Markets and Reliability Committee

Proposed Rules for Generation with Co-located Load Rejected

VALLEY FORGE, Pa. — The PJM Markets and Reliability Committee rejected a proposal to modify how generators with co-located load not interconnected with the RTO’s grid may participate in its capacity market.

The package, which was sponsored by Exelon in the Market Implementation Committee, received 19.5% support during the Oct. 25 vote. (See “Stakeholders Endorse Proposal on Co-located Load,” PJM MIC Briefs: Aug. 9, 2023.)

The proposal would have required that the generation and load each be separately metered, with the generator being designated as a load-serving entity for the load. The generator would have been billed for the energy consumed by the co-located load as an LSE in settlement.

Exelon Vice President of Federal Regulatory Affairs Sharon Midgley said the proposal would allow the generator to offer its full accredited capability as capacity and require the load to pay for a capacity commitment through LSE charges. She said the proposal would effectively be a net financial derate for capacity market participation.

Constellation Director of Wholesale Market Development Adrien Ford urged the committee to vote against the proposal, referring to her comments during the package’s first read in September arguing, in which she argued that it would violate the Federal Power Act by considering load not receiving energy from PJM’s grid to be FERC jurisdictional.

Midgley responded that the load under the proposal would be retail and end-use.

Independent Market Monitor Joe Bowring said that the IMM opposed the proposal because, despite its designation of the generator as an LSE, it would permit the same capacity to be sold twice.

PJM’s Tim Horger said that several proposed amendments were dropped based on stakeholder feedback in September and a determination that they were not necessary. He offered a friendly amendment, which the commission accepted, to adjust the cost-based offer definition to be in line with changes made throughout the manuals following the shift to cost- and market-based offers. In the event that the larger proposal did not pass, he said that PJM would seek to make the revisions as a standalone manual change.

Stakeholders have been discussing how to account for generators with co-located load, both in configurations where the load is interconnected to the wider PJM grid or only capable of receiving energy from the generator. Several proposals addressing both were voted on by the MIC in August, but none regarding grid-connected load were endorsed, and Exelon’s was the only one for unconnected load to pass.

Stakeholders Mixed on Sunsetting Clean Attribute Procurement STF

Stakeholders are considering terminating the work of the Clean Attribute Procurement Senior Task Force (CAPSTF) following several states opting to form a working group outside the PJM process to explore the creation of a voluntary market for trading clean energy attributes that is not under FERC jurisdiction.

The CAPSTF’s work culminated in three proposals being polled in May, but none received the majority support needed to advance to the MRC. The poll did show overwhelming support for putting the task force on hiatus while the Critical Issue Fast Path (CIFP) process on the capacity market that, initiated in February, ran its course.

The effort is being spearheaded by Ryann Reagan, of the New Jersey Board of Public Utilities, who told RTO Insider that the state working group is primarily focused on a forward clean energy market (FCEM) design, which she said is a process similar to the proposal that received the largest share of support in the poll at 41%.

The concept would allow the trading of products representing clean energy attributes, as well as existing renewable energy credits (RECs). PJM currently administers a registry of RECs through the subsidiary PJM EIS (Environmental Information Services), but it does not facilitate the trading of credits.

The FCEM design would not involve the procurement of capacity outside the Base Residual Auction (BRA); that would be more along the lines of an Integrated Clean Capacity Market, a variant of which received 33% in the poll.

The working group is open to the public, with those interested in participating welcome to reach out to Reagan; PJM and the Brattle Group are participating in addition to the states. The working group has a goal of reaching a general framework for a market design by the end of the year.

Whatever form any market created by the working group takes, Reagan said it’s intended for state participation to be voluntary and also be open for nonstate entities, such as companies with clean energy goals. She said she has heard frustration about the lack of a centralized way to purchase credits, particularly for smaller REC buyers.

The desire to move out of the PJM stakeholder process is partly borne of not wanting to lose momentum at a time that the RTO is beginning work on several significant issues, such as the rules around reserve resources and generation deactivation. She noted that the topic had been discussed at PJM for three years and the CAPSTF has been on hiatus for five months.

Katharine McCormick, of the Illinois Commerce Commission, said the working group is also building on discussions held at the Organization of PJM States Inc. (OPSI) that concluded over the summer. She highlighted a few priorities in the analyses at PJM and OPSI, including that all of Illinois be modeled, so that the impact of any resource deactivations to the southern, MISO-covered portion of the state are considered.

McCormick said Illinois is participating in the working group, but it has not committed to being involved in any final market design that may come out of it. In addition to being able to procure capacity that meets the state’s future clean energy requirements, she said it is also interested in ways of satisfying its capacity needs outside of PJM’s Reliability Pricing Model (RPM).

If the end result of the working group does turn out to be a FERC-jurisdictional market, PJM’s Scott Baker, facilitator of the CAPSTF, said a new forum can be found to hold those discussions.

Vistra’s Erik Heinle said the possibility of the working group yielding a product that is either FERC jurisdictional or has an impact on PJM’s markets that requires stakeholder attention could warrant leaving the task force open for at least a few additional months, especially considering the group’s goal for a framework.

Baker responded that PJM staff considered leaving the task force open but are generally averse to having task forces not actively engaged in work.

Multiple Proposals Considered for Incorporation of Multi-schedule Modeling

The committee discussed two proposals intended to allow modeling of combined cycle and storage resources to be incorporated in the market clearing engine (MCE) without causing computation times to increase to an untenable degree.

Both proposals were endorsed by the MIC at its Oct. 4 meeting and are slated to be considered for MRC endorsement on Nov. 15. (See “Multi-schedule Modeling in Market Clearing Engine,” PJM MIC Briefs: Oct. 4, 2023.)

The main motion, sponsored by PJM, would create a formula to select the offer expected to produce the lowest total dispatch cost and forward only that offer to the MCE. An alternative, jointly sponsored by PJM and GT Power Group, would select resources’ cost-based offers when they fail the three-pivotal-supplier (TPS) market power test and their parameter-limited offers during emergency conditions.

The issue stems from an expectation that the number of schedules that the MCE would have to consider would exponentially increase because of the number of configurations that combined cycle and storage resources can reflect in their offers. The changes are being considered as part of a larger overhaul of the MCE through PJM’s Next Generation Markets (nGEM) project.

GT Power’s Tom Hyzinski said the rationale behind the joint proposal was to find a middle ground between PJM’s proposal to pick a single generator’s offer using a formula, and another proposal that GT Power put forward with the Monitor that would have constructed a single offer using parameters from one offer and incremental costs from another. He said the joint PJM proposal uses the formulaic approach to pick a single offer from among multiple cost-based offers, while the IMM proposal would require the resource owner to select the single cost-based offer.

“The intent here was to move this thing towards the middle,” he said.

Deputy Monitor Catherine Tyler presented an issue with each proposal that she argued would create new ways for generators to avoid market power mitigation without resolving existing issues.

Tyler said PJM’s proposal would result in the RTO only considering offers at their economic minimum (EcoMin) value, even if that offer becomes much more expensive at higher outputs. She gave an example of a resource where the price-based offer is cheapest at its 100-MW EcoMin but which jumps to the $1,000/MWh offer cap when the resource is dispatched above 120 MW. In such a case, she said the cost-based offer should be selected even if it’s more expensive at EcoMin.

The PJM/GT Power proposal and the IMM/GT Power proposal, which was not endorsed by the MIC, would resolve the market power mitigation issue, Tyler said.

Both proposals would also use the PJM total dispatch cost formula to select among multiple cost-based offers, creating a possibility of a dual-fuel resource being dispatched on a fuel that is not the most economical for a portion of the day. Tyler said that could create a dilemma for generators because of the requirement that they base cost-based offers on the most economical fuel or risk being in violation of market manipulation rules.

PJM’s Keyur Patel said that some tradeoffs will have to be accepted to realize the benefits of combined cycle modeling.

“We know that this is not optimal,” he said.

Tyler said that the MRC should endorse the IMM/GT Power proposal, arguing that neither PJM nor GT Power had explained why it would be not the best solution.

Recommended Values for 2023 Reserve Requirement Study

The committee endorsed PJM’s recommended values for the installed reserve margin (IRM) and forecast pool requirement (FPR) components of the annual Reserve Requirement Study (RRS), which would have the effect of increasing the amount of capacity the RTO aims to procure through future BRAs.

The parameters are set to go before the Members Committee in November and to the Board of Managers for final approval in December. (See “Stakeholders Endorse Reserve Requirement Study Values,” PJM PC/TEAC Briefs: Oct. 3, 2023.)

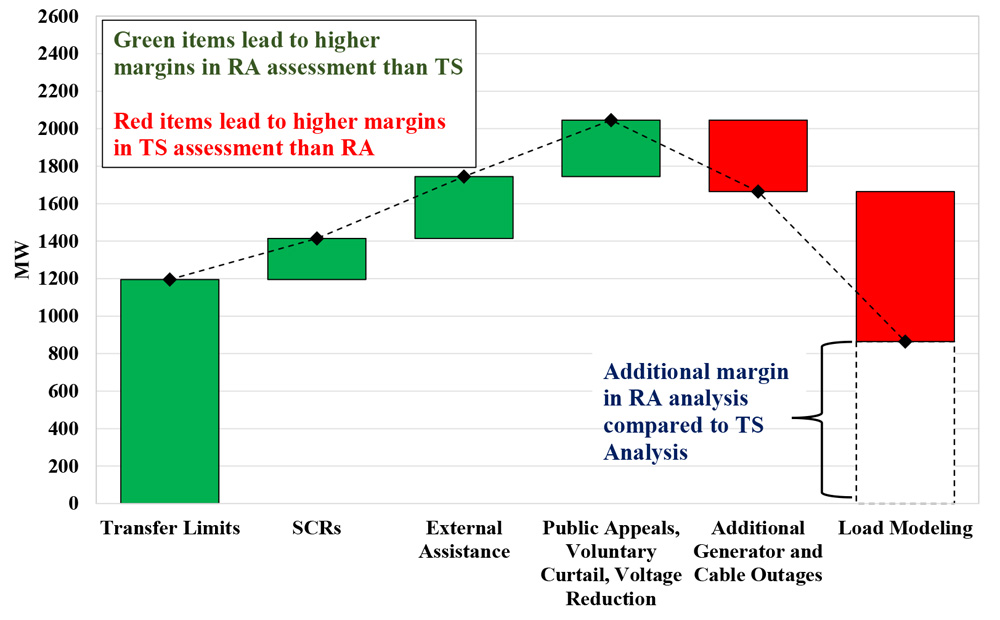

The IRM, which sets the targeted capacity level above expected loads, would rise from 14.7% for the 2026/27 delivery year in the 2022 study to 17.6% for the 2027/28 delivery year. The FPR, which includes forced outage rates, also would increase from 9.18% to 11.65% for the corresponding delivery years.

PJM made a handful of changes to how the study is conducted in the wake of December 2022’s Winter Storm Elliott and the changes to the capacity market being considered by FERC through the RTO’s filing resulting from the CIFP. Load models were developed using both the PRISM software PJM has historically used, as well as an hourly loss-of-load model developed from the effective load-carrying capability accreditation studies. PJM also included data from the 2014 polar vortex and Elliott, reversing a historical practice to not include extreme winter storms in the study’s modeling based on the impact of Elliott.

Minimal coincidence between the PJM peak load period and the “world” peak — which is defined as MISO, NYISO, TVA and VACAR — led to the capacity benefit of ties (CBOT) value more than doubling to 2.2% from the 1% value in the 2022 study. To reduce volatility, PJM elected to average the CBOT values from 2017-2022 and use that figure, which landed at 1.5%, instead.

The load model, which included data from 2013-2019, contributed to a 2.1-percentage-point increase in the IRM, while the winter peak week caused a 1.1-point increase. The values were slightly lower for the FPR drivers. The 1.5% CBOT contributed to a 0.5-point decline in the IRM value and a 0.58-point-lower FPR.

During a Resource Adequacy Analysis Subcommittee (RAAS) meeting in August, James Wilson, a consultant to state consumer advocates, calculated that the recommended values would constitute an approximate 3,700-MW increase in the summer reserve margin.

New Transmission Outage Coordination Rules

The committee signed off on revisions to Manual 38, which pertains to operations planning, to increase coordination between PJM and transmission owners to capture any potential extended transmission outages not identified by existing processes.

The proposal would add a step after board approval of Regional Transmission Expansion Plan (RTEP) windows for RTO staff and TOs to coordinate the sequencing of their outages and evaluate if any mitigation is needed, such as short-term emergency ratings or upgrades to limiting facilities. (See “Stakeholders Endorse Outage Coordination Manual Revisions,” PJM OC Briefs: Oct. 5, 2023.)

The overall outage coordination package approved by the Operating Committee in June also adds information about outage requests and transmission ratings to PJM’s website to increase transparency. (See PJM OC Briefs: June 8, 2023.)

Members Committee

3 Changes to Stakeholder Process Proposed

The Members Committee discussed first reads on three proposed changes to Manual 34, which sets the structure of the Consensus Based Issue Resolution (CBIR) stakeholder process.

Dayton Light and Power presented a change to the voting structure so that if a main motion fails, any alternative proposals submitted during the period for posting meeting materials would be voted on simultaneously.

Exelon’s Alex Stern presented a proposal that would specify that requests to add an item to a standing committee meeting agenda is considered to be timely when it is made at least seven days in advance. Requests should include a summary of the action that the committee will be asked to consider.

The language would provide committee chairs with discretion to consider agenda items posted within seven days of a meeting in the event of the subject being time sensitive or of unforeseen disruptions, such as PJM website or internet outages.

Chairs may also consider waiving the deadline for non-voting items, such as informational reports, with the suggestion that members instead provide enough time for PJM staff to review for formatting and agenda conformity.

Monitor Bowring asked for clarification on whether the flexibility around informational items would apply to the reports delivered to the MC webinar, which Stern confirmed would be the case.

Stern also presented a second proposed change aiming to clarify that senior standing committees hold final authority over issues considered by task forces and that the lower committees set the order that proposals will be voted on at the MRC and MC.