Personal finance website WalletHub has released a study that ranks the states and D.C. based on the average monthly cost of energy, with breakdowns by electricity, natural gas, vehicle fuel and home heating oil.

D.C. ranked lowest overall, followed by Colorado and Washington state. Connecticut, Wyoming and Massachusetts had the highest overall bills. D.C. residents also pay the least for electricity, followed by Illinois and New Mexico. Electricity costs are highest in Hawaii, South Carolina and Alabama.

Lower prices don’t always equate to lower bills, the study shows. Its authors used the states’ average monthly energy consumption in each category and multiplied it by the average price, adding each category to find the total cost. In Southern Louisiana, for example, where the summers are hot but the electricity is cheap, residents will pay more than in Northern California, where customers consume less because the weather is temperate.

DELAWARE

State Offers Rebates to Spur Electric Car Sales

The state has earmarked $2.7 million to fund the new Delaware Clean Transportation Incentive Program, which aims to encourage residents to buy electric, propane and natural gas vehicles.

The initiative will provide three rebate programs for consumers and two grants for the development of infrastructure to support alternative fueling. Rebates will run up to $20,000, and developers may qualify for grants up to $500,000.

More: NewsWorks

DISTRICT OF COLUMBIA

District to Buy Output of Pa. Wind Farm in Record Deal

The 20-year power purchase agreement is the largest of its kind to be entered into by a U.S. city and is expected to save taxpayers $45 million over the next two decades. The district has a goal to meet half its government’s demand by 2032 with renewable energy.

The wind farm contains 23 turbines on private property in three townships in southwestern Pennsylvania.

More: Executive Office of the Mayor

ILLINOIS

State Sets Public Forums for Power Line Project

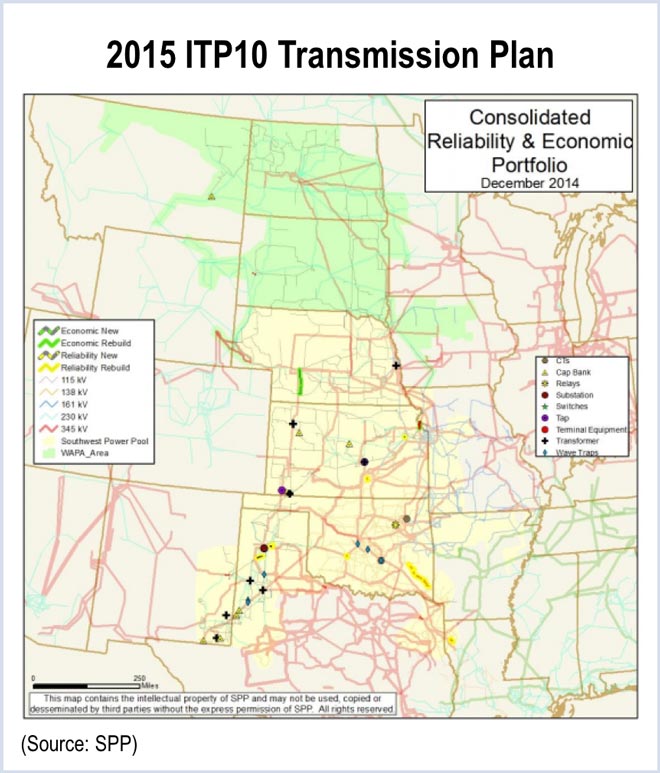

Clean Line Energy seeks a certificate of public convenience and necessity for the 780-mile-long project, which would deliver wind power from Kansas to Indiana. Hearings are set for July 28-29 at various sites.

More: Illinois Commerce Commission

INDIANA

State Claims Global Domination in Airport Solar Generation

Contractors recently completed a second phase of the airport’s solar farm, bringing total output to 17.5 MW, or enough to power 3,200 houses. Indianapolis Power & Light is buying the power from what now looks like a sea of blue-colored solar panels near the end of runways on the southwest corner of the airport.

The 161-acre site is to expand farther this year, with an additional 22 acres designated for solar generation. When all three phases are completed, the solar farm will consist of 87,000 panels.

More: Solar Power World

IOWA

Wind Could Meet 40% of State’s Energy Needs by 2020

An American Wind Energy Association report said the state could produce enough wind energy to meet 40% of its power needs by 2020 and all of its electricity demand by 2030.

The report acknowledges that a fuel mix will always be necessary, but it said wind, solar and energy-storage technologies are improving at a rapid rate. “Iowa is already a leader in wind energy, but this report shows the Hawkeye State has just scratched the surface of wind power’s benefit to the state,” said Tom Kiernan, AWEA’s CEO.

The report said the wind energy industry employs 7,000 in Iowa at 13 factories and assembly plants. Lease payments to landowners by wind energy companies could increase from the $17.1 million a year now to $55 million by 2030.

More: Des Moines Register; AWEA

KENTUCKY

Report: State’s CO2 Emissions Highest in the Country

The study considered how much electricity the plants generate along with sulfur dioxide, nitrogen dioxide, carbon dioxide and mercury. Seven of the 10 companies with the highest emissions per megawatt-hour were energy cooperatives.

Kentucky’s ranking is largely due to the portion of coal in its energy portfolio, said Dan Bakal of Ceres, a sustainability advocacy group.

More: WFPL

MAINE

Study: Supply Boost to Cost More than it Saves

An initiative to boost the region’s natural gas supply would cost consumers more than it would save them, according to a study commissioned by the state Public Utilities Commission.

A cost-benefit analysis of the Maine Energy Cost Reduction Act, which was approved by the Legislature in 2013, shows the act may be counterproductive. Boston-based consultant London Economics International said the state’s plan to augment natural gas supply would be costly. “Maine simply does not use large amounts of gas and electricity,” it said.

The 2013 law is designed to lower energy costs for consumers by having the state enter into contracts to purchase up to 200 million cubic feet per day of natural gas at a cost not to exceed $75 million annually. Ratepayers in the state would foot the bill.

More: Portland Press Herald

Power Marketer Draws Complaints

The company says it’s doing nothing wrong and last week responded to a PUC request for information with details about its training and sales protocols. The company also blames CMP for stirring up trouble, charging that the utility’s staff is anti-competition.

The PUC, which licenses electricity suppliers, said it is evaluating the information submitted by Clearview and deciding what, if any, steps to take. It said that Clearview appears to be the first electricity provider using door-to-door sales in Maine, and it’s the first time the PUC has received complaints about the practice.

More: Portland Press Herald

MARYLAND

Pepco, SMECO Pair with Energesco in Efficiency Program

Multifamily properties within Pepco’s 566 square miles of service area can apply for rebates for energy efficiency projects like LED lighting upgrades and HVAC enhancements.

Energy costs in such communities represent 25 to 35% of expenses and are highly controllable. Previously, multifamily owners and operators were restricted to rebates for upgrades in common areas.

More: EnergyEfficiencyMarkets.com

MASSACHUSETTS

Online Marketplace Would Allow Comparison Shopping for Rates

The Department of Public Utilities soon will begin soliciting ideas to build the website. Under the DPU proposal, companies initially would be allowed to offer only fixed-rate plans so consumers would be shielded from hidden charges and confusing contracts.

Several other states, including Ohio, Texas, Connecticut and Pennsylvania operate similar marketplaces. The state experienced a growth in customers shopping for suppliers after last year’s bone-chilling winter sent electricity prices soaring.

More: Boston Globe

MICHIGAN

Legislators Eye Energy Market Regulation

The Senate has begun hearings on a comprehensive energy plan governing how utilities and alternative suppliers may operate in the state and how renewable power and energy efficiency programs will figure into the equation.

Among other things, the Senate’s plan would offer incentives for utilities that already have met a renewable energy mandate to increase their energy efficiency programs.

The most controversial aspect of the plan would make it more difficult for electricity customers to opt in or out of the competitive retail supply market.

More: Detroit Free Press

Straits of Mackinac Pipeline Report Shows ‘Gaps’ in Enbridge Info

The report said the yearlong inquiry by the state Department of Environmental Quality and the Attorney General’s Office was hampered by “gaps” in information provided by Enbridge. Dan Wyant, DEQ director, said Enbridge failed to provide comprehensive information in many areas, including inspections and the nature and result of heavy mussel encrustations that could be hiding significant corrosion.

“Substantial questions remain and can only be resolved by full disclosure of additional information and rigorous, independent review by qualified experts,” the report concludes. The report was spurred in part by the rupture of another Enbridge pipeline in 2010 that spilled oil into the Kalamazoo River.

More: MLive

MONTANA

Renewable Advocates Say Utility Blocking Small-Scale Solar, Wind

Montana-Dakota Utilities wants to assess customers with wind and solar generators a demand charge, but renewable advocates say the utility is using the fee to block small-scale generation.

MDU built the fee into a 21% rate increase it has proposed for about 26,000 customers in the state. The company said it needs the $1.50/kW demand charge to cover the cost of providing power to wind and solar customers when their self-generation isn’t sufficient to meet their needs. The fee would also pay for the costs of installing emissions controls at plants in Montana and South Dakota.

A Public Service Commission spokesman says it was the first time a utility has asked for a special fee for net-metering customers. The Montana Renewable Energy Association said the utility ignores the assertion that customers who generate their own power allow the utility to reduce transmission and distribution costs across the system as a whole.

More: The News Tribune

NEW HAMPSHIRE

Kinder Morgan Starts Promotional Website

Kinder Morgan has launched a website aimed at New Hampshire residents along the 80-mile proposed route of the Northeast Energy Direct natural gas pipeline.

The pipeline would deliver natural gas from the shale formations of Pennsylvania through New York and into New England to ease supply shortages. The new website is part of a public outreach campaign by Kinder Morgan to communicate the need for the project.

EnergymattersNH.com includes videos on the project, an up-to-date project blog, as well as a running list of upcoming project-related meetings.

More: New Hampshire Union Leader

Another Electricity Supplier Pulls Out

Gulf, which entered the competitive electricity market with much fanfare in 2013, has quietly pulled out, the latest departure from a business sector that one competitive supplier says is on life support.

Competitive suppliers are having a hard time beating the utility prices for residential power supply. Bart Fromuth, a Republican state representative from Bedford and head of Resident Power, one of the earliest brokers to enter the residential space in 2012, said the pullback mostly affects the retail residential market.

“Commercial competition remains at healthy levels,” said Fromuth. “The regulatory environment for residential is absolutely suffocating. In the interests of beefing up consumer protection, the legislature and the PUC are quickly cementing New Hampshire’s position as the most unattractive place to do residential supply in all of New England.”

More: New Hampshire Union Leader

NEW YORK

Transmission Policy Requirement Adopted

The Public Service Commission has adopted a public policy requirement related to the potential need for additional transmission capability in Western New York. The decision stems from a proceeding the commission initiated last year to establish procedures that it would use to identify any transmission needs driven by public policy requirements that would be referred to NYISO. The Federal Energy Regulatory Commission’s Order 1000 requires public policy be considered in system planning.

The commission determined transmission projects in Western New York that fulfill such public policy requirements will now become eligible for cost recovery through NYISO’s Tariff if they are selected by the RTO as the most efficient or cost-effective solution. Designating Western New York congestion relief as a public policy requirement will enable NYISO to solicit potential project solutions and undertake an initial analysis of the project’s viability. The PSC did not adopt other proposed public policy requirements for other regions.

More: NYPSC

NORTH CAROLINA

Amazon to Build Major Wind Farm

Online retail giant Amazon plans to power its cloud-computing division with the $400 million Amazon Wind Farm US East, set to be built on 34 square miles in the eastern counties of Perquimans and Pasquotank.

The project will start with 104 turbines and will be built by Spanish wind farm developer Iberdrola Renewables. It is expected to begin generating power for Amazon’s data centers late next year.

The project has sidestepped obstacles that have felled such proposals in the past. The 208-MW farm is sited in isolated scrubland locally knows as The Desert where there are no homes, minimizing its impact on tourist areas, military flight paths and bird migration routes.

More: News and Observer

OHIO

Study Shows Utica Oil and Gas Play Much Larger than Thought

A study by West Virginia University shows that the amount of recoverable oil and natural gas in the Utica Shale formation is much larger than first thought. The geologic formation, which includes parts of Pennsylvania, West Virginia, Kentucky, New York and Ohio, has about 782 trillion cubic feet of natural gas and about 2 billion barrels of oil, about 20 times the U.S. Geological Survey’s estimate from three years ago.

“This is a landmark study that demonstrates the vast potential of the Utica as a resource to complement — and go beyond — what the Marcellus has already proven to be,” said Brian Anderson, director of WVU’s Energy Institute. The study leans heavily on research conducted by the Appalachian Oil and Natural Gas Consortium.

“The revised resource numbers are impressive, comparable to the numbers for the more established Marcellus Shale play, and a little surprising based on our Utica estimates of just a year ago,” said Douglas Patchen, director of the consortium. The announcement came as low oil and natural gas prices continue to curtail new production.

More: Columbus Business First; National Research Center for Coal and Energy

WISCONSIN

Enbridge Pulls Its Appeal of Pipeline Insurance Regulation After State Legislative Action

Lawmakers amended the state budget to prohibit local governments from imposing higher insurance demands on pipeline operators, a move that handcuffs Dane County, which had demanded Enbridge boost its liability coverage. Enbridge immediately dropped an appeal of the local mandate.

Dane County officials were irked. “Enbridge filed an appeal properly, and we were set to hear that appeal and make a decision,” said Dane County Board Chairwoman Sharon Corrigan. “That’s how it’s supposed to work. But apparently Enbridge sent some lobbyists to make a different kind of appeal to the Legislature and the governor, and got some special treatment slipped into the budget.”

More: Wisconsin State Journal