It’s been a year since the Southeast Energy Exchange Market (SEEM) began pairing offers and bids, with detractors certain as ever the market is dysfunctional and the utilities involved insisting they will push through the launch difficulties to long-term success.

SEEM began operations in early November 2022, a year after its foundational agreement passed a deadlocked FERC. (See SEEM to Move Ahead, Minus FERC Approval.) The market’s founding members, including Duke Energy, Southern Co., the Tennessee Valley Authority and Dominion Energy, promised that the expansion of bilateral trading in 11 Southeastern states — now 12 after the addition of utilities in Florida — would reduce trading friction while promoting the integration of renewable resources.

But Southern Environmental Law Center (SELC) Senior Attorney Nick Guidi thinks SEEM is a far cry from what Southern Co., TVA, Duke, Dominion and other utilities promised when designing the marketplace.

“We have one year’s worth of operations to reflect on and assess, and based on that, I think we can say SEEM is failing. The information that we do have shows SEEM is not performing as the utilities expected,” Guidi said in an interview with RTO Insider.

Before the market went live, SEEM participants hired consultants to prepare an analysis showing the market could deliver anywhere from $37 million to $46 million worth of benefits in its first year. But the SELC estimates SEEM has yielded just $3.3 million in savings over its first year, barely covering operating costs. The figure was derived from SELC analysts’ interpretation of the limited data that SEEM publishes on its website under the “Public Data” tab (which requires user registration to view).

SEEM also estimated it would have an average hourly trade volume of 1,323 MWh; however, in the first year of operations, it averaged about 72 MWh in hourly activity.

“We’re looking at about a tenth of what was promised one year in,” Guidi said. “The benefits are marginal, and we’re not seeing any uptick in renewable energy through this.”

Erin Culbert, a spokesperson for Duke, acknowledged to RTO Insider that despite “a lot of activity of bids and offers … we have seen a lower number of successful trades than we would like.” However, she said the market has witnessed a growth in the number of successful matches month to month, particularly after four utilities based in Florida began participating in June.

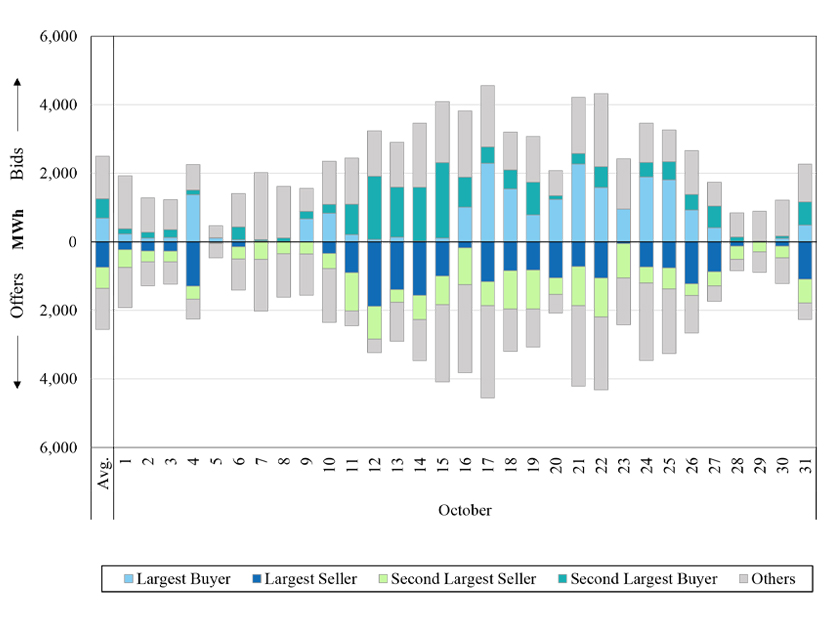

According to SEEM’s most recent monthly audit report, prepared by Potomac Economics, the market had 24 members in October. Participants traded 76,000 MWh of energy that month, up from 66,000 MWh in September and above the market-to-date monthly average of 52,000 MWh.

Culbert said more than 100,000 transactions have been performed in the first year of operations, representing more than 2.5 TW of 15-minute power.

SEEM’s sponsors are working to increase the number of successful trades, she continued, through means such as Duke’s development of automated tools to improve matches. Market participants, as well as SEEM’s independent auditor, also have suggested making additional training available next year to help participants craft bids and offers “that are a little bit closer to their actual cost.”

“At this point in time, in some cases the bids and offers are too far apart to make a successful match,” Culbert said. “So we would love to be able to continue to share best practices, maybe look and explore to see if others on the platform want to consider having some more automation on their sides to make it very simple and easy to identify the right bids and offers that have the highest success rate for a match.”

TVA and Southern deferred to Duke’s comments on the value of the exchange.

Expected Benefits and Regulatory Limbo

Since before the market’s launch, SEEM’s critics, which include the SELC, the Carolinas Clean Energy Business Association (CCEBA), the Sierra Club and the Southern Alliance for Clean Energy, have argued it would entrench the power of monopoly utilities while providing limited benefits to customers compared to alternatives. (See SEEM Critics Repeat Call for Technical Conference.) The performance of SEEM over the past year hasn’t done much to change their minds.

“I don’t know that we should call SEEM a failure yet, but it certainly needs dramatic reform if it’s going to be successful,” CCEBA Executive Director Chris Carmody said in an interview.

Carmody said that even the $40 million in savings SEEM initially estimated was a low bar to accomplish. He pointed out that Vibrant Clean Energy’s research showed that establishing a competitive wholesale electricity market in the Southeast could save $384 billion by 2040.

But Southeastern utilities avoid organized markets “like the plague,” he said.

Guidi said SEEM has a structural problem and lacks the attributes necessary to improve meaningfully. The market should develop an open-access transmission tariff and extend participation to entities outside of its footprint. Currently, he said “only a small subset of entities in the region can participate,” with approximately 65 entities that participated in bilateral trading before SEEM’s establishment now ineligible to participate because of their location outside the footprint.

The D.C. Circuit Court of Appeals this summer vacated FERC’s denial of requests to rehear its approval of SEEM, largely on procedural grounds. The court found the commission inappropriately denied requests for rehearing as filed late because it failed to take into account two federal holidays when determining the deadline. It remanded the rehearing requests back to the commission. (See DC Circuit Sends SEEM Back to FERC.)

While it did not rule on the merits of SEEM’s tariff, the D.C. Circuit did agree partially with petitioners’ requests for rehearing of individual market members’ revisions to their tariffs implementing the non-firm energy exchange transmission service used for SEEM transactions, which the FERC majority had approved. These also were remanded back to the commission, with a directive to better explain its reasoning.

“There’s not a broadly applicable SEEM tariff,” Guidi argued. “We need some transparency. There is very little to go on, and what’s out there, is a black box.”

Guidi said outside parties can’t access pricing data or know who is transacting with whom. “There’s not much for us to assess.”

Carmody advised FERC and SEEM participants to closely examine the D.C. Circuit’s ruling. If FERC and the utilities take the concerns to heart, Carmody said he thinks SEEM’s design will resemble an energy imbalance market.

From SEEM’s perspective, Duke’s Culbert said, FERC had already decided that it was “not unfair or discriminatory,” and the D.C. Circuit’s decision amounts to a request for the commission “to justify its decision-making.” She said trades are continuing on the platform under the current filed tariffs, and the focus for now is on continuing to “optimize the performance of the market.”

Problematic Governance?

Carmody agreed that parties other than utilities should be involved in SEEM governance. He said SEEM appears to have been set up to prevent competition from independent, clean sources of energy, as well as grant Southern Co. the opportunity to sell its output more easily.

“It was never really explained to us how it was going to promote renewable energy other than it would reduce solar curtailment,” Carmody said of SEEM.

Guidi said SEEM’s governance design is problematic, where member utilities can choose who they transact with and exert complete control over governance, operations and market rules.

“Independent entities have no role in SEEM governance, which raises concerns that they could be systematically excluded,” he said.

To date, no independent power producers have engaged in SEEM trading.

Guidi said the market needs a more ambitious design that emulates the Western Energy Imbalance Market with a real-time dispatch component. He blamed the slow pace of trading on the fact that SEEM completes transactions only if there’s enough of an overlap between bid and offers.

“Competitively priced offers give generation owners no guarantee that they’ll be dispatched, unlike in standard organized wholesale markets. This uncertainty would likely dissuade IPPs from participating. It also means the market is not competitive,” he said.

Culbert pushed back on these complaints about the market’s design, saying SEEM has “a very broad net of folks who can qualify to participate,” including utilities of all sizes.

She emphasized IPPs that meet the minimum qualifications are welcome to join and “entities with generation or load that can participate in other kinds of wholesale bilateral markets also can participate in SEEM … and certainly any [entities] who would be interested that are in the same footprint would be welcome to reach out for more details.”

Critics Recommend EIM Structure

Guidi said he believes that SEEM was formed in response to calls for broader market reform to bring lower energy prices and more customer choice to the South. He suggested bringing IPPs to the table would have a disciplining effect on prices and utility behavior and “better align electricity service with customer expectations and desire for cheaper prices and cleaner energy.”

“You’re looking at cheaper prices; you’re looking at more solar energy, which is exactly what people are looking for,” he said.

Carmody said SEEM lacks the transparency and the regulatory involvement of the WEIM.

“Everyone who has a computer has a transparent view into how the Western EIM is functioning,” Carmody said. He said even though an energy imbalance market is voluntary, it still would produce significant savings, though not as much as having an RTO setup.

“It seems to me that if SEEM were improved, it would be a happy medium between utilities maintaining control but also saving ratepayers a lot of money,” he said. “I really don’t think it’s rocket science to do that.”

Carmody said ultimately, SEEM’s simplest fix would be to allow more parties to participate. He agreed that including IPPs and large customers would help the market take on some of the best characteristics of an EIM.

Culbert suggested that SEEM “shares some of the same principles as an EIM, such as … assisting with imbalances and reducing energy costs.” However, she said the goal of SEEM is to be less complex, costly and time-intensive than an EIM. While the team always is looking for improvements, she said they would need to perform cost-benefit analyses to see whether adding “additional levels of complexity and cost” would bring enough value to customers.

Reliability Concerns

Finally, Guidi said reliability under SEEM is a point of concern, exemplified by the market’s futility during last December’s widespread winter storm, during which TVA and Duke were forced to order rolling blackouts.

“SEEM just went dark during Winter Storm Elliott. There were no trades for that three-day window. You want a centralized entity that has situational awareness at their disposal,” Guidi said.

Culbert observed that “energy is a seasonal product,” and that SEEM has weathered only a single example of each season in its operations so far. She said the sponsors are optimistic additional experience will enable designers to improve performance.

“We will continue to be able to gather new learnings as we go out through subsequent years — the operational team is really still considering this part of launch — to be able to craft the kind of training and the additional best practices that will keep adding value,” she said.

Guidi said he does see value in SEEM because it brought together nearly every load-serving entity in the Southeast.

“That’s a lot of different perspectives and different interests. So, that’s the hard part,” he said.

With significant structural changes, he said SEEM could become integral to the Southeast’s electricity supply.

“I think it’s worth salvaging. I think with some pretty substantial tweaks it can be a positive, but it’s not there yet,” he said.