Seasonal Demand Curves

RENSSELAER, N.Y. — NYISO on Thursday secured Business Issues Committee approval of the ISO’s proposal to create separate capacity demand curves for summer and winter beginning with the 2025/2026 capability year.

The ISO proposed the tariff revisions to better reflect winter and summer reliability risks and send clearer signals to the market about the value certain resources have in each season. It also said the changes are necessary to accommodate moving from annual capacity accreditation factors to seasonal ones in the future.

The changes are part of the latest demand curve reset, conducted every four years to update the parameters for NYISO’s capacity market. The revisions now go to the Management Committee for approval Sept. 27.

NYISO/PJM Joint Operating Agreement

The BIC also recommended approval of proposed revisions to the Joint Operating Agreement between NYISO and PJM.

The revisions are intended to improve the coordination and data accuracy between the grid operators, particularly in the areas of resource adequacy and transmission planning.

A provision NYISO considers key would remove a list of interconnection tie facilities between the ISO and PJM out of the JOA and publish it on each of their websites, which the ISO argues would make it easier to adjust and increase transparency.

Stu Kaplan, partner at Troutman Pepper, asked if the changes made to the list could in any way change who has operational control over a New York facility.

NYISO did not have an immediate answer but responded that its proposals apply mostly to low-level equipment like substations, though it added that it will consider the issue moving forward.

The MC will consider revisions at its meeting this month. NYISO anticipates implementation by the first quarter of 2024 if the Board of Directors and FERC approve them.

August Market Operations

NYISO Senior Vice President Rana Mukerji presented the August market operations report, noting that average energy prices were lower than both the previous month and August of last year. (See “July Market Performance,” NYISO Business Issues Committee Briefs: Aug. 16, 2023.)

The month’s average energy cost was 56% lower than last year, declining from $93.42/MWh to $40.13/MWh. Mukerji said lower temperatures led to lower loads.

Eclipse Preparation

At a separate meeting of the Installed Capacity and Market Issues working groups the same day, NYISO updated stakeholders about its preparations for two upcoming solar eclipses, including how it is coordinating with solar forecasters and its neighbors to mitigate the impact on New York’s energy production.

The ISO said October’s annular solar eclipse — which will most impact Texas and the Western U.S. — could reduce solar output in parts of the state by 15 to 30%, with statewide behind-the-meter solar generation declining by as much as 700 MW and front-of-the-meter down 30 MW.

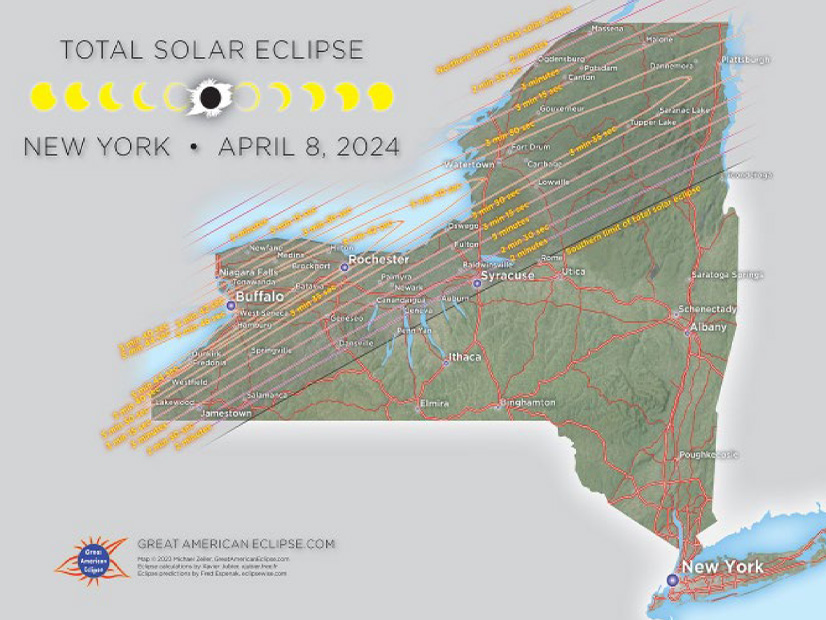

Next April’s total solar eclipse will cause even greater disruption, as it will pass directly through New York. During the roughly 2.5-hour eclipse, NYISO forecasts that solar production could decline by more than 3,000 MW at the peak, as some areas of the state will be completely obscured for nearly four minutes.

The ISO also said that wind generation could be impacted by the eclipses, both because of cloud cover and the expected localized cooling that will lower wind speeds when the sun is obscured.

NYISO has said it expects to have enough resources available to cover potential shortfalls. (See “NYISO Updates & Eclipse Prep,” NY State Reliability Council Executive Committee Briefs: Sept. 8, 2023.)