COLLEGE PARK, Md. — Maryland has already cut its greenhouse gas emissions to 30% below 2006 levels, putting it halfway to reaching the 2031 goal of a 60% reduction set in the 2022 Climate Solutions Now Act (CSNA), Secretary of the Environment Serena McIlwain told the recent Maryland Clean Energy Summit.

Implementing existing state policies will cut emissions 55% by 2031, which means “we really only need 5% to take us to the finish line,” an achievement worth celebrating, McIlwain said, leading off a panel of state officials at the event sponsored by the Maryland Clean Energy Center. Still, she warned, getting to 60% “will not be easy for any of us.”

The law also sets a 2045 target for Maryland to slash its greenhouse gas emissions to net zero. “What this really means is we have to create new policies, and new policy action may not be welcomed by everyone, because [the policies] are bold, they are specific; they will be specific for sectors and for this entire economy,” she said.

Former state Sen. Paul Pinsky (D), who sponsored the CSNA, put it more bluntly.

“We have to shift from fossil fuels to clean energy. Period. End of discussion, end of paragraph,” said Pinsky, now director of the Maryland Energy Administration. “We can’t hang onto the old ways of doing business, we just can’t. It won’t get us where we need to be.”

According to McIlwain, Pinsky and other speakers at the day-long summit, the CSNA emission-reduction goals — coupled with Democratic Gov. Wes Moore’s 2035 target for a decarbonized electric system — are among the most ambitious in the nation. (See Md. General Assembly Sends Climate Solutions Bill to Hogan.)

As reported at the conference, the CSNA and other recently passed laws have triggered a range of model projects and programs. The state’s largest investor-owned utility, Baltimore Gas and Electric (BGE), is preparing for a November ribbon-cutting at a new electric-vehicle (EV) fast-charging station in Johnston Square, a low-income, historically African American neighborhood in Baltimore.

One of the new laws passed this year (HB 908) made Maryland’s pilot community solar program permanent. Soon after, Solar Landscape, a New Jersey-based solar installer, announced a partnership with Public Storage to put community solar installations on the roofs of 57 of the company’s storage facilities throughout the state.

Solar Landscape will focus on signing up households in low-income communities, according to Elizabeth McKeever, the company’s general counsel. The first projects are currently under construction.

The state is also in the process of finalizing regulations for building energy performance standards for commercial buildings of 35,000 square feet or more, another provision in the CSNA. The proposed regulations could go into effect in 2025, when covered buildings will have to benchmark and start reducing their energy use, said Mark Stewart, climate change program manager at the Maryland Department of the Environment (MDE).

The law sets a 2030 target for a 20% emissions reduction from 2025 levels and a 2040 target for net zero.

But attendees also heard about some of the tough obstacles ahead.

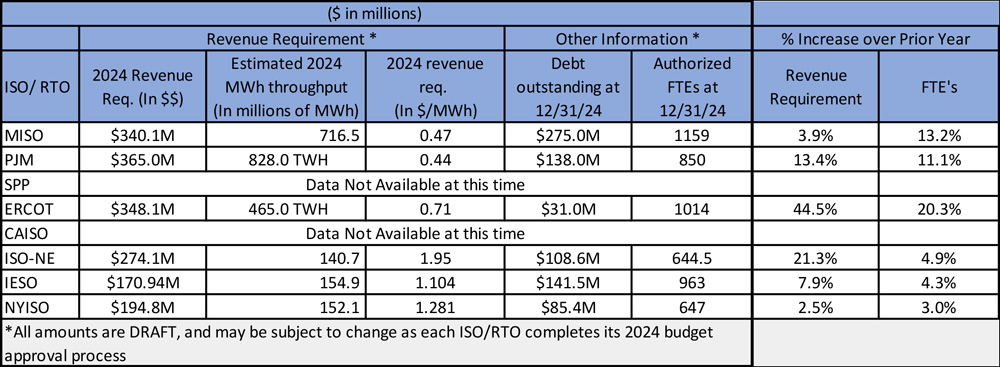

State Sen. Brian Feldman (D), chair of the state Senate Committee on Education, Energy and the Environment, reported on a recent meeting with officials from PJM, who warned of rolling blackouts in the Baltimore region if the Brandon Shores coal-fired generation plant in Anne Arundel County is closed in 2025, as is currently planned. The grid operator said it would need another three years to complete up to $800 million in grid upgrades to ensure system reliability when the plant is shut down.

“This is where things get a little more complicated,” Feldman said. “Moving forward, in 2024 and beyond, we’re going to have some very challenging policy calls.”

Maryland’s natural gas utilities could also slow progress toward the state’s emission reduction goals, with their plans to continue investing in new infrastructure at current levels, despite projections that demand for the fuel will taper as more homes and businesses electrify, said People’s Counsel David Lapp.

He foresees costs for recovering those investments shifting to lower-income customers through higher rates as more affluent households go electric.

The Right Policies

The CSNA required the MDE to produce a plan to implement the law, with an initial draft due in June of this year, to be followed by a final report sent to the governor and state legislature by the end of December.

Authored by the Center for Global Sustainability at the University of Maryland College Park, the draft plan laid out a range of policy options, some very aggressive, without making any recommendations. The report’s potential pathways included a 500% increase in solar deployments, the launch of an in-state, economywide cap-and-invest program and shifting all the electricity Maryland imports to 100% clean energy. (See Maryland Climate Report Lays out Pathways to Achieving Goals.)

Looking ahead, McIlwain was mum on specifics, but she hinted at the general direction the final report would take.

“It’s going to lay out a clear strategy that focuses on creating new statewide policies around transportation and buildings, and we’re going to explore, as we’re doing now, renewable energy pathways as well,” she said. “We’re going to focus on the right policies because when we do that, it’s going to allow us to accelerate, and when you accelerate you push the markets to respond.”

McIlwain also stressed the health and economic benefits of Maryland’s emission reduction goals. Lower emissions could result in a reduction of respiratory illnesses in the state, which could provide $591 million in health savings by 2030, she said.

The clean energy incentives and tax credits in the Inflation Reduction Act are another driver for Maryland to move fast on its climate policies and programs, she said: “It makes decarbonization way more affordable.”

Pinsky said decarbonization has to start with energy efficiency, electrification and renewables, and encouraged companies to leverage state and federal dollars to grow their markets. “We have to put our creative juices and your dollars to invest when you see a good idea that can be scaled up and has implications not just for the state of Maryland but for the nation.”

But, like McIlwain, he warned of opposition — “people who want to take potshots” at the state’s clean energy goals — and called for broad business and social support.

“We need the public and the advocacy community … the business community to get behind [this] and say, ‘There’s no wavering.’ … We’re not going to make this tentative. We’re going to implement this damn thing if we’re going to move our state forward,” Pinsky said.

Business Opportunities

Business leaders at the conference talked about both the economic opportunities and risks in decarbonization.

For A.O. Smith, a manufacturer of water heaters, the potential market is enormous, according to Josh Greene, the company’s vice president for government affairs. Of the 10.2 million units of water heating equipment shipped in the U.S. in 2022, only 145,000 were heat pump water heaters, he said.

But while heat pumps are the most efficient technology for water heating on the market, a range of factors can affect adoption, such as a state’s decarbonization goals and regulations, local utility distribution systems, consumer awareness and, of course, cost.

About 25,000 water heaters are either repaired or replaced every day in the U.S., Greene said. After one cold shower, “when you think about that turnover and what consumers are looking at, are you going to wait a few days” to get a heat pump water heater, he asked.

Overcoming such barriers to market growth also means educating contractors to stock and install heat pump water heaters, Greene said. A.O. Smith is training 2,000 contractors a week on heat pump installation, he said.

The opportunities for utilities are also significant. For example, EV programs can simultaneously support state and local decarbonization efforts, increase electricity demand and allow for new capital investments — in the form of EV chargers — that can be included in their rate base.

Alexander Núñez, BGE vice president of governmental, regulatory and external affairs, framed the utility’s EV programs as part of its efforts to “leave no one behind.” Using federal funds, BGE has partnered with ride-sharing company Lyft to help develop a fleet of 100 EVs that Lyft drivers in Baltimore can rent at discounted rates.

The first 25 EVs in the Lyft fleet were Kia Niros, which “have been on the road for just over a year, and already they have produced an aggregate of more than one million miles,” Núñez said. “These are one million miles of new people getting into an EV, experiencing … the comfort, the quiet, getting them a chance to consider whether that’s going to be their next car.”

He also noted that about one half of the Lyft drivers renting the EVs are “diverse,” and one half of the rides are either starting or ending in the city’s disadvantaged neighborhoods. The rest of the fleet will be unveiled at the ribbon-cutting for the Johnston Square EV chargers in November, he said.

But Núñez said that leaving no one behind also means maintaining service for the utility’s 700,000 natural gas customers. BGE has been working to replace gas equipment, he said, including more than 350 miles of main distribution lines, with newer equipment that helped the company lower its greenhouse gas emissions by 27% by the end of 2022.

The Coming Gas Cost Shift

Lapp and the Office of the People’s Council (OPC) have countered arguments of BGE and other utilities in proceedings before the Maryland Public Service Commission.

While acknowledging the role utilities play in providing critical services to all Maryland residents, Lapp also stressed that they are monopolies making decisions that primarily benefit the interests of their investors.

“It is the state’s job, through the legislature and the Public Service Commission, to regulate monopolies,” he said.

If Maryland gas utilities continue to invest in distribution infrastructure at their current rates, the cost of those investments could triple by 2050, from just over $1 billion to $3.1 billion, an OPC analysis projects.

Lapp said the concern is that customers will leave the gas system as electrification becomes more economic “just on a pure technology basis.”

“Climate policy will also drive further customers [off the system] for incentives like the IRA and other policies … increasing [natural gas] rates because those revenues have to be recovered from fewer and fewer sales and fewer customers,” he said.

While Lapp does not oppose all gas infrastructure spending, he said “we don’t need to replace entirely the existing systems we have today.” But even utilities that acknowledge that gas use is going to decline continue to argue for maintaining current investment levels to provide backup, he said.

Others claim that they are “not aware of any heat pumps currently available that would require no backup heating system,” Lapp said.

The OPC currently has a petition before the Public Service Commission asking it to open a proceeding aimed at ensuring gas utility planning is based on the state’s climate policies and a future of diminished gas use.

At the same time, as Feldman said, working with PJM to balance Maryland’s ambitious climate goals with grid reliability also will be critical.

Talen Energy had originally planned to convert its coal-fired Brandon Shores plant to natural gas, but found that fuel switching would not pencil out and set a closure date of June 2025. According to Jeff Shields, PJM’s media relations manager, the plant closure could result in “voltage collapse and thermal overloads on the transmission system, particularly in the greater Baltimore area.”

The issue underlines the extent to which Maryland’s dependence on imported power will affect its decarbonization efforts. A Brandon Shores closure could mean the Baltimore region will need to import 80% of its power from outside the state, Shields said.

To ensure adequate power imports, PJM has planned for system upgrades as part of its Regional Transmission Expansion Plan and is in talks with Talen to keep Brandon Shores online with a special contract, called a reliability-must-run agreement. (See PJM Shortlists 3 Scenarios for 2022 RTEP Window 3.)

Speaking with NetZero Insider at the conference, Pinsky said Maryland will need to get more aggressive on transmission, but acknowledged that the state will have to figure out how to build the system it needs without putting all the costs on its ratepayers. “I think we’ve got to look at a period of years to do that,” he said.

U.S. Sen. Chris Van Hollen (D-Md.) raised concerns about the challenges states face in applying for the $8.5 billion in federal dollars available from the IRA for home energy efficiency upgrades, one of the law’s provisions that he worked on and supported.

“It’s our goal to make sure these [funds] can be provided to states in order that they can quickly get them out the door and into the hands of the people that are doing this work,” Van Hollen said. The current application process may be making that more difficult, he said.