NYISO on Wednesday announced that EVP Emilie Nelson was named COO, replacing Rick Gonzales, who is retiring at the end of the year.

CEO Rich Dewey told stakeholders at an ISO Management Committee meeting that he recommended Nelson to the Board of Directors, which approved the promotion. Nelson will now be responsible for overseeing both the operations and the market mitigation and analysis (MMA) teams.

“I feel that this really positions us well for the future and is a good leadership expansion for Emilie and sets up both our organization and teams for the challenges of the future,” Dewey said during the meeting.

Nelson joined the ISO in 2004 and has been in the industry for almost 25 years. She previously worked for Mirant New York as a power plant performance engineer. During her tenure at NYISO she has held various roles of increasing responsibility on the market monitoring, energy market design and operations teams.

Nelson holds a bachelor’s degree in mechanical engineering from Tufts University, an MBA from Pace University and is a graduate of Harvard Business School’s Advanced Management Program.

NYISO Board Chair Dan Hill said in a statement that “Emilie has built a strong record of performance-driven results in a number of senior management roles throughout her career at the NYISO.”

Gonzales also congratulated Nelson during the meeting, saying she “will bring some great change to the organization by bridging [the operations and MMA] parts together.”

Gonzales, who has been with NYISO since its inception and previously worked for the New York Power Pool, is scheduled to retire on Dec. 31, 2023.

Draft Budget

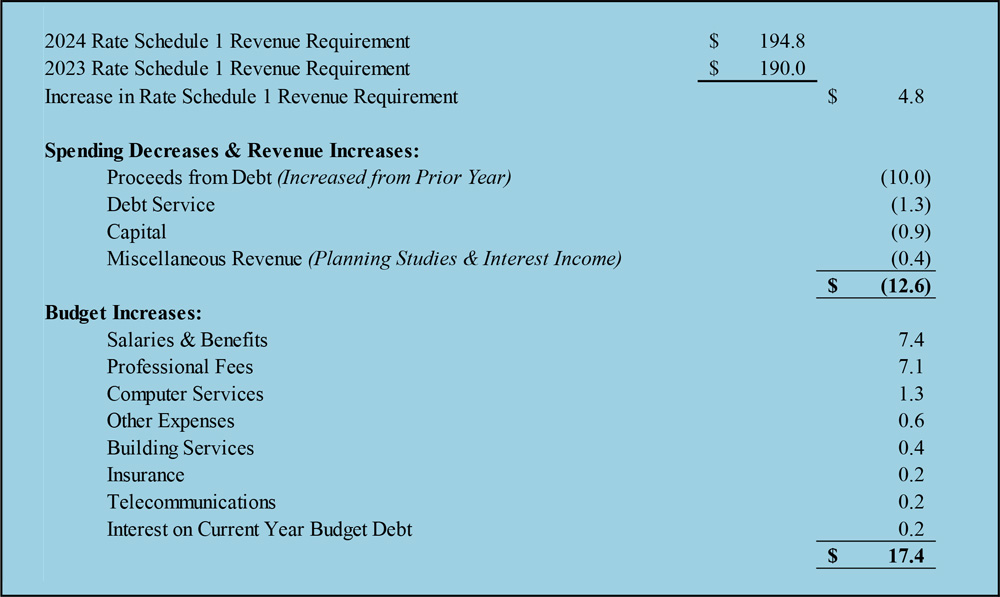

NYISO presented the MC its draft budget for next year, saying it will total $194.8 million and that $8 million remaining from this year’s budget will be used to make early repayments on outstanding debt.

The 2024 draft budget is roughly $5 million higher than this year’s budget, with much of the growth attributable to proposed increases in consulting fees and staff salaries, which NYISO says are necessary to accomplish next year’s project portfolio. The ISO will also hire for 19 new positions in both the system and resource planning and operations teams next year.

NYISO already faced stakeholder scrutiny after presenting its final project budget recommendations of $41.62 million for next year, with many balking at the proposed labor cost increases. (See NYISO Proposes $41.62M Project Budget for 2024.)

Stakeholders can discuss the draft budget again in early October before the board reviews it on Oct. 16. The ISO anticipates bringing the final draft to the MC for a vote on Oct. 25.

Seasonal Demand Curves

The MC also approved NYISO’s proposed revisions related to implementing winter and summer demand curves into the next demand curve reset for the 2025/26 capability year.

The ISO’s proposed changes will be part of the next four-year DCR, which regularly updates the parameters for New York’s capacity market, and seek to better reflect seasonal reliability risks and the value that certain resources provide during the competing seasons.

The revisions were previously approved by the Business Issues Committee and will now go before the board for final approval. (See “Seasonal Demand Curves,” NYISO Business Issues Committee Briefs: Sept. 14, 2023.)

August Market Performance

Gonzales delivered the August market performance report during the MC meeting, saying, “we had pretty mild temperatures that were cooler than average and a little less wet than July.”

He noted that August’s year-to-date energy prices are down 56% compared to last year, decreasing from $93.42/MWh in 2022 to $40.13/MWh this year. August’s gas prices were also down 85% compared with last year, and prices at the Transco Z6 NY pipeline touched a low of $1.18/MMBtu.

As in a monthly operations assessment delivered to an earlier Operating Committee meeting, Gonzales highlighted how an unexpected four-day heatwave in early September saw some of the highest demand during the summer and that the ISO will investigate the hot weather phenomenon. (See “August Operations Report,” NYISO Operating Committee Briefs: Sept. 15, 2023.)