As the months get warmer, utilities in the West are gearing up for another wildfire season, equipped with new technology and lessons learned from recent fires in Los Angeles they hope can assist in mitigation work.

“The January 2025 windstorm and fires have driven SCE to further mature and evolve its wildfire mitigation efforts,” Southern California Edison spokesperson Jeff Monford told RTO Insider on April 15. “Based on these experiences, we have developed a forward-looking strategy that addresses both immediate and long-term wildfire risks.”

The L.A. wildfires erupted on Jan. 7 following a windstorm. The fires collectively destroyed thousands of homes and businesses in the Altadena, Malibu and Pacific Palisades communities, killing more than 20 people, according to Cal Fire. (See No Grid Impact from LA Fires, CAISO Says.)

SCE has stated its equipment may have been involved in the cause of the Eaton Fire, which burned more than 14,000 acres and engulfed parts of the Altadena community.

On April 11, SCE announced plans to underground more than 150 miles of transmission lines in Altadena and Malibu after the fires. The cost of the rebuild is estimated at $860 million to $925 million, according to a news release.

The effort comes after California Gov. Gavin Newsom suspended environmental laws to accelerate the undergrounding and hardening of utility equipment in communities ravaged by the Los Angeles wildfires. (See Newsom Issues Order to Speed Undergrounding of Lines in Los Angeles.)

SCE already has allocated $5.4 billion to implement its 2023/25 Wildfire Mitigation Plan. Additionally, between 2018 and 2024, the utility installed more than 200 cameras with artificial intelligence capabilities, over 1,700 weather stations and approximately 6,400 circuit miles of covered conductor, while carrying out “more than two million tree trimmings and removals,” according to Monford.

SCE will share its 2026/28 Wildfire Mitigation Plan in May, Monford added.

On March 24, Cal Fire completed an update to its fire hazard severity zone map for the first time since 2011. The updated map shows large swaths of Southern California falling under “very high fire hazard” zones.

Other utilities RTO Insider spoke with have ramped up their wildfire mitigation work in the face of increased risks.

For example, San Diego Gas & Electric launched its Wildfire and Climate Resilience Center in the fall of 2024.

“The center is essentially a focal point of SDG&E’s climate resilience strategy,” Alex Welling, communications manager at SDG&E, told RTO Insider in March, before Cal Fire issued the updated maps.

The center is a hub for research, development and implementation of wildfire mitigation tools built on AI and predictive modeling and information sharing with emergency responders, Welling explained.

SDG&E also uses data from the California Public Utilities Commission’s High Fire Threat District maps to power its modeling software. The software “helps prioritize wildfire mitigation projects by considering both wildfire risk and public safety power shutoff risk to determine the likelihood of either a wildfire or PSPS taking place, its subsequent impacts and then recommends proactive mitigation measures” Welling said.

Pacific Northwest

Information sharing has become increasingly important in the wake of the L.A. fires, Ryan Murphy, director of electric operations at Puget Sound Energy (PSE), told RTO Insider.

“Wildfire has changed the risk paradigm for utilities,” Murphy said. “We used to be a relatively low-risk industry. That is no longer the case — we now have become extremely high-risk because of wildfire.”

Because of changing weather conditions, PSE has stepped up its wildfire mitigation work and expanded its Wildfire Mitigation and Response Program, Murphy said.

For example, the utility uses AI to improve fuel models, consults with a third-party fire science expert and uses weather stations, cameras and insights from field crews to get a “much more granular and local level where to focus grid hardening and vegetation management work,” Murphy said.

“We have also added a meteorologist in the last year, giving us much greater visibility into the varied weather conditions across our service area and how those might impact operations,” he added.

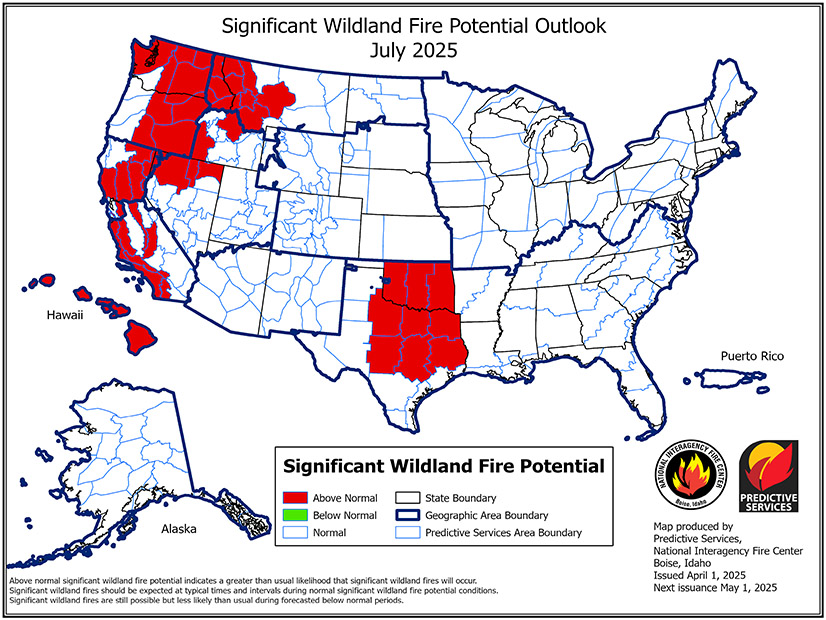

Still, with recent trends of longer, hotter and drier summers, the wildfire threat in 2025 “has the potential to be very high,” Murphy said.

“If timely rains arrive across the region throughout spring, it will help delay the start of peak wildfire risk into late June or July, thereby shortening the overall risk duration,” according to Murphy. “However, if spring plays out to the warmer and drier side across Washington, the potential for earlier and active wildfire threat should be expected.”

In Oregon, investor-owned utilities must by June file wildfire mitigation plans for approval by the Oregon Public Utilities Commission. Utilities presented their plans in February.

Portland General Electric, Idaho Power and PacifiCorp, all of which serve customers in Oregon, have started undergrounding lines, building out networks of wildfire cameras and installing weather stations to gather wind speed data, among other efforts, according to their February presentations. (See Oregon Utilities Enter 2025 With Ambitious Wildfire Plans.)

There were 64,897 reported wildfires in 2024 that burned about 8.9 million acres nationwide, compared to 2.7 million acres in 2023. Oregon saw nearly 1.8 million acres burned due to wildfires, according to the National Interagency Coordination Center.

Oregon PUC spokesperson Kandi Young told RTO Insider in an email that this year “Oregon utilities are improving their outreach and communication to customers as the more extensive use of sensitive or enhanced safety settings reduces the risk of ignitions but also degrades the reliability experienced by customers with less advance warning than a [PSPS].”

“Communities are seeking more clarity about why outages occur and how long an outage is likely to last, whether due to these settings, a PSPS, or due to approaching wildfires and the need for turning off the power so fire suppression resources can operate,” Young added.

The PUC also is paying attention to the fire events in L.A., Young said.

“We continue to see extreme fire behavior and urban conflagrations under high wind conditions, regardless of the source of the ignition,” Young said. “Power is often turned off during these conditions, complicating the response. Public safety partners, entities that provide critical services such as communications, and community members need to be preparing for wildfire, even if they are not in a designated high fire risk zone.”

Federal Workforce Reductions

Layoffs among federal agencies initiated under the Trump administration have caused uncertainty within the power industry. The layoffs also have reached agencies like the National Oceanic and Atmospheric Administration that monitor wildfire activity and produce seasonal outlooks. (See BPA to Restore 89 ‘Probationary’ Staff, Agency Confirms.)

Young said workforce reductions among agencies “raise concerns about both off-season mitigation activities and fire-season readiness. We expect the utilities to incorporate any reduced federal prediction and response capabilities in their seasonal and operational risk assessments.”

Murphy with PSE said the utility monitors changes within the federal workforce and recognizes “the situation remains fluid. We consult with a number of agencies and third-party vendors for modeling in addition to federal agencies.”

SDG&E is less concerned, Welling said.

The utility’s monitoring systems, weather forecasting models and cameras “ensure we maintain the highest level of situational awareness,” according to Welling. “These capabilities allow us to independently monitor and predict wildfire behavior, ensuring our operations remain efficient and effective.”