EPA was deluged with comments Tuesday on its proposal to limit greenhouse gas emissions from existing plants, with supporters and opponents urging changes to what the agency produced. (See EPA Proposes New Emissions Standards for Power Plants.)

Filing as the “Joint ISOs/RTOs,” four organized electricity markets — ERCOT, MISO, PJM and SPP — told EPA that the power plant rule could exacerbate the trend of retirements outpacing the commercialization of new resources needed to produce vital reliability attributes.

“The Joint ISOs/RTOs have long been at the forefront of renewable energy integration but have seen an increasing trend of retirements of dispatchable generation, which provides critical attributes that are needed to support the reliable operation of the grid,” the grid operators said. “Although each region is working to facilitate a substantial increase in renewable generation, the challenges and risks to grid reliability associated with a diminishing amount of dispatchable generating capacity could be severely exacerbated if the proposed rule is adopted.”

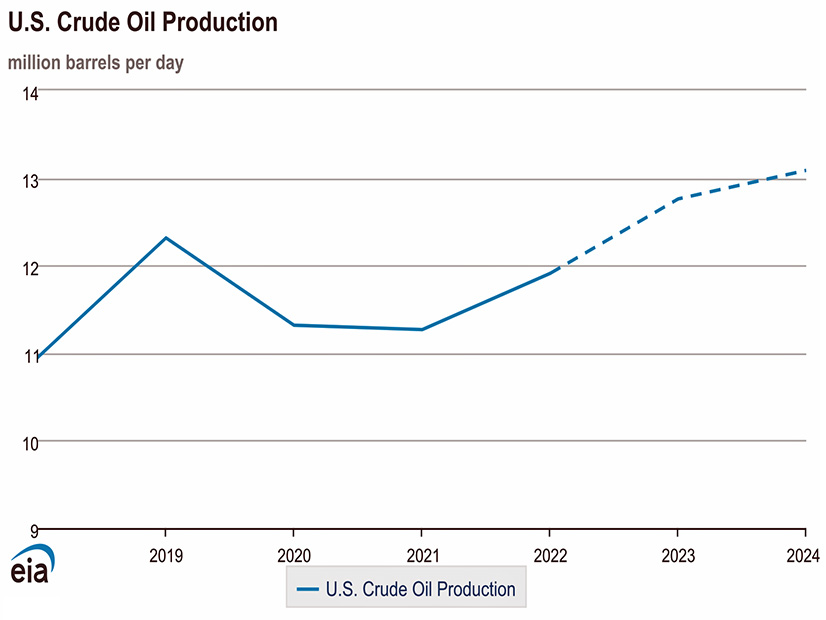

While EPA has created subcategories of dispatchable generation in an attempt to stagger retirements, its rule assumes that new, low-greenhouse gas substitutes will be available, and that existing plants will be able to retrofit with carbon capture and storage (CCS) or co-fire with clean hydrogen. The grid operators said the proposal overstates the commercial viability of CCS and clean hydrogen while ignoring the cost and practicalities of developing new supporting infrastructure.

EPA should do additional analysis and address the potential reliability impacts of its proposal before moving forward with a final rule, the Joint ISO/RTOs said. If EPA decides to go forward, the grid operators suggested that it allow for a new sub-category of existing units, which are needed for local or regional reliability until alternatives are running that address the reliability issues. ISOs and RTOs would identify such units, in a process similar to reliability-must-run agreements.

“To be clear, the reliability sub-category is not a panacea,” the Joint ISO/RTOs said. “It still would leave generation owners with considerable uncertainty as they assess the long-term future of market participation.”

But the reliability sub-category could keep some generation that would put reliability at risk if it retired too early running while viable alternatives are developed and can be deployed economically and practically, they said.

The agency should also build a regular technology review into the rule to determine whether CCS and hydrogen-fired generation are developing quickly enough to meet compliance timelines, the grid operators argued. That would help balance the pace of retirements with needed replacements, they said.

The rule suggests states could develop allowance trading systems, but the ISO/RTOs said it should provide specific recognition of allowance trading on a regional, if not national level to allow for greater flexibility and to allow units that can “over comply” early to do so (and sell any excess allowances that leads to).

The Joint ISO/RTOs also want a tweak to the proposal’s definition of a system emergency, which would apply under “any abnormal system conditions.” That “abnormal” is unnecessary because grid operators already have to determine that the generator in question was needed for reliability, they said.

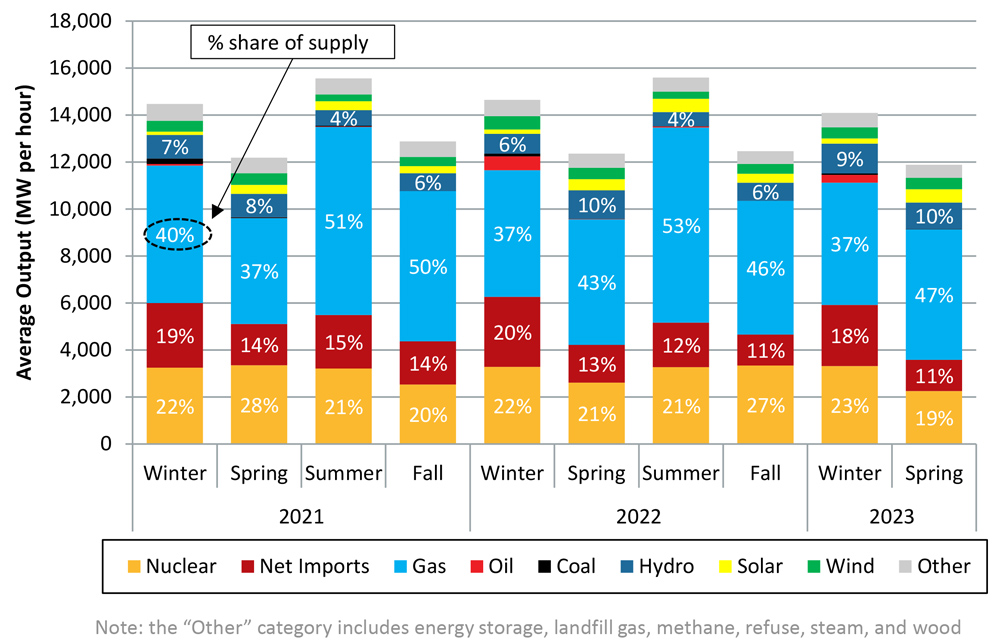

ISO-NE filed its own comments, which noted that while it had lacked the time for a complete analysis of the rule, it believes some of EPA’s proposals could actually work against reducing emissions. When it comes to natural gas power plants, the proposal is focused on combined cycle plants above 300 MW that operate more than half the time.

“The resulting effect is a shift in generation from these large EGUs [electric generating units] to the smaller, less efficient EGUs,” ISO-NE said.

ISO-NE’s modeling assumes all coal generation will be retired by 2032 and the grid will have less generation from large gas plants, which means the grid will rely on active demand response (ADR) much more often than it does now.

“If ADR resources dispatch as often as they are in the results of the ISO’s analysis (a large increase from today), some resources may no longer choose to provide ADR,” ISO-NE said. “In the absence of ADR, other load in this model would go unserved.”

EPA has not released a related rule on how it plans to regulate smaller natural gas plants, and ISO-NE said it was difficult to determine how its system would be impacted without those details.

Broad Opposition to CCS

A diverse array of stakeholders challenged EPA’s designation of CCS as a best system of emissions reduction (BSER), arguing the technology has not been “adequately demonstrated,” as the proposed rule states.

Representing a consortium of environmental justice and conservation groups, the Clean Energy Group (CEG) argued that carbon capture could increase greenhouse gas emissions. “Because of the additional fuel needed to power CCS equipment itself, electricity generation paired with CCS requires up to 44% more fuel than standalone power generation,” it said. Emissions of nitrogen oxides (NOx) and particulate matter, generally not captured by CCS technology, would also increase.

Leading a group of five other unions, the International Brotherhood of Boilermakers pointed to the $2.5 billion in the Infrastructure Investment and Jobs Act (IIJA) for CCS demonstration projects as clear evidence that the technology is not at commercial scale, nor is likely to be within the time frames the rules suggest.

Power plants with a retirement date of 2040 “would need to begin preparations for a major CCS retrofit project — engineering, financing, permitting and related activities — as soon as possible following a final rulemaking,” the unions said.

EPA’s requirement that these plants capture and sequester 90% of their CO2 emissions “itself is objectionable because these units likely differ widely in age, size, capacity factor, access to suitable CO2 storage capacity, and the technical and economic feasibility of retrofitting CCS.”

Other commenters pointed to the lack of adequate pipelines and storage facilities and the lead time needed for buildout.

Mississippi’s Office of Pollution Control suggested that the agency’s promotion of both CCS and hydrogen were intended to build demand for the technologies as a means to justify the incentives they would receive from the IIJA and the Inflation Reduction Act.

“However, the cost and feasibility of constructing thousands of miles of pipeline to address the CO2 and hydrogen infrastructure requirements is not contemplated in the proposed rules or regulatory impacts analysis. EPA provides no substantive evaluation of the environmental impacts constructing thousands of miles of additional pipeline will have, including additional air emissions that may be generated from compressor stations required along these pipelines or associated with sequestration and storage facilities.”

Even the Carbon Capture Coalition, an industry advocacy group, said that while EPA’s time frame for getting CCS projects planned and online is possible, “there are several potential economic and practical delays due to project permitting and financing. EPA should clearly specify what happens when factors outside the owner’s control delay construction or operation of a carbon-capture system.”

The coalition called for “a cohesive national plan” for CCS buildout.

“We urge EPA to work with states to make available supportive infrastructure and a robust and timely permitting process to deploy carbon-capture technologies not only at individual facilities but in a coordinated regional manner.”

EEI Offers to Work with EPA

The Edison Electric Institute said that while its members are committed to cleaning up the grid, with 41 having committed to getting to net-zero emissions by midcentury, some elements of EPA’s proposal need to change to get that job done while maintaining reliability.

“While there are challenges presented by the proposed [Clean Air Act Section] 111 rules, these challenges are technical in nature,” the investor-owned utility trade group said. “EEI and our member companies share EPA’s goals of continuing to reduce emissions from the power sector and of achieving an economy-wide clean energy transition.”

Current technologies can support a continued decline in emissions from generation over the foreseeable future, but getting to net zero is going to require the development of technologies that are not commercially feasible today, EEI said. CCS and hydrogen blending have yet to be adequately demonstrated and are not deployable, available or affordable across the entire industry, and they require significant infrastructure outside of the power plants to work, it said.

EEI supports the proposal’s use of subcategories, which in the case of coal units are based on their operating horizon or when they plan on retiring, and one of the categories caps plant’s capacity factors. Coal plants running past 2040 would need 90% CCS, with declining standards for those that retire earlier. While EEI has some quibbles with those specifics, it noted that EPA’s much less flexible approach to large natural gas units is not supported.

“EPA’s inflexible, rate-based approach to regulating existing natural gas-based turbines presents significant challenges and is likely to result in perverse outcomes that are inconsistent with EPA’s larger emissions-reductions goals,” EEI said. “EPA’s failure to offer similar compliance flexibilities to existing natural gas-based turbines as those offered to states for existing coal-based units is fundamentally arbitrary.”

Gas units provide some of the same key grid services that coal plants do, but they are also more flexible and thus help in balancing intermittent renewable power, EEI said. EPA should develop and provide a full range of flexibilities in compliance for natural gas units, it argued. By the 2030s, such plants will either have to make costly, long-term investments or agree to capacity factor limits that will make them unavailable to help meet growing demand from electrification, which the industry is already experiencing. The power industry would have to turn to less efficient power plants to meet demand, it said.

“Under several plausible scenarios, this could result in an aggregate increase in emissions during the 2030s, at the expense of reliability,” EEI said. “This is an outcome that should be avoided by the agency.”

EEI noted that it had a limited amount of time to file comments on the rule, and it would continue to update its analysis and keep EPA in the loop on those efforts. EPA should also pay attention to FERC’s annual reliability technical conference in November, which the commission announced would cover the impact of EPA’s proposal.

Other Power Sector Trade Groups More Skeptical

The Electric Power Supply Association (EPSA) told EPA that it should give weight to its comments as its members own and operate power plants and thus are going to be responsible for the costs of implementing any final rule. The trade group said that implementation of the proposal would degrade reliability at a time power demand is growing.

“This proposed rule is intended to reduce emissions,” EPSA said. “However, while indirectly boosting investment in renewable energy, the proposal may negatively impact emissions reductions by rewarding less efficient existing power plants and hampering the use of existing lower-emission resources. Further, retirements of existing fossil fuel resources may occur before adequate replacement resources of any/all types are constructed, raising genuine concerns about electric grid reliability in the near and midterm.”

While many might dismiss the reliability concerns as voiced by directly impacted generators, EPSA said, FERC, NERC and the ISO/RTOs have made the same kind of arguments. FERC Commissioner Mark Christie recently told the Senate that the industry is headed toward a reliability crisis. (See Senators Praise Philips, FERC’s Output at Oversight Hearing.)

The lynchpins of compliance in EPA’s proposal are co-firing hydrogen and CCS, but those are emerging technologies, the group said.

“As a practical matter, robust CCS/hydrogen co-firing industries will need to be built almost from scratch, and the proposed rule requires those technologies be counted on in an unworkable and unrealistic time frame,” EPSA said. “They are not ‘adequately demonstrated’ by any real-world definition, and it is critical that the fundamental impediments to the technologies given the timelines outlined in the proposal be addressed and mitigated.”

The National Rural Electric Cooperative Association (NRECA) told EPA that it should withdraw its proposal, arguing that it exceeds the agency’s authority and would jeopardize reliability by requiring the industry to shift too early to technologies that are not commercially viable.

“Under the Clean Air Act, EPA’s standards must be adequately demonstrated, achievable and cost effective,” NRECA said. “Its proposed best systems of emission reduction in the form of carbon capture and storage, co-firing clean hydrogen or co-firing natural gas all fail to meet these criteria.”

CCS has promise, and NRECA members have been involved in deploying it, but it is not ready to capture 90% of the emissions from the nation’s coal- and gas-fired power plants, the group argued.

The proposal “is also heavily reliant on outside-the-fence-line infrastructure that does not currently exist and will not exist by the proposed compliance dates,” NRECA said. “Clean hydrogen is even further behind CCS in its development. There is currently no supply of clean hydrogen to meet EPA’s standards.”

NRECA said that even without the proposal, the U.S. is seeing too many power plants retire too early, noting that NERC and ISO/RTOs have raised that concern in recent reports. Federal agencies, including EPA, should be considering how they can avoid exacerbating those risks.

The American Public Power Association made similar arguments, saying that the agency could not rely on hydrogen and CCS under the CAA because they are not commercially viable. EPA needs to analyze the impact of its proposal on electric reliability, as the grid has already started on its transition away from traditional power plants to a growing share of renewables, the group said.

APPA said the impact of retiring fossil-fuel plants can be seen in the number of requests that the Department of Energy has had to process under Section 202(c) of the Federal Power Act, which suspends compliance with environmental rules when a unit needs to do that to maintain reliability. In the first 20 years of the century, DOE issued eight orders under 202(c).

“This number of orders was nearly matched in 2022 alone, when seven such emergency orders were issued, highlighting the urgency of the situation,” APPA said. “Since 2020, DOE has issued a total of 11 emergency orders over reliability concerns. This surge in emergency orders underscores the need for EPA to re-evaluate the proposed rule to maintain the reliability of the electric system.”

Flexibility Needed

Other commenters said EPA should broaden its definition for BSERs to include renewable energy or other energy-efficient and clean technologies.

The Business Council for Sustainable Energy, an industry organization that includes natural gas companies, recommended a “flexible and technology-inclusive approach” to BSERs. EPA should “recognize and consider recent market trends that include the falling costs and increased deployment of clean energy and energy efficiency. Regulation should provide clear and sustained market signals that spur emissions reductions through investment in the full portfolio of clean energy technologies.”

With the electricity sector already moving toward decarbonization, narrow and prescriptive regulations could draw resources away from planned projects and investments, BCSE said. EPA’s regulations “should not inhibit compliance with local, state and regional policies or divert investment and/or human capital that has been dedicated to decarbonization goals.”

CPS Energy, the municipal utility serving San Antonio, Texas, and its suburbs, also argued that both CCS and hydrogen “might not be easily applied to every fossil generating plant depending on design and location. The rule should allow for flexibility and not lean on specific technology solutions but rather allow each state broad discretion while working with utilities to evaluate measured proposed responses that protect system reliability and resiliency.”

Advanced Energy United wrote in support of the proposed rule but presented renewables, demand response and virtual power plants as technologies that also can provide grid reliability and resilience, undercutting traditional arguments on the need for dispatchable fossil-fueled generation.

“During Winter Storm Uri in 2021, coal and gas plants made up 73% of generation capacity in Texas that experienced ‘outages or de-rates,’” AEU said.

“Fossil-fueled power plants will need to employ costly best systems of emission-reduction technologies in order to meet [EPA] standards. However, renewable energy provides a price-competitive and reliable opportunity to maintain access to affordable power and mitigate grid outages.”

Similarly, CEG argued for renewables and energy storage as BSERs, noting that the proposed rule acknowledges that renewables and battery storage would eventually outcompete natural gas, leading to an expected decline in gas-fired generation.

Given that renewables and storage are “readily available, more than adequately demonstrated and reasonable in cost,” why is EPA trying to incentivize CCS and hydrogen, technologies that are not mature and “not non-emitting”? CEG asked. “Why isn’t the focus instead on developing rules that help accelerate the pace of renewable energy and energy storage displacement of fossil generation?”

Finding themselves potentially on the same side as utilities and fossil fuel companies opposing the rule, environmental groups have been quick to differentiate their concerns and goals from the industry’s.

“Utilities oppose regulation; we oppose bad regulation,” Monique Harden, of the Deep South Center for Environmental Justice in New Orleans, said during a Tuesday press call. “We want the EPA to do better, and it can do better.”

“Our problem with the rule is that it’s not bold enough; the rule doesn’t go through that rapid-change transition … to renewable energy and energy efficiency,” said Nicky Sheats, director of the Center for the Urban Environment at Kean University in New Jersey. “We want massive change not only in technology, but systemic change also.”

‘Penalty-free Emissions’

Another subset of commenters supported the rule as a way to cut emissions from coal and natural gas plants but called for accelerated timelines for compliance for more power plants, with a specific focus on the health impacts for disadvantaged and low-income communities.

The nonprofit Wisconsin Environmental Health Network encouraged “the EPA to strengthen and fast-track the improved standards placed on new and existing fossil fuel-fired power plants.”

“To maximize the efficacy of these regulations … the EPA [should] apply pollution safeguards to a wider number of power plants across the nation. A [broader] distribution of this action will ensure that fewer communities are subjected to unhealthy levels of pollution and dangerous air quality. This is especially important for socially vulnerable populations, since they are impacted more severely from climate change.”

Mass General Brigham, a network of hospitals in Boston, also urged that the rules be applied to more power plants “by lowering the threshold for unit size and capacity factor. … As written, the rule only regulates larger power plants [more than 300 MW], which could incentivize plant operators to shift power generation to smaller facilities that emit more pollution and are more likely to be proximal to environmental justice communities.”

The group also called for EPA to require new plants to immediately comply with the proposed 90% emission reduction and to move up compliance dates for existing coal and natural gas plants. If opting to “co-fire” with natural gas and hydrogen, existing plants would have until 2032 to comply, while those using CCS would have till 2035.

“The health harms of fossil fuel combustion have long been known,” Mass General said. “These delays represent 10 additional years of penalty-free emissions and lost opportunities to accrue additional health benefits.”