MISO last week said it plans to handle four of the five recommendations this year from the Independent Market Monitor’s State of the Market report, putting a recommendation regarding transmission planning on hold.

The grid operator announced it’s deferring action on the IMM’s recommendation that it re-evaluate the future generation mix used to develop the long-range transmission plan (LRTP).

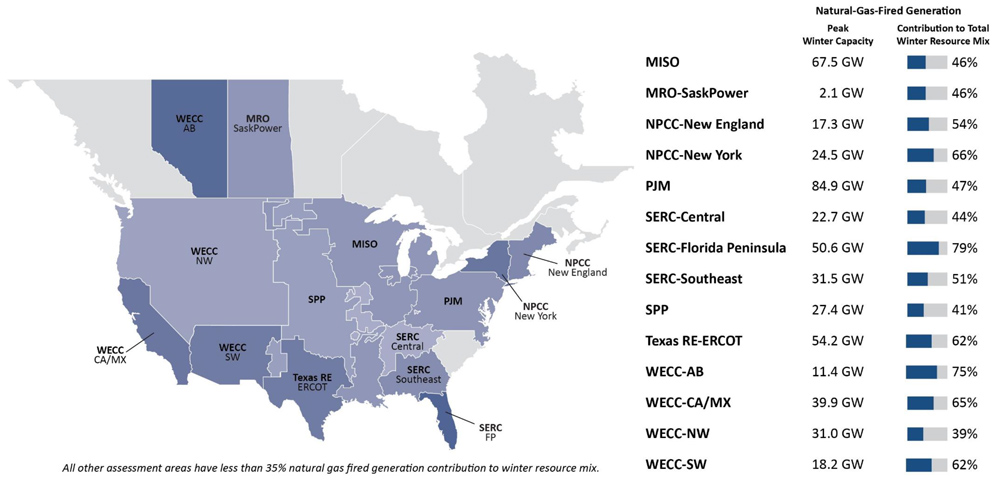

MISO Independent Market Monitor David Patton tied multiple State of the Market recommendations this year to reducing transmission congestion. He said most of the root cause of congestion can be tied to wind generation, which has little incentive to follow MISO’s dispatch instructions. (See MISO IMM Zeroes in on Tx Congestion in State of the Market Report.)

However, Patton also used this year’s report to criticize the future resource mix assumptions the RTO is using to shape a second LRTP portfolio for its Midwest region. It marked an unprecedented foray into transmission planning when the IMM typically focuses on MISO markets.

Patton recommended MISO use more battery storage, hybrid resources, other dispatchable resource additions and grid-enhancing technologies as alternatives to expensive transmission buildout. (See MISO Promises Analyses on Long-range Tx; Stakeholders Divided on IMM Involvement.)

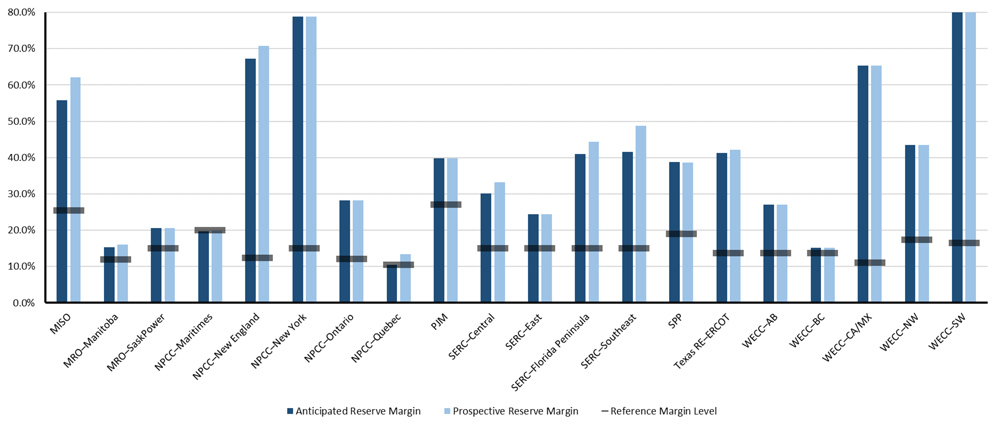

MISO said while it agrees with the IMM that it’s important to “evaluate the cost and benefits of transmission to avoid inefficient investments,” it disagrees that the fleet mix envisioned in its second of three 20-year transmission planning futures isn’t well-founded.

“MISO is still evaluating and will work with stakeholders to define LRTP scenarios, business case and alternatives to manage uncertainty,” Zhaoxia Xie, of MISO’s market design team, said during a Nov. 9 Market Subcommittee meeting.

Xie said MISO may not end up taking the IMM’s recommendation but will conduct more analysis and hold discussions with stakeholders.

Jeremiah Doner, MISO’s director of cost allocation and competitive transmission, said MISO still finds that Future 2A is a valid “anchor” to its LRTP. But he said as with any 20-year planning scenario, MISO could conduct more analysis and scrutinize uncertainties. He said the IMM’s recommendation likely can be tackled through the course of stakeholder meetings on the second portfolio of the LRTP.

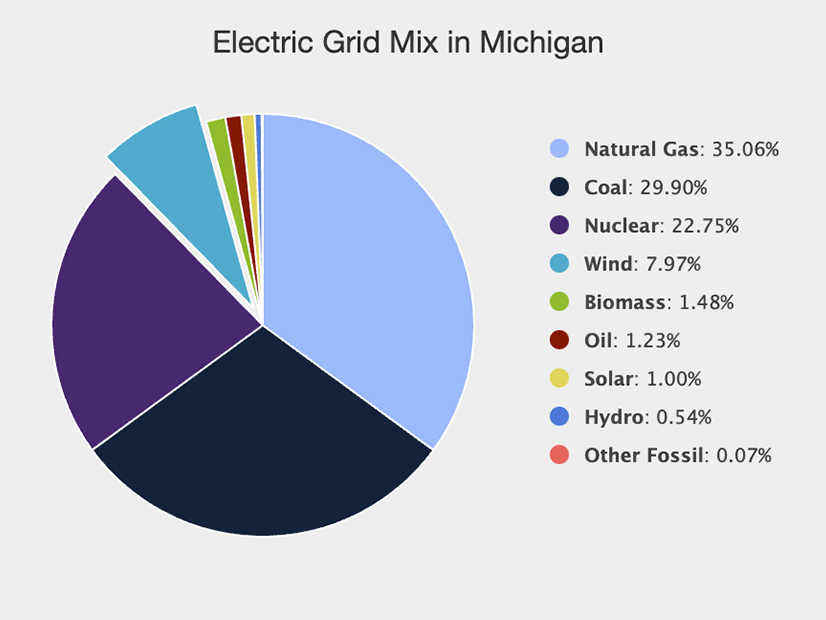

Minnesota Public Utilities Commission staff member Hwikwon Ham said MISO should outright reject the IMM’s recommendation. He said the IMM’s view of the future resource mix is based on a pessimistic view that “MISO members’ goals aren’t real and that decarbonization isn’t going to happen.” However, he said the Monitor’s opinion is increasingly implausible, as evidenced by Michigan Gov. Gretchen Whitmer (D) preparing this week to sign a bill requiring the state to reach 100% clean energy by 2040.

“This is going to be a real deal,” Ham said. “MISO should not waste its time on this.”

Other stakeholders said the IMM’s recommendation blurs the line between the duties of MISO’s Market Subcommittee and Planning Advisory Committee.

Work in Progress on Other Four

MISO was more receptive to the IMM’s four other recommendations in this year’s report.

MISO said it agrees with the advice that it ratchet up its excess and deficient energy deployment penalty charges, which Patton said are not high enough to dissuade generators from deviating from MISO’s dispatch instructions.

Xie said the MISO operations team is working on the design of a “follow dispatch flag” that will be sent to generators when they’re being dispatched down so they get a clearer signal to wind down output. Xie said the flag system will be MISO’s first step, and it will consider upping penalties in the future for generation that fails to curtail.

“Further evaluation and discussion are ongoing for the settlement incentives for the following dispatch,” she said.

Patton also recommended MISO expand its transmission constraint demand curves so its market dispatch system can better manage network flows.

Xie said an expansion of those curves likely will be contained in a larger filing that also will elevate MISO’s operating reserve demand curve and value of lost load. She said MISO could file with FERC for those changes sometime next year.

Patton has said MISO is missing out on valuable unrealized transmission flows because it’s forced to manually redispatch resources to manage constraints, especially when wind generation fails to scale back production on MISO dispatch instructions.

He said his recommendations will reduce flow uncertainty on the transmission system.

MISO stakeholders over the summer said MISO should introduce a software flag to let units more clearly know when they are being curtailed. Some said it’s not always apparent when MISO expects curtailment. Multiple stakeholders also said MISO sends incorrect dispatch instructions or instructions that don’t align with individual market participants’ offer curves.

Patton also recommended MISO improve its near-term wind forecasting to better reflect the characteristics of wind generation output. He said MISO uses a “persistence” forecast that assumes wind resources will produce the same amount of output as it most recently observed.

Xie said MISO will explore releasing more recent data through its interface to its forecasting vendors.

Finally, Xie said MISO agrees with the Monitor that it should establish a way for suppliers to submit annual offers instead of just seasonal offers in the new, seasonal capacity auction and rework some of its 31-day outage limit for generators per season.

Patton said MISO’s 31-day limit on non-exempt generation outages is causing some distortion in the capacity market because many suppliers this year deliberately adjusted their longer unit outages so they straddled seasons, thereby dodging penalties.

Xie said MISO plans to discuss with stakeholders a more “comprehensive participation model for resources looking for more flexible participation in the Planning Reserve Auction.”

She also said MISO will investigate modifying its outage penalty provisions and mitigation measures.