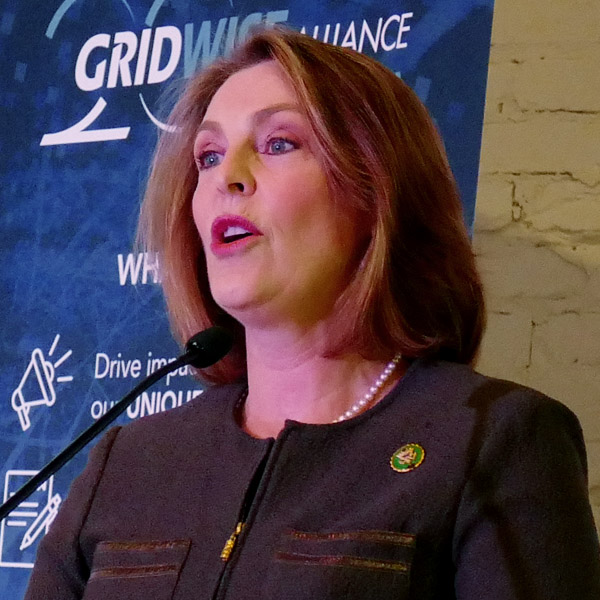

DFW AIRPORT, Texas — Texas Public Utility Commissioner Will McAdams promised SPP’s REAL Team a “therapy session” in forming a consensus position around its schedule and priorities for 2024.

“Save most of your intellectual bandwidth for after lunch, because that’s where we’re going to need some discussion and dialogue,” the REAL (Resource and Energy Adequacy Leadership) Team’s chair said during its Nov. 28 meeting, alluding to a discussion of SPP staff’s draft loss-of-load expectation (LOLE) study.

“I think that schedule of priorities will be heavily impacted by the discussion around LOLE, because it shows us what our system needs are in the very near future,” McAdams said.

“This conversation is going to be the first of many,” said SPP’s Casey Cathey, senior director of grid asset utilization. “This particular area is a very, very important topic for the region. It’s not just the loss-of-load expectation study, but specifically establishing a separate winter planning reserve margin.”

SPP conducts a LOLE analysis every two years to determine the capacity needed to meet reliability targets. It follows the industry threshold of one day in 10 years (equivalent to 0.1 days/year). The study also establishes the RTO’s planning reserve margin (PRM), currently 15%.

According to the draft 2023 study, maintaining a one-day-in-10 LOLE will require a summer PRM of 16.9% and a winter PRM of 45.2%, with 44% of the year’s LOLE allocated to the summer and 56% to the winter. Staff included full incremental cold weather and planned and maintenance outages in its modeling.

Staff extended its historical wind, solar and load profile assumptions, looking back 43 years instead of nine in looking at 2026 and 2029 planning years. The study forecasts 2026 summer and winter non-coincident peaks of just over 58 GW and almost 48 GW, respectively.

Responding to McAdams’ call for a more defined policy around outages, Cathey said planned outages should be included in the PRM. He noted that modeling planned outages associated with seasonal years or seasons of risk would increase the PRM.

“You’re making that assumption that you’re planning for that,” Cathey said. “We have to make some assumptions here and determine what are going to be the net effects as we’re creating the outage policy.”

“I just don’t want this to be an exercise where we’re going to assume that the planning outages are basically being swept over to the spring and fall season, so we don’t have to worry about [them],” the Advanced Power Alliance’s Steve Gaw said. “I don’t want the model to avoid the problem that we’re trying to fix. We need to have an appropriate level of planned outages that are taking place in the wintertime.”

Cathey promised to bring back to the team an evidence-based value proposition. “How do we appropriately assess the improvements in correlated outages for extreme events?” he asked rhetorically. “Maybe that helps better isolate where we’re going with this this grid and ultimately, a recommendation for next year.”

The Supply Adequacy Working Group (SAWG) is working on summer and winter PRM recommendations as part of the final study, due to be released in March or April. The PRM recommendation revision requests will go to the REAL Team and, in July, the quarterly governance meetings.

The daylong “therapy session” concluded with SPP Director Steve Wright telling McAdams his service to the group has been “remarkable.” McAdams has said he will resign from the Texas commission, leaving the REAL Team chairmanship as well. (See McAdams Says He Will Resign from Texas PUC.)

“Just the time and effort you put into this, you came so incredibly prepared for these meetings, and that set a very high bar for all of us who are participating here,” Wright said.

“We would not be where we are on these very important issues for this region without your leadership. You will very much be missed,” echoed SPP Engineering Vice President David Kelley.

In a manner reminiscent of his military background, McAdams brusquely cut off further plaudits.

“All right, that’s the meeting.”

FERC Rejects Winter Requirement

FERC added to the REAL Team’s workload Nov. 30 when it rejected SPP’s proposed winter resource adequacy requirement for its footprint. However, the commission said the RTO can address FERC’s concerns and resubmit the proposal (ER23-2781).

The commission said the proposal does not contain any requirement that a load-responsible entity’s (LRE) resources are expected to be available. It said SPP has not demonstrated it is reasonable to permit LREs to rely on resources that are not expected to be available in the winter season to satisfy their resource adequacy requirements.

SPP’s Market Monitoring Unit, as it had throughout the stakeholder process, opposed the tariff revision at FERC. It has pointed out the absence of language requiring a reasonable expectation of availability for resources. It also said an LRE could offer a resource to meet its winter obligation while planning to conduct a maintenance outage.

FERC said that in any future filing, the grid operator should take “appropriate steps” to ensure that resources included in LREs’ adequacy workbooks for the winter are expected to be available “just as in the [summer].”

“This would provide a more accurate reflection of the system’s capacity to meet winter demands and reinforce the need for LREs to maintain an adequate amount of available capacity,” the commission said.

Acknowledging recent extreme winter events in the Midwest, FERC encouraged SPP to consider expedited proceedings for any future filing.

“Delays could result in insufficient preparation for these increased demands, potentially compromising the reliability of the power grid and the safety of the consumers who depend on it,” it said.

SPP’s board and its stakeholders and state regulators approved the winter obligation in July. The Members Committee, which provides advisory votes to the board, approved the proposal in a 10-9 vote, with four abstentions. (See “Board, RSC Endorse Winter Obligation,” SPP Board/Members Committee Briefs: July 24-25, 2023.)