as asthma, inflammation, cognitive decline, Parkinson’s, Alzheimer’s, premature birth and other medical conditions.

The peaking power plants are often located in urban areas, with a map CEG produced showing their locations overlaid on the most populous areas of the country. New York City is home to about 6 GW of peaking capacity, including some plants that are more than 55 years old, said CEG President Seth Mullendore.

To grow VPPs going forward, one policy that states could adopt is what CEG calls the “Connected Solutions Model,” said its senior project director, Todd Olinsky-Paul.

“Through this mechanism, homes and businesses with batteries and other types of renewable resources can supply capacity and energy to the grid during peak demand times and also retain the use of those batteries for resilience and other needs,” said Olinsky-Paul. “And in return, they get paid by the utility; whereas the utility would ordinarily pay a peaker plant, now they’re paying participating customers for these services.”

Customers would purchase distributed resources and sign multiyear contracts with utilities to be able to dispatch them using a VPP model, he added. It is important that such programs offer some upfront equity because often the people who want to participate the most and save on their monthly bills can least afford the upfront payments for DERs.