New Jersey is launching a $15 million grant program to help commercial building owners retrofit heating or cooling systems as part of an ongoing series of initiatives to cut natural gas use and pursue building electrification.

The New Jersey Board of Public Utilities (BPU) also voted Dec. 6 to hire a contractor to help carry out an executive order to study how to support the natural gas sector as the state ramps up electrification.

Gov. Phil Murphy’s (D) order, EO 317, requires the BPU to consider how to mitigate the impact on the gas industry and its workforce as the state works toward the goal of a 50% reduction in greenhouse gas emissions below 2006 levels by 2030.

The BPU vote followed an unrelated Nov. 30 hearing of the Assembly Environment and Solid Waste Committee at which the lack of consensus on how to cut building emissions was on full display. Utility, business and union interests vigorously backed a bill, A577, that would enable the use of renewable natural gas, while environmentalists — who fiercely oppose the bill — argued in part that it would weaken the state’s move to electricity.

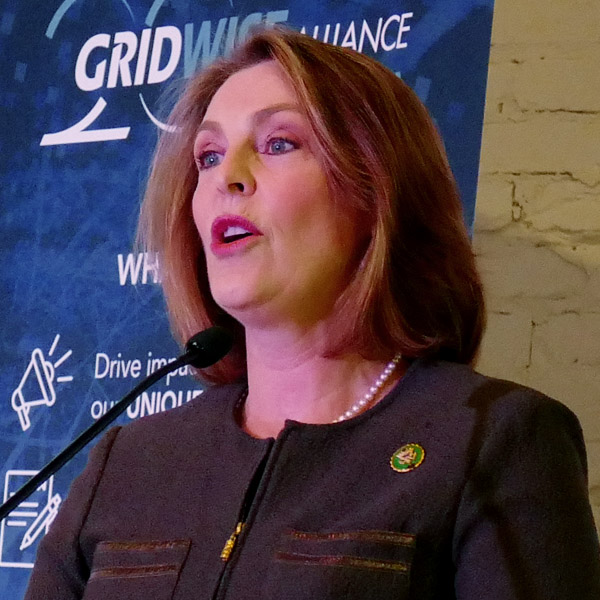

Backing the hiring of the consultant, BPU President Christine Guhl-Sadovy said the move was part of a plan to consider all sides of the issue. The board agreed to contract with one of two companies that responded to a request for proposals the BPU put out March 6. The BPU did not release the name of the consultant, and a spokesperson said they will release details of the order when the state Treasury has approved it.

“We are looking forward to continuing stakeholder engagement throughout this proceeding, once the consultant gets on board,” Guhl-Sadovy said after the vote. “I look forward to the public’s engagement.”

Transitioning Commercial Buildings

Murphy signed EO 317 the same day he signed an executive order, EO 315, setting a state goal to have 100% of the state’s electricity generated through clean energy sources by 2035, moving that goal up from 2050. At the same time, Murphy signed an order, EO 316, seeking to “advance the electrification of commercial and residential buildings,” with a goal of electrifying 400,000 additional dwelling units and 20,000 additional commercial spaces or public facilities by December 2030. (See NJ Governor Sets Out Accelerated Emissions Targets.)

In line with that effort, the New Jersey Economic Development Authority (EDA) on Nov. 16 approved a pilot program, called NJ Cool, to allocate $15 million in funds from the 2023 Regional Greenhouse Gas Initiative (RGGI) auction to provide grants for building decarbonization.

The funds will pay to “retrofit projects in existing commercial buildings that result in a reduction of operating greenhouse gas emissions,” EDA CEO Tim Sullivan said in a memo to the EDA board.

The pilot initially will award grants in Newark, Edison and Atlantic City, one each in the northern, central and southern regions of the state, all of which “have significant numbers of commercial buildings” that could be eligible and “are municipalities with high commercial energy usage,” the memo said.

The EDA board also gave Sullivan authority to increase program funding to $30 million if RGGI funds are available and demand for the grants exceeds the initial $15 million.

The authority expects to begin accepting applications for the grants in 2024.

Building emissions are New Jersey’s second largest source of emissions, and 80% of the buildings that exist today will still exist in 2050, according to Sullivan. The state’s 2019 Energy Master Plan recommended at least 90% of residential and commercial buildings be converted from gas to electric appliances by 2050, he said.

“Cost is a major barrier when upgrading homes and businesses to reduce carbon emissions and transition to low GWP commercial refrigeration systems or chillers,” his memo said, referring to global warming potential (GWP) refrigeration systems.

Grants awarded under the program will cover up 50% of a project, to a maximum of $1 million and a minimum of $50,000 per project. Eligible projects must switch 75% or more of building space heating loads from existing fossil fuel-based combustion systems to low- or zero-emissions systems, or replace GWP with low-GWP alternatives.

Threat or Opportunity?

At the Assembly Environment and Solid Waste Committee hearing, more than two dozen speakers addressed the merits of A577, even though committee Chairman James J. Kennedy (D) said at the outset the body would not vote on it that day. The bill, introduced in January 2022, secured the backing of the Assembly Telecommunications and Utilities Committee a year ago but otherwise has not moved in either the Assembly or Senate.

“To get the pure clean energy by the year 2050, we have to have a matrix of energy sources,” said Assemblyman Robert J. Karabinchak (D), a bill sponsor. “This bill will allow the biogas methane, potentially hydrogen, to be mixed by our gas providers today into their infrastructure.”

The bill’s definition of “renewable natural gas” includes “biogas that is upgraded to meet natural gas pipeline quality standards such that it may blend with, or substitute for, geologic natural gas,” as well as hydrogen or methane gas.

The bill directs the BPU to establish a program to implement the use of renewable natural gas in the state and give gas utilities a customer rate recovery mechanism to recoup the costs of the program. It requires the creation of guidelines for the “procurement of renewable natural gas and investments in renewable natural gas infrastructure in order to enable that procurement.”

Business groups said the state needs to have a diverse set of clean energy options to cut emissions, and renewable natural gas would create jobs and investment. Supporters of the bill included the New Jersey Chamber of Commerce, New Jersey Business and Industry Association, the New Jersey Utilities Association and the Chemistry Council of New Jersey, which represents manufacturers in the chemistry sector. Also supporting the bill were unions for pipefitters, plumbers and steamfitters.

Speakers noted that President Joe Biden on Oct. 13 announced that he had picked Mid-Atlantic Clean Hydrogen Hub (MACH2) — which will serve Pennsylvania, Delaware and New Jersey — as one of seven regional clean hydrogen hubs that together will receive $7 billion in funding.

“This bill would send a message that New Jersey is open for business investments in these energy sectors, which include renewable natural gas and hydrogen,” said Erick Ford, president of the New Jersey Energy Coalition, which promotes clean energy use and represents sectors include business, health care and labor groups.

Environmental groups vigorously opposed the bill, with one speaker saying renewable natural gas is an “Orwellian name for a product that is neither renewable nor natural” and would divert funds away from “real clean energy projects.”

“Hydrogen is drawing growing interest as a way of delivering clean energy without harmful climate pollution,” said Mary Barber, New Jersey director for Environmental Defense Fund. “But hydrogen actually comes with safety, climate and other environmental challenges including the propensity to leak, raising serious questions over its ability to deliver the benefits.

“This bill would allow utilities to charge customers for hydrogen and bio-methane mixing into the natural gas distribution systems that come into our homes and buildings without adequate oversight, creating safety and climate risks,” she said.

The Division of Rate Counsel also opposed the bill. In a Nov. 29 letter to the committee, division Director Brian O. Lipman said renewable natural gas is more expensive than natural gas and it’s “unclear” if it is any more beneficial to the environment.