CARMEL, Ind. — State regulators of MISO South are withholding support for MISO’s plan to implement a sloped demand curve in its capacity auctions based on a proposed option for states to shield themselves from the effects.

The majority of Organization of MISO States members sent a letter last week to MISO CEO John Bear, urging MISO to move away from a vertical demand curve and file for FERC approval on a sloped demand curve in the fall so it can be implemented in the 2025/26 planning year. OMS said a sloped demand curve is essential to the footprint’s future reliability.

“MISO’s current resource adequacy construct does not provide the true value of capacity and does not address the resource adequacy challenges facing the MISO region. As a result, it does not send the price signals that motivate the decisions necessary to maintain MISO’s systemwide reliability going forward,” OMS said.

MISO shares the goal to make a fall filing and use a sloped curve in the 2025/26 Planning Resource Auction. (See MISO: Sloped Demand Curve Would Have Raised 2023/24 Capacity Prices.)

During an August OMS board meeting, North Dakota Commissioner Julie Fedorchak said the sloped demand curve is “one of the most important, immediate” things MISO could do to support reliability and send a signal to dispatchable generation that their output is valuable.

However, OMS’ letter is not unanimous: MISO South states did not sign on, since OMS backed MISO’s opt-out provision contained in the demand curve proposal. The opt-out is meant to respect state jurisdiction over resource adequacy.

MISO’s opt-out provision is shaping up to require load-serving entities to opt out of the sloped demand curve for three years at a time, provided they can prove they have anywhere from 1.5 to 3% over their planning reserve margin requirement. Failure to meet the obligation could result in penalties that are 2.7 times the cost of new entry for generation.

Entergy has said MISO’s design is too harsh and instead has advocated that for LSEs to opt out, they must prove they can meet 50% of their planning reserve margin requirement for three consecutive years.

MISO staffers have said the Entergy proposal resembles the RTO’s failed attempt to institute a 50% minimum capacity obligation. (See FERC Again Rejects MISO Minimum Capacity Obligation.)

Entergy put its proposal forward for a stakeholder vote this month; the measure passed 25-20 in an email vote.

Speaking at an Aug. 22-23 Resource Adequacy Subcommittee meeting, Bill Booth, consultant to the Mississippi Public Service Commission, said a full third of MISO members opposed the letter of support, not exactly an “overwhelmingly majority” of MISO states supporting MISO’s proposal.

MISO’s Mike Robinson said the opt-out was borne out of the understanding that most of MISO’s load-serving entities already engage in some sort of integrated resource planning.

“And we respect that,” Robinson added.

Robinson said MISO isn’t on the hunt for a convex shape to the demand curve; rather, its loss of load expectation studies are informing the shape.

“If we’re going to do this auction, let’s do it right, and make sure the supply and demand reflect market fundamentals, and stand up a more efficient market,” Robinson said.

Stakeholders Question Separate Curves for Midwest, South

Meanwhile, some stakeholders remain dissatisfied with MISO plans to develop separate demand curves for its Midwest and South subregions.

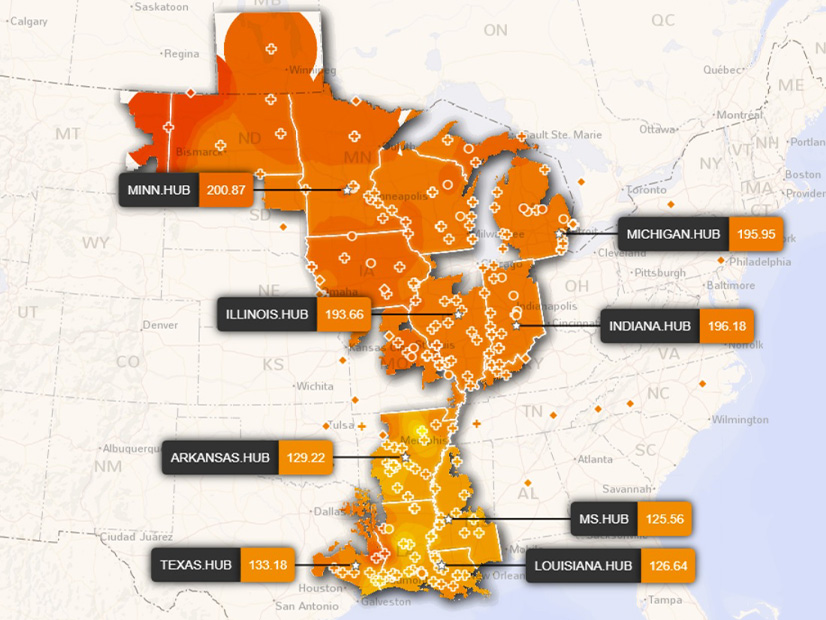

MISO plans to churn out separate, seasonal demand curves for MISO Midwest and MISO South to account for seasonal margin requirements and the possibility of the transfer constraint binding. MISO said it will develop curves independent of one another based on its systemwide loss of load expectation study.

But stakeholders said they struggled with the rationale to create separate curves. Customized Energy Solutions’ David Sapper asked why MISO would continue to calculate a footprint-wide planning reserve margin requirement but maintain subregional demand curves.

Robinson said MISO is starting from established practices that it’s comfortable with.

“We made a conscious decision not to change the loss of load analysis,” MISO’s Neil Shah said. MISO’s loss of load analysis doesn’t currently contemplate MISO’s subregional transfer limit.

WEC Energy Group’s Chris Plante said applying separate curves for the Midwest and South creates a “slippery slope” because market participants place different values on excess capacity.

“Where does it end?” Plante asked. “We could create separate curves for each local resource zone. … There’s a limit to where we can keep tacking things onto our [resource] adequacy construct.”

“This was a compromise,” Executive Director of Market and Grid Strategy Zak Joundi said, adding that MISO began with the assumption that it would have a single curve. However, he said that’s not how the system operates and how recent Planning Resource Auction clearing prices have shaken out. MISO has experienced price separation between the Midwest and South multiple times after capacity auctions.

MISO Independent Market Monitor David Patton said he was confused as to why MISO is treating the Midwest and the South as if they’re “islands” with the curves when that’s not how the system operates. MISO had said it’s unlikely but possible under the new curves for price separation between the regions to occur even without a binding subregional transfer limit, prompting Patton’s remarks.

WPPI’s Steve Leovy said MISO is pursuing a “very aggressive timeline” that could result in some “half-baked” concepts finding their way into the filing.

As part of the move to a sloped curve, MISO will remove its annual price cap. In the future, the total annual price for a local resource zone could reach as high as four times the cost of new entry (CONE) if shortages occur in all four seasons. MISO’s current auction design employs a 1.75 times CONE price cap for a local resource zone.

MISO’s new curve design will preserve states’ right to set their own planning reserve margin for their jurisdictional utilities. To date, no state has ever elected to supersede MISO’s reserve requirements.