The world’s leading offshore wind developer has canceled two major U.S. projects and suspended work on a third but committed to building a fourth and is trying to salvage a fifth.

None of the five have reached steel-in-the-water construction yet, but all were in various stages of development.

Ørsted announced the news Nov. 1 with its nine-month 2023 financial results, which painted an unhappy picture for the Denmark-based company: an impairment of $4.06 billion in U.S. currency, $2.83 billion of it attributed to the cancellation of the Ocean Wind 1 and 2 projects in New Jersey.

The company expects to announce further developments later this year as it reviews its U.S. offshore portfolio.

Ocean Wind 1 received its federal approvals for construction in July and September. It was an important project to New Jersey’s clean-energy initiatives, an 1,100-MW first chapter in what state leaders had hoped eventually would be an 11,000-MW offshore power portfolio.

Gov. Phil Murphy (D) and other proponents criticized Ørsted after the announcement. Opponents unhappy with Ocean Wind’s potential impact on the fishing and tourism industries cheered the decision and vowed to keep up the fight as the state’s third contracted project, Atlantic Shores, continues in preconstruction development.

Also Wednesday, Ørsted CEO Mads Nipper said during a conference call:

-

- The company would halt work on the Skipjack project off the Delaware coast so as not to incur any further costs on it; if negotiations do not yield significant increases in the offshore renewable energy credit (OREC) prices, the company will cancel that project as well.

- Ørsted and partner Eversource have made the final investment decision on Revolution Wind and will start construction next year, albeit with a longer time frame.

- Having had their request for higher ORECs rejected by New York, Ørsted/Eversource hope to rebid the Sunrise Wind project under the expedited process promised by the state.

Headwinds

The problems Ørsted is reporting with the Ocean Wind projects are being felt to some degree by everyone in the first wave of U.S. offshore wind development: soaring material costs, surging interest rates, supply chain constraints and lack of domestic infrastructure.

The exceptions are projects that locked in their costs early on. Ørsted/Eversource, for example, is now building South Fork, which may be the first commercial-scale offshore wind project completed in U.S. waters. Vineyard Wind also is under construction, and Dominion Energy says its Coastal Virginia Offshore Wind project — approved by federal regulators just hours before Ørsted’s announcement — also locked in its contracts early on. (See BOEM Approves Virginia Coastal Offshore Wind.)

Nipper said Ocean Wind ran into a severe problem when completion date of the first U.S.-built offshore wind vessel, the Charybdis, was pushed back. That pushed the entire construction schedule back to the point of requiring contract re-negotiations. The cost increases in those new contracts would make Ocean Wind untenable, he said.

Ørsted will look to use the equipment it has purchased for Ocean Wind 1 on other projects. It will retain the seabed lease area for Ocean Wind 1 and 2 and consider options for it as part of the review of its U.S. portfolio.

Offshore wind has become a political flash point in New Jersey, where the Legislature earlier this year allowed Ørsted to claim federal tax credits that otherwise would go to ratepayers. (See Murphy Signs OSW Tax Credit Bill.)

Murphy blasted the company Wednesday. In a prepared statement, he said:

“Today’s decision by Ørsted to abandon its commitments to New Jersey is outrageous and calls into question the company’s credibility and competence. As recently as several weeks ago, the company made public statements regarding the viability and progress of the Ocean Wind 1 project.”

Tim Sullivan, CEO of the New Jersey Economic Development Authority, posted on X: “Gov. Murphy’s statement is exactly right — outrageous decision but offshore wind remains vital to our future. Note on the bill passed in June: it permitted federal credits to benefit Ocean Wind 1 *if and only if* they built the project. Now they get nothing from that bill, period.”

U.S. Rep. Jeff Van Drew (R), who represents much of the Jersey Shore, where opposition had galvanized, posted: “I am thrilled to see that Ørsted has decided to pack up its offshore wind scam and leave South Jersey’s beautiful coasts alone. A tremendous win for South Jersey residents, our fisherman and the historic coastline of the Jersey shore.”

Save Long Beach Island posted: “One down-One to go. We are encouraged by Ørsted’s decision to move on but remain steadfast in our fight with Atlantic Shores. This fight is not over.”

Wider Picture

Offshore wind is off to a late start in the United States. Thirty-two years after the first wind farm went live off the coast of Denmark, installed capacity is estimated at more than 64,000 MW worldwide. Just 42 MW of it is operational in the United States.

The ill-fated Cape Wind project famously collapsed almost a decade ago, but Ocean Wind 1 is the first of the new wave of U.S. offshore wind projects to be canceled.

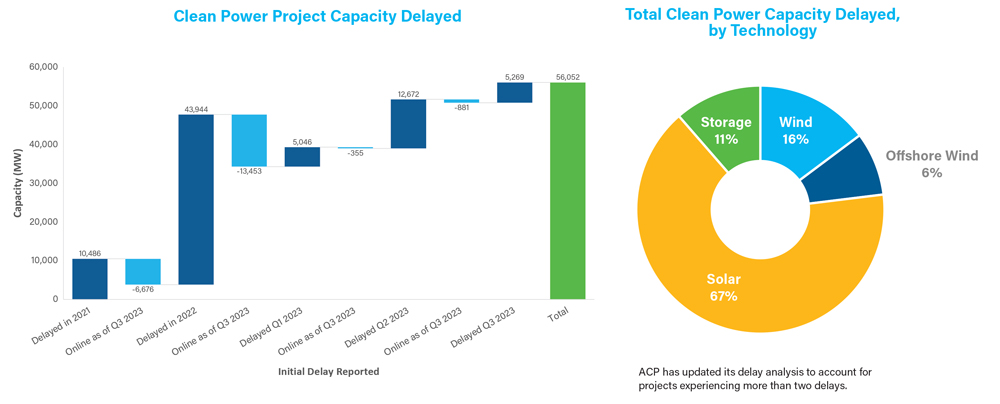

It is the strongest blow yet to President Biden’s goal of 30 GW of offshore wind capacity installed by 2030.

But it is far from the only setback.

Vineyard Wind and SouthCoast Wind have canceled their power purchase agreements in Massachusetts and Park City Wind has reached a deal to do the same in Connecticut.

The difference there is that the developers hope to rebid, secure higher compensation and start construction.

Ørsted is walking away from Ocean Wind.

Developers of the Beacon, Empire and Sunrise projects also have said they cannot continue without more money. New York rejected their requests in October but invited rebids. (See NY Rejects Inflation Adjustment for Renewable Projects.)

Atlantic Shores in July said it needed more support from New Jersey of the kind the state had just extended to Ocean Wind. But it told the Philadelphia Inquirer on Wednesday it is continuing development for now.

Ørsted’s Other Projects

Nipper said during the conference call there would be minimal financial repercussions if Ørsted cancels the Skipjack project.

But cancellation of the Ørsted/Eversource Sunrise project would run in the range of $420 million, he said.

Nipper said he sees rebidding as the best path forward for Sunrise, although he would like to keep the current contract alive during the rebid process. Initial indications are that New York will require cancellation before rebid.

Two things give him optimism on Sunrise: The average OREC price in the latest round of tentative offshore wind contract awards is higher than Sunrise had been seeking, and soil testing reveals the landfall site for the Sunrise export cable is contaminated — making the project eligible for enhanced federal investment tax credits.

Revolution Wind also should benefit from brownfield designation, Nipper said.

Importantly, Ørsted has been able to secure a backup installation vessel for both Revolution and Sunrise.

Revolution received its positive record of decision in August and its construction and operations plans are expected to be approved this month. (See BOEM Approves Revolution Wind off New England Coast.)

Nipper said a risk analysis was favorable and Ørsted decided to move ahead with Revolution. Ørsted and Eversource announced the final investment decision Wednesday.

Eversource is actively attempting to sell its share of the partnership. It did not return a request for comment on the progress of that effort.

Nipper said Revolution and potentially Sunrise would proceed to construction with Eversource as a partner if the New England utility is unable to reach a sale deal.

The two companies also are partners on South Fork Wind, a smaller project that may be the first to reach completion in U.S. waters. In early October, Newsday reported that installation vessel availability was delaying the work.

But on Tuesday evening, the first turbine set sail from the Port of New London, Connecticut. It will be installed in the coming days.

Financial Trouble

Ørsted’s nine-month financials were not well-received. Its stock price dropped more than 25% in heavy trading Wednesday to close at its lowest point in more than five years.

As one financial analyst noted during the call, each update in 2023 has been worse than the one before it.

The company did take some effective hedges against interest rates earlier this year, Nipper said, but accounting rules do not allow that to be deducted from the impairment.

Equinor and bp, partners on the financially troubled Beacon Wind and Empire Wind projects in New York, also are suffering financially, though not to the same degree as Ørsted.

Equinor on Oct. 27 announced a $300 million impairment due to its U.S. renewables portfolio and bp on Oct. 31 announced a $540 million impairment attributed to its New York Offshore wind projects.

Reuters reported that bp’s head of U.S. renewables told a conference in London on Wednesday that “offshore wind in the U.S. is fundamentally broken.”

However, she said she believed that while the path forward will be challenging, the projects will be built.