Texas regulators last week directed ERCOT to not include scenarios assuming the loss of more than 8 GW of fossil generation as the grid operator’s staff continues to develop a reliability standard.

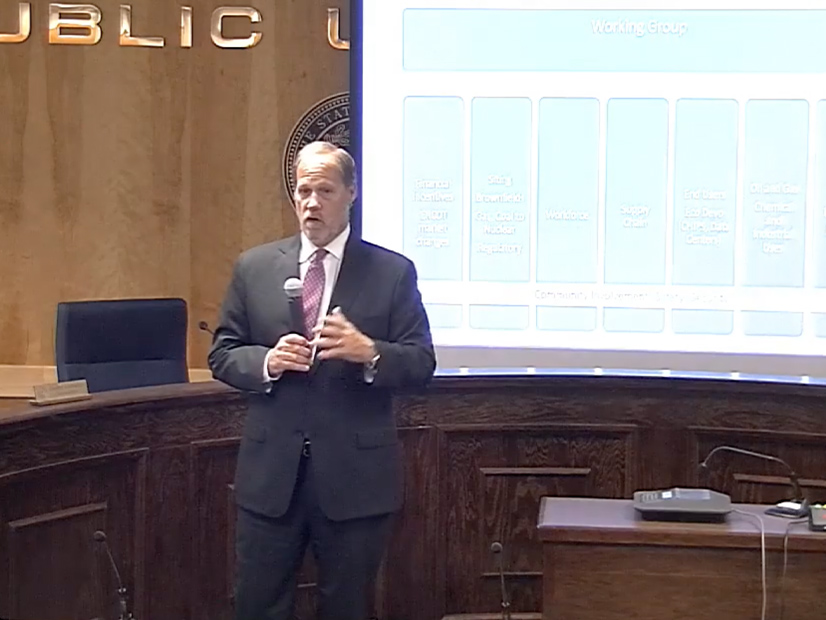

ERCOT briefed the Public Utility Commission on its reliability standard study modeling results during Thursday’s open commission meeting. Staff shared the outcome of the 48 scenarios they developed for the analysis and recommended that an additional study iteration be performed (54584).

However, the commissioners balked at the inclusion of an aggressive 8.3-GW figure for assumed coal and gas units’ retirement. The figure is based on EPA’s proposed rules limiting greenhouse gas emissions and other regulations. (See EPA Power Plant Proposal Gets Mixed Reception in Comments.)

Commissioner Will McAdams said, “There’s no way the Public Utility Commission of Texas is going to allow this to happen.”

Commissioner Lori Cobos agreed with McAdams, saying ERCOT’s current 3.3-GW assumption for retirements would be more “reasonable” to expect.

“I think that 8,300 is an extreme scenario, and I don’t think it does any good to be opining for an extreme scenario that doesn’t seem to be coming to fruition, given market dynamics but also ERCOT actions and legislative action,” she said.

“Even then, the state will take steps to ensure that this doesn’t happen,” McAdams added. “We are not powerless and there are legal remedies here. There are market-driven remedies to keep these in system. We argued about this in the market design debate, and I said, ‘This ain’t gonna happen.’

“I fear that if we start subtracting massive amounts of megawatts out of the models — due to hypothetical federal regulations which we are sure to litigate and go all the way to the U.S. Supreme Court, which will take some time — I believe it will blow out the top of our models, unduly alarm the public and create a narrative that certain alternatives are better,” he said. “I would advise simpler is better. Provide focus to ERCOT, clear the field of the massively hypothetical scenarios and then just look at what we have in the range.”

ERCOT’s Kristi Hobbs, vice president of system planning and weatherization, agreed to reduce the retirement assumption to 3.3 GW. She also said staff would continue to include a one-day-in-five-years loss-of-load expectation in its frequency scenario limitations, along with LOLE expectations of one day in 10, one day in 15 and one day in 20 years.

Frequency Target

The PUC agreed with ERCOT’s recommendation to include a reliability frequency target in future studies that uses a capacity mix with additional inverter-based resources.

ERCOT has proposed a three-part framework that considers the duration and magnitude of a loss-of-load event, along with the occurrence’s frequency. It says this will better quantify LOLE risks when intermittent resources are a large percentage of the generation fleet. (See “ISO Prioritizes Market Changes,” Texas Public Utility Commission Briefs: Aug. 24, 2023.)

$30 Million Procurement

ERCOT staff also shared with the commission results of the firm fuel supply service’s (FFSS) second procurement, revealing the ISO acquired 3,319.9 MW of the reliability product for $29.9 million for the Nov. 15-March 15, 2024, obligation period (53298).

That was 13% more capacity and an estimated 43% cost reduction from the grid operator’s first procurement of FFSS capacity. That resulted in 2,940.5 MW of capacity for $52.9 million during the Nov. 15, 2022-March 15, 2023, obligation period.

Five qualified scheduling entities responded to ERCOT’s second procurement by offering 32 generation resources to act as FFSSRs during the obligation period. The grid operator awarded each resource the commission’s clearing price cap of $9,000/MW; 31 of the 32 generators offered fuel oil as the reserve fuel and one offered natural gas storage.

The first procurement saw 19 resources awarded at $6.19/MWh ($18,000/MW). Eighteen of the 19 generators offered fuel oil as the reserve fuel and one offered natural gas storage.

ERCOT added FFSS at the PUC’s direction after the disastrous 2021 winter storm, when curtailed gas supplies knocked numerous units offline and nearly collapsed the grid. The service is designed to provide additional reliability and resiliency during extreme cold weather by maintaining resource availability during gas curtailments or other fuel-supply disruptions.

The commission expanded eligibility to a broader range of resources for the service after its first phase.

Nuclear Working Group Meets

Following the open meeting, Commissioner Jimmy Glotfelty held an informational briefing for stakeholders interested in joining a PUC working group that will spend the next 14 months looking for ways to position Texas as a national leader in small modular reactors (SMRs) (55421).

In August, Gov. Greg Abbott (R) directed the PUC to create a working group to study and provide recommendations on SMRs. He also asked Glotfelty to chair the team, which the commission has labeled the Texas Advanced Nuclear Reactor Working Group. (See Texas Seeking Lead Role in Nuclear SMRs.)

“When the governor asks you to do it, you have to do it,” Glotfelty said.

Nearly 20 market participants, companies and individuals already have filled out applications to join the working group. The first meetings will be held in October after the team members have been selected. Public meetings will continue into April before the team begins drafting a report with recommendations that is due to Abbott by December 2024.

“It’s exciting to see so much interest in this even when every day there’s another headline about something in this space. The challenge with those headlines is very few of them say Texas,” Glotfelty told stakeholders. “Our goal in this process is to figure out how we get more of them going.”

The commission says the group will evaluate how advanced reactors can provide safe, reliable and affordable power for Texas. It will study financial incentives, state and federal regulatory impediments to growth, the electric market’s effects, technical challenges and additional factors necessary to grow nuclear energy in the state.

“This is not going to be a government report that sits on a shelf. I’ve written plenty of those,” said Glotfelty, who brings years of experience at the U.S. Department of Energy to the position. “This is not to understand a good place to deploy these reactors. It’s to set the playing field so we can deploy these reactors.”