Texas regulators last week set aside further discussion and consideration of an ERCOT protocol change that one commissioner said was “totally discriminatory” to energy storage resources (ESRs).

The nodal protocol revision request (NPRR1186), approved by stakeholders and the ERCOT board, sets a one-hour state of charge (SOC) for energy storage resources participating in two ancillary services (ERCOT contingency reserve service and non-spinning reserve). It also includes penalties of up to $25,000 per violation.

Calling the rule change a “proposed solution in search of a problem,” Public Utility Commissioner Jimmy Glotfelty said in a memo that NPRR1186 “sets operational limits and potential compliance fines upon storage resources even as those resources are making outsized contributions to ERCOT reliability.”

“There have been no reliability problems from batteries, and there’s been no evidence provided by ERCOT that this has been a problem,” Glotfelty said during the PUC’s open meeting Nov. 30. “This the most flexible resource that we have on our system today, and one that will likely get us through the cold winter, which we’re fearful about.”

He said that because ERCOT hasn’t adopted similar protocols regarding the real-time state-of-fuel availability for coal or gas plants, “it would be discriminatory to adopt burdensome operational requirements on storage devices when no such requirements are placed upon thermal plants.”

“We should be able to understand the benefits of these flexible resources without having penalty structures that are disproportionately challenging to that resource,” Glotfelty said.

ESRs proved invaluable Sept. 6, when ERCOT entered emergency operations for the first time since the disastrous 2021 winter storm. Storage contributed a record 2.17 GW of energy during the event. (See ERCOT Voltage Drop Leads to EEA Level 2.)

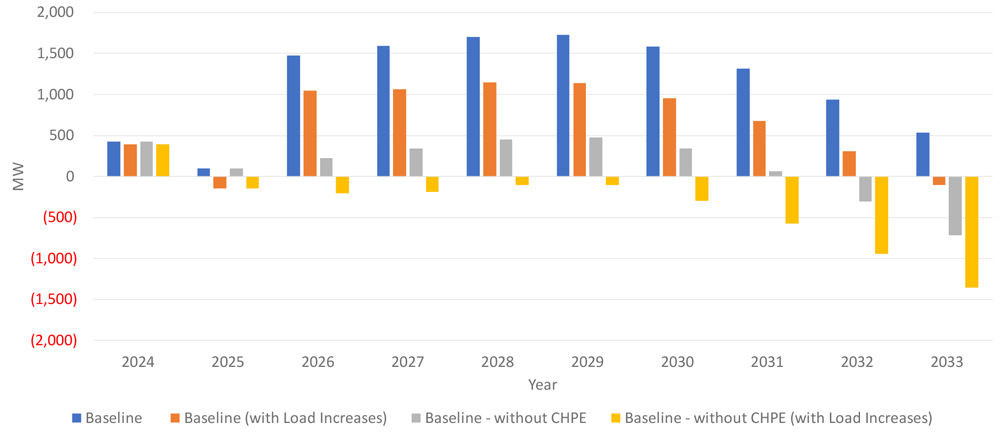

“We’re also getting tremendous value from storage facilities at a time when we have really no other dispatchable generation resources coming onto the system,” Commissioner Lori Cobos said. She noted ERCOT is expecting about 1 GW of gas generation over the next few years, but about 8 GW of ESRs.

ERCOT’s vice president of system operations, Dan Woodfin, told the PUC the grid operator is trying to clarify rules to ensure it has enough reserves “to manage that system that’s much more uncertain than what it’s historically been.”

The change represents a compromise in that it reduced the original SOC requirement from two hours to one. That has done little to assuage storage developers who say the revision would chill the resource’s growth.

“ERCOT has not provided any evidence to show that the additional discriminatory restrictions and penalties on ESRs are founded upon a substantial and reasonable ground of distinction between ESRs and other resource types,” Eolian said in a pre-meeting filing (54445).

The PUC will resume discussion on NPRR1186 during its next regularly scheduled open meeting Dec. 14. It is expected to then approve, reject or remand back to ERCOT the change.

The commission did approve NPRR1184 and a system change request (SCR824). The NPRR clarifies ERCOT’s management of the interest it receives and is owed to counterparties for posted cash collateral and requires staff to credit counterparty collateral accounts for interest every month. The SCR increases the attachment file size and quantities allowed within the resource integration and ongoing operations system.

PUC Recognizes Jones, Bivens

The commissioners opened the meeting with words of praise for Brad Jones, the former ERCOT interim CEO who passed away Nov. 8.

Jones, who previously served as ERCOT’s COO, came out of retirement following the disastrous 2021 winter storm and helped the grid operator pick up the pieces after it nearly collapsed during the event. He is widely credited with restoring confidence in the ISO and its ability to manage the grid. (See Brad Jones, Former ERCOT, NYISO CEO, Dies at 60.)

“Brad did a great service to the state under extraordinary circumstances. He came back in from the sidelines, brought the organization together, helped us pick ourselves up and make things better,” Commissioner Will McAdams said. “Brad’s in a better place. He will be missed.”

“We’re forever grateful for his selflessness and tireless leadership at ERCOT,” interim PUC Chair Kathleen Jackson said. “Brad took on an incredibly difficult task with great enthusiasm and urgency. He immediately rolled up his sleeves working to strengthen the Texas grid, [reestablish] confidence in ERCOT and speak to Texans frankly and honestly about our state’s power needs.”

Glotfelty said there was “zero choice” other than Jones to step in at ERCOT following the storm. He also praised Jones’ work during the state’s deregulation efforts in the late 1990s.

“There were few that could bridge the divide between technical engineering and policy and legislative language. [Jones] could and he could do it fluently and he could do it with ease,” Glotfelty said. “Clearly, he’s done a great service, and he will be missed by, I know, everybody here in this commission and ERCOT.”

“He has been a tremendous contributor to our industry for many years. His charisma, his intellect and humor will always be missed,” Cobos said, recalling the time she compared Jones’ rugged good looks to Texas actor Matthew McConaughey.

The commissioners also recognized Carrie Bivens, who recently stepped down after 3½ years as ERCOT’s Independent Market Monitor, and her ability to raise issues few others would. (See Bivens Resigns as ERCOT’s Market Monitor.)

“This is a tough role that has tough responsibilities right now, but it’s very important. It’s crucial,” McAdams said. “[Bivens] embraced that, that mantra of independence, and did so by maintaining credibility and enhancing it with key policymakers, and that’s something that is invaluable right now. It was more than just a contract. It was service, as well.”

“Carrie was not afraid to give her points, although they weren’t always in line with everybody else’s in this dynamic system that we have. She was bold enough to step out there,” Glotfelty said.

“She exemplified a very strong will to stand behind her positions, and whether we agreed or not with all Carrie’s positions, she made her independent voice heard,” Cobos said. “It’s important that you all hear perspectives, even if you don’t agree with them, and that’s what the IMM is there for.”

Glotfelty Named to NARUC Team

Glotfelty was one of six state regulators named Nov. 22 to a National Association of Regulatory Utility Commissioners (NARUC) working group that will “zero in” on one of the grid’s biggest reliability risks: the “misalignment of the gas and electric power systems.”

The Gas-Electric Alignment for Reliability (GEAR), composed of regulators and industry officials, will conduct a 15-month effort to develop solutions that “better align the gas and electric industries to maintain and improve the reliability of both energy systems.” The lack of such coordination between the two industries has been singled out as one of the primary reasons for load shed events during the 2020-21 and 2022-23 winters.

Glotfelty is joined by Georgia’s Tricia Pridemore, New Hampshire’s Carleton Simpson, Michigan’s Daniel Scripps, Arizona’s Lea Márquez Peterson and Minnesota’s Katie Sieben. Pridemore and Simpson will serve as GEAR’s chair and vice chair, respectively.

Officials from gas and electric utilities and operators will be added to the group later.

Glotfelty also chairs the Texas Advanced Nuclear Reactor Working Group, which was created by Gov. Greg Abbott (R) in August to help position the state as the “national leader on advanced nuclear energy” (55421). (See Texas Seeking Lead Role in Nuclear SMRs.)

The group will next meet Dec. 5 in the PUC hearing room. David Wright, a Nuclear Regulatory Commission commissioner, will discuss regulatory and licensing procedures with the group.

University of Texas at Austin associate mechanical engineering professor Derek Haas, Zachry Sustainability Solutions’ Mike Kotara and Natura’s Doug Robison share the group’s leadership responsibilities.

Legislation Becomes Rules

The PUC approved a change to ERCOT’s emergency pricing program (EPP), reducing the amount of time the high system-wind offer cap (HCAP) remains at $5,000/MWh (54585).

Wholesale prices will be reduced to a $2,000/MWh emergency offer cap should they hit the $5,000/MWh HCAP threshold for 12 hours within a rolling 24-hour period. The $2,000 cap will remain in effect until 24 hours after the EPP is activated, or, if ERCOT is in emergency operations while the EPP is active, 24 hours after the grid operator exits emergency operations.

Generators are eligible to be reimbursed for any marginal costs they incur above the $2,000 offer cap while the EPP is active. To recover marginal costs above the HCAP, generators must submit to ERCOT additional attestations and information justifying any exceedances. Cobos added language to the rule that denies reimbursement to resource entities that fail to provide the necessary information to ERCOT.

ERCOT must notify market participants when the EPP is activated and when it ends.

“This puts iron in the glove of ERCOT to gather this information,” McAdams said. “It reassures the system that somebody is going to be checking to see what exactly is going on in the event of an emergency. It’s just one more measure that allows us to gauge the overall impact to the system and the root causes.”

The change is a result of 2021’s Senate Bill 3 and is designed to limit consumer exposure to high prices during emergency events.

The commission adopted a rule stemming from this year’s legislative session that creates a temporary solar-only renewable energy credit (REC) trading program. The program replaces the PUC’s renewable portfolio standard that is being phased out and will terminate on Sept. 1, 2025. ERCOT will continue to maintain an accreditation and banking system to award and track voluntary RECs generated by eligible facilities, as required by House Bill 1500 (55323).

The PUC also approved a proposal for publication that establishes an allowance for a transmission service provider’s (TSP) interconnection costs for connect resources at transmission voltage to ERCOT’s system (55566).

Renewable interests said the allowance, applied equally across all TSPs, would encourage continued interconnections that keep pace with load growth. Glotfelty agreed, calling the policy non-discriminatory while allowing that it might affect renewable resources more than others.

“This will force some financial discipline on siting for renewables and other facilities,” he said. “If it moves them closer to interconnecting facilities, then they’re going to be OK. These numbers will allow them to interconnect if they move far away, per their decision. They may have to pay more, but it’s all laid out in these rules.”

Foundation Set for $10B Loan Program

The commission approved several proposals for publication that will lay the foundation for the Texas Energy Fund Program, beginning with giving PUC Executive Director Thomas Gleeson permission to solicit and hire a contractor to manage the fund (55562).

The PUC issued a request for proposal for the fund’s manager in October. It hopes to have the contractor on board by the second quarter of 2024.

Texas voters in November approved the TEF program, a result of state legislation passed this year. (See 2023 Elections Bring Billions for Texas Gas, Dem Wins in Virginia, NJ.)

The TEF fund will provide $7.2 billion in low-interest loans and is intended to incent the development of up to 10 GW of natural gas plants. Some $5 billion will be set aside for 20-year, 3% interest loans to build new generation with at least 100 MW of fully dispatchable capacity. Power plants that come online before June 2029 are eligible for bonus payments.

Another $2.8 billion will be dedicated to grants for infrastructure improvements in non-ERCOT regions and to strengthen resiliency by setting up microgrids at hospitals, fire stations and other critical facilities.

Other proposed rules for publication include:

-

- Procedures for loan applications in ERCOT, evaluation criteria, repayment terms and the performance standard a generator must meet to obtain the loan (55826).

- Procedures to apply for completion bonus grant awards, terms for requesting the annual grant payment and performance standards necessary to obtain a completion bonus grant payment (55812).