After nine years of development and dozens of stakeholder meetings, the Independent Electricity System Operator (IESO) is poised to launch its new nodal market May 1, a change it says will save Ontario $700 million over the next decade through reduced out-of-market payments and increased efficiency.

The Market Renewal Program (MPR) is intended to improve the way IESO supplies, schedules and prices power by creating a financially binding day-ahead market (DAM) and creating almost 1,000 locational marginal pricing (LMP) nodes.

The IESO says nodal pricing — which is used in all seven U.S. RTOs and ISOs — is crucial to efficiently dispatching and providing market signals to renewables and new resource types such as distributed energy resources, storage and hybrids.

The current day-ahead commitment process is not financially binding, resulting in uncertainty for generators. The addition of a financially binding day-ahead market gives resources “much more certainty over what they will be paid, and it gives us much more certainty over what’s available and how we how we can schedule and commit those resources,” said Candice Trickey, director of the MRP, at an April 16 webinar attended by almost 600 people. “So, it gives much, much more clarity, transparency and certainty for both sides.”

Under Ontario’s current two-schedule market design, the initial schedule ignores system constraints and transmission losses to calculate the Hourly Ontario Energy Price. The second schedule incorporates transmission constraints to determine system dispatch, with uplift payments used to address differences between the two schedules.

The new market will use a single schedule to dispatch the system and calculate LMPs at more than 970 generation, load and intertie nodes in the day-ahead and real-time markets, a number IESO says may increase as its system grows. The day-ahead market will have hourly pricing while the real-time market will continue to price in five-minute increments.

IESO says the improved price transparency should increase efficiency and lower costs.

The pricing granularity is “really important to sort of underpinning all of the changes that we’re making and giving us the ability to make those cost decisions, and it will also provide longer term signals for resources across the province in terms of where it makes the most sense to locate if you’re looking for future opportunities,” Trickey said. “It will also help better inform consumption decisions for loads that want to be responsive to price.”

Work Began in 2016

Work on the new design began in 2016, when IESO held a series of consultations with stakeholders. “Stakeholders have been a big part of this all along the way [with] literally hundreds of meetings covering all kinds of topics — committees, groups, working groups, you name it,” Trickey said.

The goal? “Making sure that we make the most of Ontario’s electricity supply resources — those that we have today and those that we know are coming in the future,” Trickey said. “It’s really about improving how we schedule the resources and ensuring that we make the most cost-effective scheduling decisions in all hours of the day.”

The IESO’s MRP business case predicted total 10-year benefits of $975 million, including $525 million in market efficiency improvements and $450 million from eliminating unnecessary congestion management settlement credit payments. After implementation costs, the IESO expects $700 million in net financial benefits for Ontario electricity consumers over the first decade.

Accounting for congestion in LMPs will reduce uplift payments. “That’s where a good chunk of the cost reduction comes from,” Trickey said.

Changes for Non-Quick Start Generators

A new Enhanced Real-Time Unit Commitment process will seek to optimize the scheduling of non-quick start gas generators over multiple hours versus the current system, in which dispatch is determined for individual hours.

Most non-quick start (NQS) generators need one to six hours to start up and synchronize with the grid and have limited flexibility because of minimum loading points, maximum daily starts and minimum runtimes.

The IESO will be “looking up to 27 hours ahead to schedule the least cost solution and make sure that we schedule all of the pieces together,” Trickey said.

IESO also will replace its Real-Time Generator Cost Guarantee (RT-GCG) program with a Generator Offer Guarantee program. The former program provided financial and operational guarantees to NQS generators on days when they may not be able to recover their costs through energy prices. But that allowed them to claim reimbursement for start-up costs greater than what they incurred, the Ontario Electric Board (OEB) concluded in a March 6 ruling dismissing the generators’ challenge to the MRP.

Under the new rules, NQS generators must provide a three-part offer, including energy costs, start-up costs and the cost of remaining connected to the grid while generating net-zero active power.

“The non-competitive nature of the RT-GCG leads to productive inefficiencies in the short run when demand is not met using the lowest cost resources, as offers do not accurately reflect generation costs,” the OEB wrote. “The RT-GCG program also suppresses market prices below efficient levels by removing the incentives for these generators, who are frequently market price-setters, to incorporate fixed start-up costs into their offer prices. The result is a weakened price signal and a reduction of incentives for other market participants to be available at these times.”

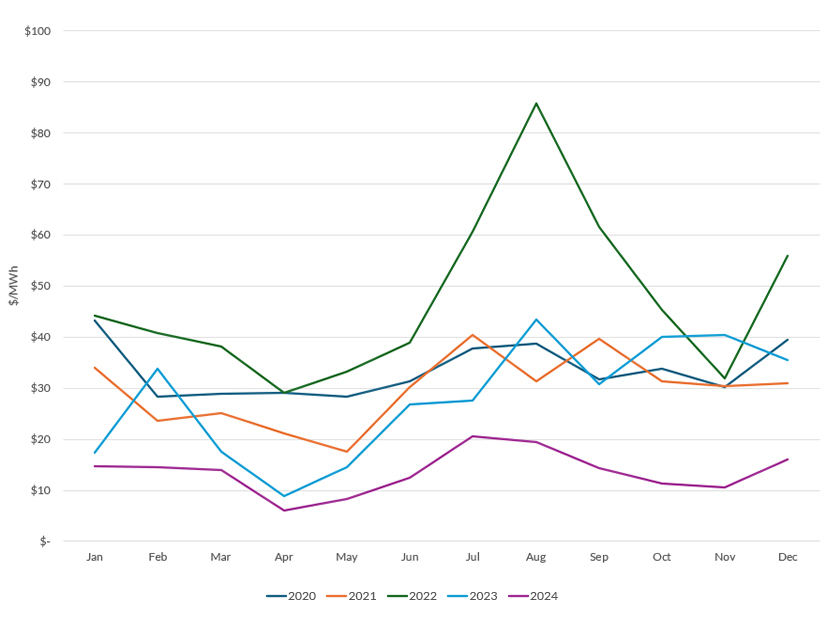

An analysis by the generators’ consultant, Power Advisory, found a 600-MW gas generator with a heat rate of 7.5 MMBtu/MWh would have had a net margin of $75.5 million from 2018 to 2023 under the new rules, a reduction of $21 million from the current rules. The analysis also found gas generators set prices in 41% of day-ahead hours and 62% of real-time hours in summer 2021.

Impact on Loads, Resources

Nodal pricing will be applied to dispatchable loads, price-responsive loads and generation, including dispatchable resources, self-scheduling and intermittent suppliers (wind and solar). Non-dispatchable loads will settle on one of 10 hourly zonal prices. Large industrial consumers can continue to pay an hourly Ontario-wide price or choose the LMP for their location.

Dispatchable loads — “a very, very small percentage” of loads, according to Trickey — must be able to respond to IESO instructions and reduce their consumption within five minutes.

Pricing for non-dispatchable loads will remain uniform across Ontario, but the new Ontario Electricity Market Price will be based on the hourly load-weighted average of all non-dispatchable load DAM LMPs plus a price adjustment to account for the cost of the differences between day-ahead and real-time schedules.

Although the calculations behind them will change, consumer bills will look the same, with an hourly province-wide price for electricity added to the Global Adjustment, which covers the cost of building and maintaining the electric system.

Intertie Transactions

The market will use dynamic settlement pricing on its interties with Quebec, MISO, NYISO and PJM.

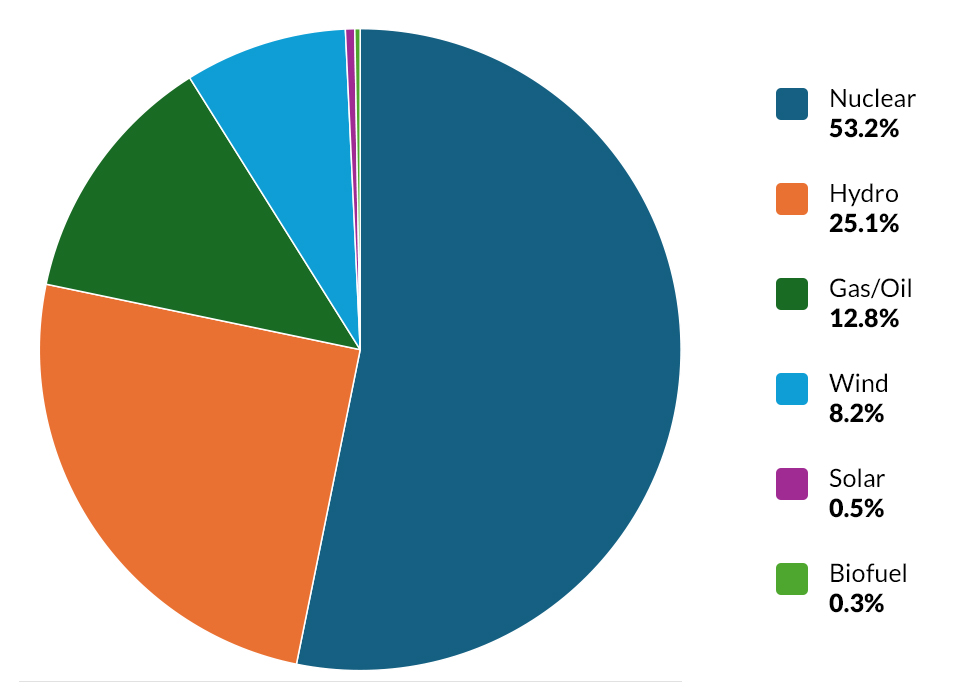

IESO imported 4.1 TWh to meet its 137.1 TWh of demand in 2023, while exporting 16.5 TWh.

The real-time intertie border price will be used if there is no congestion in the final pre-dispatch run. For export-congested interties, the sum of the five-minute real-time intertie border prices and the pre-dispatch intertie congestion price will be used. For import-congested interties, the lesser of the pre-dispatch intertie LMP (which includes the intertie border price plus the intertie congestion price) or the five-minute real-time intertie border prices will prevail.

The current day-ahead commitment evaluates import and export legs of wheel-through transactions as linked transactions while pre-dispatch assesses both as separate transactions. In the new market, both the DAM and pre-dispatch will assess import and export legs as linked transactions.

No Virtuals or FTR Markets

With a system-wide price and the lack of a binding day-ahead market, IESO’s current system has no virtuals market for arbitraging between day-ahead and real-time prices.

And while there is a financial transmission rights market for hedging import and export risks, there is no FTR market for hedging internal congestion.

The MRP will create a virtuals market at the zonal level, like those in NYISO and ISO-NE. Market participants will be able to submit hourly bids and offers in any of nine virtual transaction zones in the day-ahead market. The Bruce zone has a low load relative to supply, so it was combined with the Southwest to create a more balanced zone, according to IESO.

MISO and PJM began their virtuals market at the zonal level until they became more established, and SPP’s Markets+ virtuals market also will begin on a zonal basis when it launches, noted Emily Merchant, a director of product at Yes Energy.

Merchant said nodal virtual markets require significant trading activity to ensure prices accurately reflect market conditions. “Given all the changes rolling out with the MRP, the market operator may have wanted to de-risk this new virtuals market by starting off zonal,” Merchant wrote in a Yes Energy blog post on preparing for the nodal market.

The introduction of LMPs also creates the “framework to support FTRs” said Merchant, although the IESO says it has no current plans for such an expansion.

“There are no internal nodal transmission rights like there are in some other markets,” said Warren Hill, a senior adviser for market development at IESO. “We are not going in that direction.” (See IESO’s Introduction to Virtual Traders.)

Yes Energy power market analyst Tim Hough said the zonal virtual market may be most attractive to asset operators looking to hedge against volatility.

“Since there’s only nine different nodes you can virtually transact on, there is just a lot less opportunity for traders to find a couple little nodes and a special little weather pattern to make a lot of money on,” he said.

Market Power Mitigation

IESO will change from an ex-post to an ex-ante approach to market monitoring, employing a “conduct and impact” test to mitigate market power before prices and schedules are determined.

If a market participant fails the conduct test — or is found to have made an offer significantly above that expected under competitive conditions — IESO will apply an impact test to determine the difference in market outcome between the higher offer and the reference level offer. If the MP fails both tests, its offer will be replaced with reference levels.

Implementation Plan; Potential for Delays

The MRP will result in about 36 new public reports from IESO and updates to more than a dozen others, while more than 20 will be retired. The MRP also will include a new four-zone demand forecast, “so you’ll be able to see demand in different areas with a more accurate view than what we would provide today,” Trickey said.

IESO will provide updates on the status of the launch beginning the morning of April 30 and continuing through completion of the launch, expected May 2.

“There is always a small chance that something could happen in between now and then that would impact that — likely to be something in terms of system conditions,” Trickey said. “If there was some sort of reliability event — you know, weather event, or something that impacted us — we may need to change that.”

If the launch is delayed, IESO will not go forward until the first of a subsequent month, Trickey said, ruling out a launch on July 1 or Aug. 1 because of holidays. “[We] may not want to necessarily launch in the heat of the summer as well, when system conditions can be more challenging.”

Market participants will need to submit dispatch data into both the legacy and renewed market systems on April 30 because existing bids and offers will not be moved to the new system. There will be no day-ahead market for the May 1 and 2 trade dates as IESO establishes the new real-time market and monitors dispatch results.

“There will be bumps along the way as we transition, because it is a very large and complex change, and one that depends on people from across the sector,” said Trickey. “I know there’s going to be bumps coming, but we’re in a good position to weather through those.”

Although IESO is making the changes to improve operational certainty and reduce system costs, initial market results may not show immediate improvements, said Yes Energy’s Hough. “It’ll be a very big change for a lot of people. So, I would expect some volatility there. If you’re a battery asset operator — which there isn’t much of in Ontario — you will probably be raking it in early on.”

For More Information:

-

- IESO’s Overview of the Transition to the Renewed Market presentation and webcast

- Yes Energy’s on-demand webinar on IESO’s nodal market launch

- Yes Energy’s blog post: 20 FAQs about the Ontario Market Renewal Program

- Yes Energy’s blog post: Ontario’s Power Market Goes Nodal. How to Prepare

Editor’s note: RTO Insider is a wholly owned subsidiary of Yes Energy.