Rising demand and the potential for higher generator retirements are raising reliability concerns over the next 10 years, NERC said in its 2023 Long-Term Reliability Assessment, released Dec. 13.

“In our latest assessment, it really confirms that we’re in an absolute step change in terms of the risk environment we’re seeing on the system, both in terms of reliability, as well as energy assurance,” John Moura, NERC director of reliability assessment and system analysis, said on a webinar with reporters. “The electric power industry continues to face challenges in the future: a rapidly changing resource mix, threat landscape, extreme weather and inverter-based resources.”

Moura said ensuring reliability as the resource mix changes involves stopping plants from retiring early and making sure new resources can provide enough of the same needed services.

Peak demand net energy growth rates in North America are growing more rapidly than at any point in the past three decades, according to the LTRA. Electrification of heating and electric vehicles, as well as increased demand from commercial and industrial customers such as data centers, has reversed the decadeslong trend of falling or flat growth rates.

The aggregated summer peak demand forecast is expected to grow by 79 GW over the next 10 years, while winter demand growth is expected to rise by nearly 91 GW in the decade. Winter demand is growing so fast that NERC expects the Northeast and Southeast to become winter-peaking, or at least dual-peaking, in the coming years.

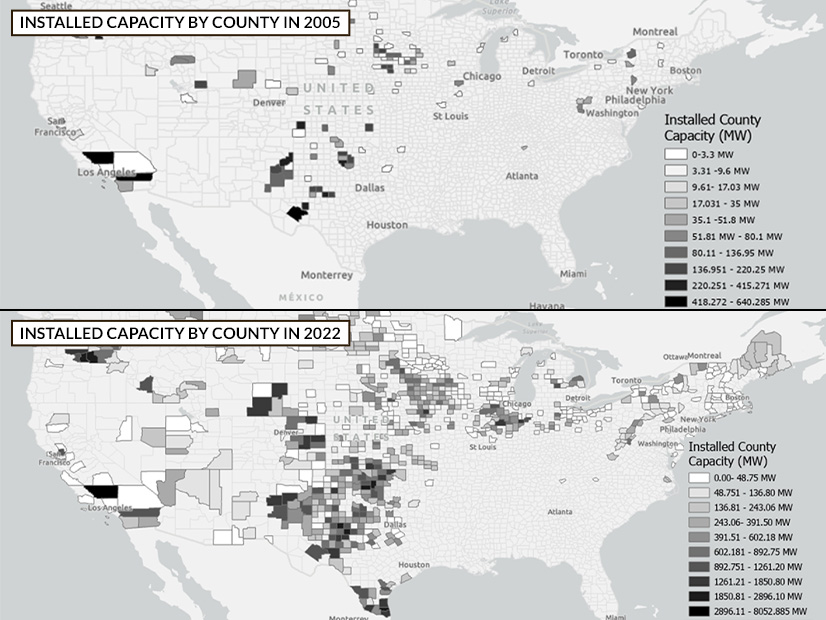

The supply side is seeing overall growth, dominated by solar power, while fossil generation is expected to decline in the coming decade.

“We are projecting moderate growth,” NERC Manager of Reliability Assessments Mark Olson said. “But it’s not quite keeping up with where the demand projections are going in this most recent forecast that we received. Our total capacity growth is expected to be about 34 GW over the next 10 years.”

New England and New York are expected to have higher winter peaks by the mid-2030s, while the Southeast has already gone through changes.

“SERC-Central and SERC-East became dual-peaking systems in recent years,” the report says. “SERC-Southeast recently began experiencing slightly higher peak demand in winter compared to summer.”

SERC-Central, made up of six states centered around Tennessee, joins MISO as one of the two “high-risk areas” in NERC’s report. That means they are more likely to have insufficient supplies to meet demand at some point in the next decade.

Despite its high risk, MISO has actually improved since last year, when shortages were expected this year, but delayed retirements and some new resources now have NERC expecting a 4.7-GW shortfall in 2028. SERC’s shortfall is expected to hit in 2025-2027 as the region retires 5 GW of coal and brings online 7 GW of natural gas.

Many more regions were “elevated risk areas,” meaning NERC is not worried about them in normal weather, but their systems could run into issues under extreme conditions. Five of the ISO/RTOs are included in the category.

California has also improved because of new capacity additions, as now NERC is expecting negligible risks next summer, but it warns by 2026 that unserved energy risks emerge in the summer.

ERCOT is seeing huge additions of solar power but faces elevated risks during the off-peak periods when its output is lower. Those risks are during peak summer days, and when dispatchable generation is down for maintenance in the shoulder months. Extreme winter weather is also still a concern and warrants continued efforts ensuring generators and the fuel they need to keep running remain available.

New England continues to face elevated risks in the winter with persistent concerns about fuel availability being exacerbated by electrification as its winter peak demand growth rate is the highest in North America, with a 3.46% compound annual growth rate over the next decade.

NERC confirmed NYISO’s own reliability studies, which show a risk of shortfalls for New York City starting in 2025 as peak demand rises and generators become unavailable because state laws reducing the emission of nitrogen oxide.

SPP has a surplus now, but it is going to drop rapidly over the next few years because of retirements and rising peak demand. The RTO also raised its reserve margin from 16% to 19% in the past year.

The only RTO to have a normal risk level — meaning NERC expects its system would handle even extreme conditions — is PJM. While NERC’s forecast has healthy reserve margins in PJM throughout the decade, it noted that accelerated retirements and higher demand growth could still pose challenges in the later years of its assessment.

Ultimately, the shortfalls NERC identified in its report can be resolved with additional procurements of supply, Olson said.

The power industry’s ongoing transition is playing a role, as the move to net-zero emissions is driving electrification that is pushing up demand and is also changing the resource mix on the supply side of the equation. The industry, policymakers and regulators all have to balance reliability with affordability and addressing environmental concerns, Moura said.

“I think when we get tripped up is when in how we prioritize those,” he added. “And so, reliability is something that needs to be prioritized. It’s the heart and soul, for the health, safety and the prosperity of our consumers and all of our communities. And so that needs to be at the heart of it.”

As policy continues to move forward on net-zero issues, reliability must not be forgotten, and the industry needs to continue focusing on it, Moura said.

Reactions to LTRA Highlight Risks

National Rural Electric Cooperative Association CEO Jim Matheson put out a statement saying EPA’s proposal to curb emissions from power plants would only exacerbate the situation NERC’s report highlights.

“NERC’s latest assessment paints another grim picture of our nation’s energy future as demand for electricity soars and the supply of always-available generation declines,” Matheson said.

The coal power trade group America’s Power also used the report to highlight its qualms with recent energy policies.

“Unfortunately, NERC’s latest assessment is deeply troubling because it indicates that, despite several years of warnings about the possibility of electricity shortages in many parts of the country, the risk of electricity shortages has grown worse,” said America’s Power CEO Michelle Bloodworth. “This is largely due to coal retirements, EPA policies and dangerous subsidies for unreliable sources of energy. We again urge Congress and federal and state policymakers to act immediately on these continued warnings.”

On the other side of the debate, the World Resources Institute held a webinar earlier in the day to highlight a new working paper on how to maintain reliability throughout the clean energy transition. Author Kelli Joseph, WRI senior fellow, noted it was more focused on operating reliability, while the LTRA is all about resource adequacy.

“We don’t spend as much time talking about operating reliability,” Joseph said on a webinar. “And I think what we need to recognize going forward, especially through the transition, is that operating reliability becomes a bit more challenging.”

Operating reliability refers to the ability of the system to withstand sudden disturbances, which many of NERC’s mandatory standards address.

If anything, the clean energy transition is going to make reliability more important, as more of the economy is connected to the grid through electrification, Karen Palmer, director of Resources for the Future’s electric power program, said at the WRI event.

“But it’s also important in the near term for continued progress on electricity sector decarbonization,” Palmer said. “Any reliability events or outages or mandatory load-shedding events that could be in any way pinned on decarbonization efforts, rightly or wrongly, could really stall clean energy progress in its tracks. And that wouldn’t be good for meeting domestic and international climate targets.”