RENSSELAER, N.Y. — NYISO on Tuesday updated the Transmission Planning Advisory Subcommittee (TPAS) and Electric System Planning Working Group (ESPWG) about the New York City Public Policy Transmission Need assessment.

Ross Altman, transmission integration manager at NYISO, outlined the baseline case assumptions and methodology for the forthcoming viability and sufficiency assessment, which evaluates whether a proposed transmission solution would fulfill the deliverability requirements set forth by the state’s Public Service Commission.

The PSC called for solicitations from energy developers that could deliver at least 4,770 MW of offshore wind energy from Long Island’s coast to New York City and fulfill the state’s goals of producing 9,000 MW of OSW by 2035. (See “NYC PPTN,” NYISO Addresses NYC Near-Term Reliability Need.)

Developers will work with Consolidated Edison, the company responsible for Long Island’s transmission system, to design a solution that not only delivers energy to the city, but also upgrades the local buildout to be more resilient to higher voltage outputs.

Several attendees were apprehensive about the timing of the required technical conference on the PPTN and whether there would be enough time to have it by the end of the year, as the meeting will be the first chance to learn more about the PPTN and ask both NYISO and Con Ed questions before solicitations are issued. The conference is slated for the fourth quarter.

Altman told questioners to expect the meeting to happen before December, but that the ISO will provide details on the conference as soon as possible. The conference “is very much top of mind, and our intent is to get this kicked off soon,” he said.

Kevin Lang, partner at Couch White, asked how energy storage will be considered.

Altman responded, “We will certainly have certain amounts of storage modeled, especially projects that have gone through Class Year 2021; however, [the ISO] will be modeling them at zero output, so not injecting or absorbing.”

Lang also asked for clarification on the baseline case assumptions related to downstate renewable output and what the presumed energy production conditions will be in a proposal’s evaluation.

Altman said the assumptions are set around 10 to 15% for solar output and OSW at full output: “Imagine it will be a very windy, slightly sunny condition.”

The ISO asks any questions to be sent to publicpolicyplanningmailbox@nyiso.com.

Long Island PPTN

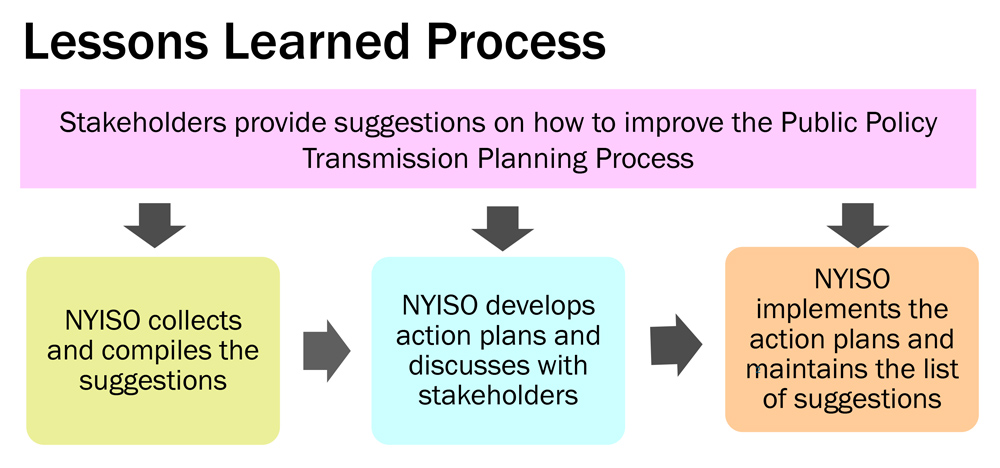

NYISO also kicked off its lessons-learned process for the Long Island PPTN solicitation, which selected Propel NY Energy to facilitate the delivery of offshore wind energy throughout the state. (See NYISO Selects Propel Project for Long Island Transmission.)

Altman said the ISO is willing to consider all improvements to the process and wants stakeholders to provide feedback that could improve the current New York City PPTN and future solicitations.

Michael Mager, a partner at Couch White, said many developers were struck by the huge discrepancies that occurred between developers’ bids and the estimated cost by the ISO’s consultant —sometimes trillions of dollars.

Altman acknowledged the potential differences but expressed confidence in NYISO’s estimates. He said any further questions, concerns or suggestions should be sent to PublicPolicyPlanningMailbox@nyiso.com.

System & Resource Outlook

NYISO staff presented the preliminary outline for the second System & Resource Outlook report.

The biannual Outlook forecasts New York’s transmission system for the next 20 years and came in response to the state’s Climate Leadership and Community Protection Act, which mandated aggressive goals climate and energy goals that forced the ISO to adjust its system forecasting processes. (See “NYISO Releases the Outlook,” NYISO OC Discusses NOPR Comments, High Temps, EDS Results.)

The report will be benchmarked to 2021 and modeled on an hourly load profile. It will include new emission-allowance considerations and programs, such as the Ontario Carbon Price scheme or the Regional Greenhouse Gas Initiative.

Chris Wentlent, chair of the New York State Reliability Council’s Executive Committee, and Howard Fromer, who represents Bayonne Energy Center, asked whether NYISO considered the state’s cap-and-invest policy, which would establish dynamic limits on emissions-producing activities and is working its way through state agencies. (See NYISO to Comment on State’s Cap-and-invest Plan.)

NYISO responded that it could be considered as part of the Outlook’s base assumptions should it become pertinent.

Additional feedback or questions must be sent to Jfrasier@nyiso.com at least one week prior to the ESPWG’s meeting Sept. 21.

FERC Order 2023

The TPAS/ESPWG also received an update on the status of FERC Order 2023 compliance from NYISO, which said it is focused on the potential requests for rehearing or clarification on the order.

FERC’s July order sought to unclog interconnection queues by imposing financial penalties. (See NYISO ‘Still Digesting’ FERC Order 2023.)

NYISO attorney Sara Keegan told members the deadline for requests is next Monday but the ISO has not made a final determination on whether to submit a request. It will work to develop a compliance strategy after all rehearing and clarification motions are addressed.

Mark Reeder, representing the Alliance for Clean Energy New York, asked how the commission’s order would fit into NYISO’s ongoing work on its interconnection queue.

Keegan responded that “the order was pretty generous about independent entity variations” and seems flexible enough to work NYISO’s own proposals into the compliance directives, but this avenue is still under consideration.

Keegan added that compliance filings are due within 90 days of the rule’s publication in the Federal Register, but she does not expect that date to be earlier than late November; also, extension requests could be filed, which would further delay the process.