Amazon is stepping further into the nuclear energy market, announcing multiple agreements surrounding advanced reactor technology that could provide carbon-free electricity for its operations.

The Oct. 16 announcements are the latest display of nuclear interest by energy-intensive data crunchers. Just two days earlier, Google announced a pioneering agreement to support Kairos Power’s development of its small modular reactor (SMR) and then buy power from the first few units built. (See Google, Kairos Sign 500-MW Nuclear PPA.)

Amazon itself agreed earlier this year to operate a data center co-located with Talen Energy’s existing nuclear plant in Pennsylvania. The move made news, and waves. (See Talen Energy Deal with Data Center Leads to Cost Shifting Debate at FERC.)

“One of the fastest ways to address climate change is by transitioning our society to carbon-free energy sources, and nuclear energy is both carbon-free and able to scale — which is why it’s an important area of investment for Amazon,” Matt Garman, CEO of Amazon Web Services, said in a news release. “Our agreements will encourage the construction of new nuclear technologies that will generate energy for decades to come.”

Amazon’s latest plans involve three other entities: X-energy Reactor Co., Energy Northwest and Dominion Energy Virginia.

X-energy

Amazon and others will invest $500 million in X-energy to help it complete design and licensing of its Xe-100 SMR and build a fuel fabrication facility.

The reactor’s design will be shippable via highways; it is intended to accelerate construction timelines and create more predictable and manageable construction costs.

Amazon and X-energy hope to bring more than 5 GW of SMRs online in the United States by 2039.

As part of the deal, X-energy and Amazon will develop a standardized deployment and financing model for future projects with infrastructure and utility partners.

“To fully realize the opportunities available through artificial intelligence, we must bring clean, safe and reliable electrons onto the grid with proven technologies that can scale and grow with demand,” X-energy CEO J. Clay Sell said in a news release. “We deeply appreciate our earliest funders and collaborators … we are now uniquely suited to deliver on this transformative vision for the future of energy and tech.”

Energy Northwest

Amazon will partner with Energy Northwest to fund efforts to develop the Xe-100 SMR and deploy it near the public power agency’s Columbia Generating nuclear power station in Washington.

The deal gives Amazon the right to purchase electricity from the first phase (four modules totaling 320 MW) and gives Energy Northwest the option to add up to eight more modules (640 MW).

Energy Northwest said as the owner and operator of the only nuclear facility in the Pacific Northwest, and as a developer of clean energy and storage resources, it is well-suited for this new partnership.

“We’ve been working for years to develop this project at the urging of our members, and have found that taking this first, bold step is difficult for utilities, especially those that provide electricity to ratepayers at the cost of production,” Energy Northwest’s Vice President for Energy Services and Development Greg Cullen said in a news release. “We applaud Amazon for being willing to use their financial strength, need for power and know-how to lead the way to a reliable, carbon-free power future for the region.”

Dominion

The memorandum of understanding between Amazon and Dominion Energy Virginia commits them to exploring commercial and financing structures for SMR development in Virginia.

In July, parent company Dominion Energy sought proposals from SMR developers to evaluate the feasibility of adding an SMR at the company’s North Anna nuclear generating station in Virginia.

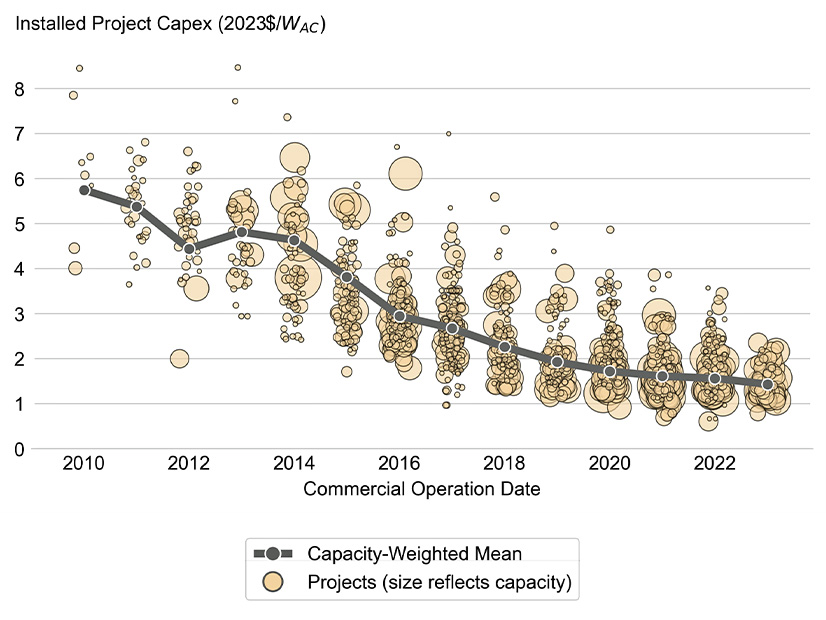

An objective of the Amazon MOU is to mitigate potential cost and development risks for customers’ capital providers. Large nuclear reactors have proved extremely expensive to develop in the United States in recent decades, and while SMRs hold the promise of eventual cost reduction through standardization, they are still in development and early projects are expected to be expensive.

The SMRs in development now must still clear numerous technical and regulatory hurdles. And any future scenario in which scores or hundreds of new reactors with smaller safety zones dot the American landscape could be expected to prompt extensive debate and litigation.

But Dominion said SMRs could play a pivotal role in the energy mix in the 2030s. “This collaboration gives us a potential path to advance SMRs with minimal rate impacts for our residential customers and substantially reduced development risk,” CEO Robert Blue said in a news release.