Support for New Jersey’s development of offshore wind projects has plummeted after 15 years of solid support, with just 54% of state residents now in favor of the strategy, according to a new poll by Monmouth University.

That’s down from 76% support in 2019, the year in which the state awarded its first offshore wind project, when just 15% opposed the move, according to the institute. Forty percent of those questioned now oppose the development of offshore wind, according to the poll.

Offshore wind projects drew 82% support in 2008 and peaked at 84% support in 2011, according to the institute. The poll, of 814 New Jersey adults, was “sponsored and conducted” by the Monmouth University Polling Institute, the institute said.

The poll presents another dose of bad news for the two offshore wind developers looking to complete projects in New Jersey’s waters. Danish developer Ørsted said Wednesday it will delay the expected commercial operations date for its Ocean Wind 1 project — the state’s first offshore project — from 2025 to 2026 because of rising costs. The developer said it will make a final investment decision on the project in late 2023 or early 2024. (See More Bad OSW News: SouthCoast Bails, Ørsted Tanks.)

A spokesperson for Ørsted, responding to a question from NetZero Insider about the poll, said the project will begin onshore construction in a few weeks and “has not slowed down or paused any planned activity.”

“A majority of New Jerseyans support offshore wind because they recognize the incredible need to reduce our reliance on fossil fuels, while more than two-thirds agree that significantly increasing the amount of offshore wind energy produced should be a priority over the next 10 years,” the spokesperson said. The poll shows that 37% think increasing the amount of wind energy produced should be a “major priority” and 30% think it should be a “minor priority.”

The state’s second OSW developer, Atlantic Shores Offshore Wind, released a statement blaming the adverse poll numbers on the “harmful effect of misinformation on sustainable energy development.”

Hurt Summer Tourism

Part of the decline in public opinion stems from concern about the effect on tourism, which is based on the New Jersey Shore. Forty percent of residents say “placing wind farms off the coast will hurt summer tourism,” according to the institute. In contrast, just 9% say it will help tourism, the institute said.

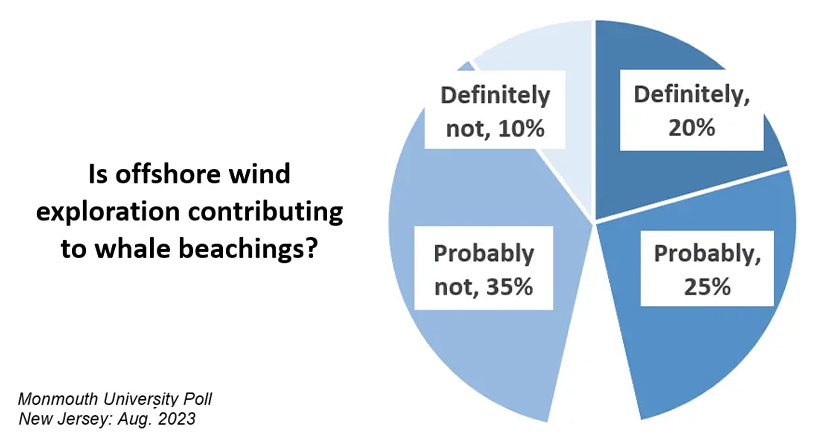

The recent spate of dead whales washing up on New Jersey beaches also influences the debate over offshore wind, the poll said. Twenty percent of those polled said they believe the development of offshore wind “definitely” contributed to whale deaths, and 25% thought it “probably” was connected. Ten percent said wind energy sector “definitely” had no connection to the deaths, and 35% said it probably didn’t.

State and federal investigators say they have found no connection between the whale deaths and any preparation work for the turbine projects, for which construction has yet to start.

“Opinion on the beached whale phenomenon has a high correlation with support for wind energy,” the institute said in an article outlining the poll results. “Among New Jerseyans who see a connection between the two, just 29% favor offshore wind energy development. Among those who feel these things are not related, 76% support wind energy.

Tony MacDonald, director of the Urban Coast Institute at Monmouth University, said in the article that it’s not surprising the offshore wind sector is facing headwinds, given that New Jersey is pursuing “very ambitious goals” to develop renewable energy, and “changing the status quo is very hard.”

“Clearly the state and wind industry have to do a much better job in reaching out to communities to demonstrate the economic and environmental benefits of these projects, as well as to counter misinformation about threats to tourism and threats to whales,” he said.

The statement from Atlantic Shores Offshore Wind, a joint venture between Shell New Energies US and EDF-RE Offshore Development, said, “the need to educate and engage in information sharing” is one of the challenges of developing a new energy source.

“We have a role to play in helping people understand offshore wind and ensuring that they have accurate information,” the developer said. “The spreading of misinformation and lies is dangerous and doesn’t serve the people of this state, who so urgently need the benefits that offshore wind will bring. It must stop.”

The project will bring power to more than 700,000 homes, generate $1.9 billion in economic activity and create 18,000 jobs, the statement said.

37% See OSW As Major Priority

The poll shows clearly that residents don’t necessarily see those benefits. Only 22% said they think the offshore wind sector will create a lot of jobs, compared to 55% who said they think it won’t create any jobs, the institute said.

Thirty-seven percent of residents said offshore wind should be a “major priority” for the state over the next decade, down from 48% in 2019, the institute said. The latest poll showed that 30% think offshore wind should be a minor priority, and 30% say it shouldn’t be a priority at all, the institute said.

The extent of the disaffection can be seen in the support for other forms of energy. Forty-one percent of residents favor building a new nuclear reactor, up from 26% in 2019, and 40% of residents favor drilling for oil or gas off the coast, according to the institute. Among those who think the wind turbines would hurt tourism, 23% support wind development, but twice as many favor drilling for fossil fuels off the coast.

The institute released the poll as the state Board of Public Utilities (BPU) evaluates applications submitted by four bidders in the state’s third offshore wind solicitation. The BPU expects to announce the winning bids by the end of the year. (See NJ’s 3rd OSW Solicitation Attracts 4 Bidders.)

The solicitation guidelines say the agency may award capacity of up to 4 GW, and perhaps more, as the state seeks to develop 11 GW of offshore wind capacity by 2040.

The state awarded its first OSW contracts to the 1,100-MW Ocean Wind 1, followed by the selection of the 1,148-MW Ocean Wind 2 and the 1,510-MW Atlantic Shores projects in 2021. All three projects are located about 10 to 15 miles from the shore, prompting opposition from residents and businesses who fear the visible turbines will ruin the ocean view and deter tourists.

The opposition, including citizens groups and municipal and county government, has instigated several lawsuits against the projects, especially against Ocean Wind 1. A new opposition group, Move ‘Em Out, announced itself this week with a website carrying the slogan “SOS: Your beach is next.”

In turn, Ørsted has filed suit to ensure it gains approvals needed to move the project ahead. (See Lawsuits Mount over NJ OSW Projects as Opposition Digs in.)

The company gained a small victory Aug. 15 when the two sides signed a consent order in New Jersey Superior Court in which the County of Cape May agreed to grant a road-opening permit that will allow the developer to start preliminary work and testing for the eventual installation of underground cables for Ocean Wind 1.

The developer is looking to build a 275-kV underground line through the Jersey Shore community of Ocean City, which is in Cape May County, to connect with the PJM grid at a substation sited on a closed coal-fired power plant in neighboring Upper Township.