Joseph L. Fiordaliso, who led the New Jersey Board of Public Utilities as it embraced an aggressive and sweeping clean energy agenda marked by a major investment in offshore wind, has died, Gov. Phil Murphy (D) said Thursday.

Fiordaliso, 78, a BPU commissioner since 2005 and a former deputy chief of staff to former Gov. Richard Codey, spoke frequently about the need to adopt aggressive policies to combat climate change, saying he did not want future generations to look back at the agency’s efforts and question why it didn’t do more.

“Climate is changing,” he said at the board’s most recent meeting, on Aug. 16, shortly before it voted to enact a permanent community solar program after two well-received pilot programs. “And we all better be adults about the fact that we have to do something about it, not hide our heads in the sand. Because it’s not going to get any better; it’s only going to get worse.”

Fiordaliso’s death leaves the agency leaderless as it confronts increasing challenges to the state’s clean energy investment and especially the OSW program, which is facing community and special interest opposition and several lawsuits, as well as developer concerns about increasing costs that have raised questions about project viability.

The passing of the president removes a key font of experience on the board. Three of the four remaining BPU commissioners — Democrats Christine Guhl-Sadovy and Zenon Christodoulou, and Republican Marian Abdou — joined the board in the past year. The fourth, Republican Mary-Anna Holden, was appointed in 2012.

Under New Jersey law, the governor picks the BPU president and the senate can either confirm or reject the candidate.

Murphy, in a statement announcing Fiordaliso’s death, called Fiordaliso a “consummate public servant, a trusted colleague and a good friend.” The governor’s office did not say how or when Fiordaliso died, but the Associated Press said he died Wednesday.

“As president of the BPU since the beginning of my administration, Joe skillfully led our work to responsibly transition to a clean energy economy while always putting the needs of consumers first,” Murphy said. “Every time you saw Joe he was wearing his signature offshore wind pin or handing one out to anyone and everyone he met.”

To Fiordaliso, the pin — fashioned in the shape of a wind turbine — demonstrated support for the OSW program. But it drew criticism from opponents who saw in it a sign that he was too closely aligned with the OSW sector. The pin even drew the attention of a Republican lawmaker who quizzed Fiordaliso about it at a recent budget hearing.

Fiordaliso, however, said his interest was in doing what was best for the state and for ratepayers. In fact, at the board’s June meeting, he lashed out at the state’s two offshore wind developers who he said had created “delay after delay after delay … almost since Day 1.

“So I’m issuing a recommendation to those developers: Put your nose to the grindstone, and let’s get this going again,” he warned them. “Because my patience is short, and your delays are intolerable. And if you can’t do that, we have to have a very intense discussion.” (See NJ BPU Pulls Offshore Tx Project Mod from Agenda After Complaint.)

Top Priority

Murphy, who appointed Fiordaliso as BPU president on Jan. 15, 2018, has set a target for the state to develop 11 GW of OSW capacity by 2040. The BPU has approved three projects, totaling 3.758 GW, in two solicitations and is expected to announce the winners of a third round early in 2024, which could add 4 GW. In addition, the state has moved aggressively to jump-start a logistics sector to support the OSW projects, along with those of other states, which include the development of the New Jersey Wind Port to handle material and equipment for use in the projects. (See NJ Opens Third OSW Solicitation Seeking 4 GW+.)

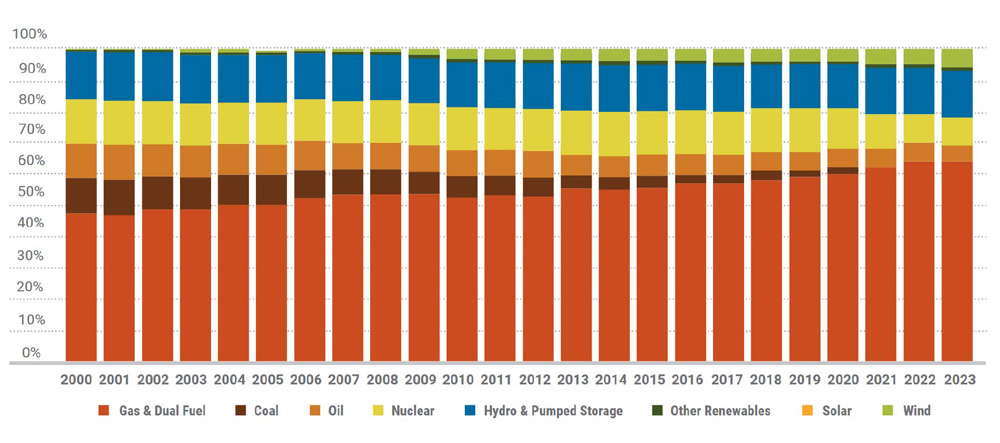

Doug O’Malley, executive director of Environment New Jersey, an environmental group, said that Fiordaliso’s lengthy tenure as a BPU commissioner meant he was present in, and accrued a great depth knowledge of, the early years of the solar sector in the early 2000s. The BPU’s support helped put the state in the forefront of solar capacity development.

Fiordaliso also saw the inactivity on OSW during the tenure of Republican Gov. Chris Christie, from 2010 to 2018, and the BPU’s aggressive embrace of OSW when Murphy appointed Fiordaliso as the agency’s president will be a key plank of his legacy, O’Malley said.

“Wind was arguably the top priority for President Fiordaliso,” he said. “He cared deeply about offshore wind as kind of a new technology that you can harness.”

“Obviously, offshore wind has had choppy waters this year,” he said. “But we would not be in the position we are in without President Fiordaliso’s leadership.”

Other parts of the BPU’s aggressive agenda under Fiordaliso also have ruffled feathers. The agency is facing criticism from Republicans and business groups over the expense of the clean energy programs, including the lack of clarity on how much it will cost ratepayers. The programs include extensive subsidies for the purchase of electric vehicles (EVs) and trucks and the development of charging sites, proposals for subsidies of energy storage systems and plans to promote the use of electric heat and water systems in buildings and reduce the use of fossil fuels.

The New Jersey Business and Industry Association (NJBIA), which frequently disagreed with the BPU over cost concerns and the focus on electricity instead of other alternative energy forms, said in a statement prompted by his death that Fiordaliso was “truly and passionately committed to his job and its many missions.”

“Even when we didn’t agree on policy issues, President Fiordaliso always had an open door, took part in many NJBIA events and had receptive ears to our concerns,” said the statement from CEO Michele Siekerka.

Anjuli Ramos-Busot, director of the Sierra Club of New Jersey, released a statement that called Fiordaliso a “fighter for renewables and a proud supporter of offshore wind.

“He understood the severity of climate change and had a vision for the BPU to combat it,” she said.

Tough Upbringing

Fiordaliso grew up in a cold-water apartment in Newark, and he never forgot his roots as he was putting together policy, O’Malley said. That was particularly evident in Fiordaliso’s support for the state community solar program, which provides discounted clean energy to low- and moderate-income ratepayers, O’Malley said. (See NJ Opens Community Solar and Nuclear Support Programs.)

“He was a big supporter of making clean energy, especially solar, more accessible for more people,” O’Malley said. “He wanted to make sure the clean energy could reach every New Jersey resident.”

Fiordaliso graduated with a degree in business education from Montclair State University and was a teacher from 1967 to 1986, according to the university’s website. He was director of government relations for the Saint Barnabas Health Care System and served three terms as mayor of Livingston, N.J.

He was a member of the National Association of Regulatory Utility Commissioners’ Committee on Critical Infrastructure and Committee on Energy Resources and the Environment and also sat on the Executive Committee for the Regional Greenhouse Gas Initiative (RGGI) and RGGI’s Strategic Communications Team, according to the BPU website.

He also was board member of the Organization of PJM States Inc. and of the advisory council to the board of directors of the Electric Power Research Institute. In May 2023, FERC appointed Fiordaliso to the Joint Federal-State Task Force on Electric Transmission.

At the BPU’s meeting last month, Fiordaliso introduced several interns and spoke about the role of the board.

“We are doing work that’s going to help, hopefully save future generations,” he said. “It’s not many times in one’s career, and I’ve been working a long time, that you can actually say that I’m doing something that is going to affect future generations in a positive way.”

He noted that he had spent all but five years of his working life in the public sector.

“It is one of the most gratifying experiences I think a human being can have,” he said. “You may not make a million dollars but the satisfaction that you get from doing what you do is certainly worth a million dollars.”