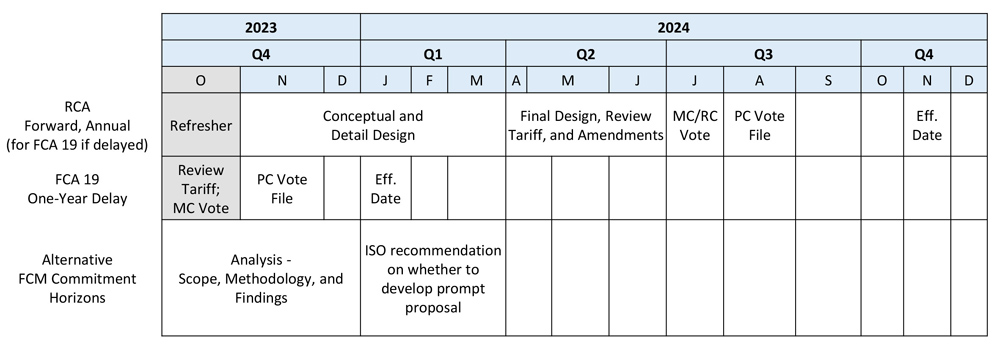

WESTBOROUGH, Mass. — Analysis Group outlined the methodology of its study of major changes to the structure of ISO-NE’s Forward Capacity Market (FCM) at the NEPOOL Markets Committee meeting Nov. 7. The study will consider quantitative and qualitative effects of prompt and seasonal capacity market formats.

“These options are being evaluated in light of multiple changes to the region’s electricity system and markets arising in part from state policies aimed at decarbonizing the region’s grid, as well as technological innovation that increases performance and decreases costs of new technologies,” Todd Schatzki of Analysis Group told the MC.

A prompt market would reduce the time between the capacity auction and the capacity commitment period (CCP) from three years to just a few months, while a seasonal auction would split up the CCP into distinct seasons with separate auctions.

Working on a tight timeline — with draft results expected in December — Analysis Group is tasked with studying the tradeoffs associated with both formats. The study will consider prompt and seasonal constructs both separately and together and compare them to the existing three-year forward annual market.

Analysis Group will also consider other market design factors, including how the seasons are separated within a given year, whether seasonal auctions are held simultaneously or sequentially, and whether the transition to a new capacity market will be accomplished all at once or in multiple phases.

The quantitative assessment of auction outcomes associated with various constructs will look at the 2028/29 and 2034/35 CCPs, with a resource supply that “reflects resources that have recently bid into the [Forward Capacity Auction], as well as state-legislated procurements and additional assumed resources (to meet state environmental goals).”

ISO-NE is requesting stakeholder feedback on the study by Nov. 13 and is planning to make a recommendation on a potential move to a prompt market at some point in the first quarter of 2024.

RCA Updates

Feng Zhao of ISO-NE presented updates to the RTO’s proposal for winter accreditation of oil and gas resources as part of its ongoing Resource Capacity Accreditation (RCA) project.

Under the updated proposal, “gas capacities will be modeled as an aggregated profile, and oil resources will be modeled as individually de-rated thermal units for the winter period,” Zhao said.

The RCA project aims to “support a reliable, clean-energy transition by implementing methodologies that will more appropriately accredit resource contributions to resource adequacy as the resource mix transforms,” Zhao said.

The seasonal risk assessments that result from these models will then be used as resource accreditation inputs.

“The newly proposed gas and oil models better capture the characteristics of gas and oil energy limitations and historical performance in the winter period, and therefore are expected to yield a more accurate winter risk level,” Zhao added.

Retirement Rules

ISO-NE continued discussions on changes to the rules for retired resources looking to re-enter the FCM.

In August, the RTO proposed to eliminate investment requirements for retired resources seeking FCM re-entry. ISO-NE has said the requirements “could create a barrier to cost-effective and timely re-entry of FCM resources.”

Responding to stakeholder concerns about seller-side market power and cost-of-service impacts, ISO-NE is now proposing to treat certain retired resources that re-enter the FCM as existing capacity and require “clawback” provisions for resources retained by cost-of-service agreements (COSAs) that seek to re-enter the capacity market.

The changes are intended to prevent unintended incentives for resources retiring and then re-entering the FCM.

“Absent a provision requiring repayment, resources could uneconomically retire only to seek a (perceived) profitable retention agreement,” said Ryan McCarthy of ISO-NE. “If retained without a clawback provision, the resource can re-enter in a later period, benefiting from any capital expenditure compensation … received via the COSA.”

ISO-NE is targeting January for a vote by the MC on the proposal, followed by the Participants Committee in February.

IMM Quarterly Report

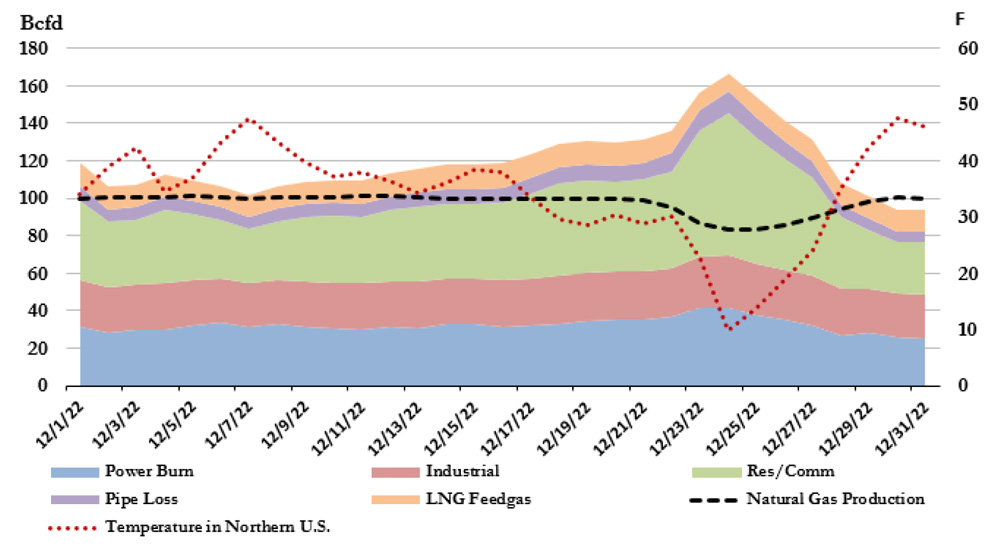

Summer wholesale market costs were down by 60% and energy costs were down by 64% compared to the previous summer, ISO-NE’s Internal Market Monitor found in its quarterly markets report.

The Monitor attributed this to the decline in average natural gas prices, which were 71% lower than in the summer of 2022. Average loads were also significantly lower than the previous two summers — and the lowest summer peak load since 2000 — in part because of cooler weather in the region.

The IMM also noted that nuclear generation decreased because of planned and unplanned outages, making up 17% of the region’s average output compared to 21% in the previous two summers.