It’s the time of the season for some happy talk. Real happy talk.

Let me start with a rock concert almost 40 years ago. For you kids, this was Live Aid, a 16-hour concert split between London and Philadelphia.

It was the greatest assemblage of rock royalty in history. By far. Thank you, Bob Geldof, for this miracle.

In no particular order: Elton John, George Michael,[1] Queen, Dire Straits, Sting, David Bowie, and Bob Dylan with Keith Richards and Ron Wood (introduced by Jack Nicholson).[2]

Eric Clapton, Phil Collins, The Beach Boys, The Who (also introduced by Jack Nicholson),[3] Led Zeppelin and Mick Jagger.

Tina Turner, the Pretenders, Madonna, Tom Petty and the Heartbreakers, Hall & Oates, the Cars.

U2, Paul McCartney,[4] REO Speedwagon,[5] Crosby, Stills & Nash, Boomtown Rats[6] and Black Sabbath.

The Hooters (introduced by Chevy Chase and Joe Piscopo),[7] the Four Tops, Joan Baez, Elvis Costello, Rick Springfield and Neil Young.

Bryan Adams, George Thorogood & The Destroyers, Simple Minds, Santana, Ashford & Simpson with Teddy Pendergrass, Kenny Loggins and Run-D.M.C.

And the all-star Band Aid closing London with “Do They Know It’s Christmas?”[8] OMG. And the all-star U.S.A. For Africa closing Philly with “We Are the World.”[9] OMG 2.

Yeah, that’s what I’m talking about. Just plug Live Aid and your favorite rock star into YouTube and turn it up to 11.[10] Or get the 4-disc DVD set (which sadly came out 20 years late and left out 6 hours of performances).[11]

How much would tickets go for these days? Maybe even more than Taylor Swift’s!

Global Famine

The theme of Live Aid was “Feed the World.”

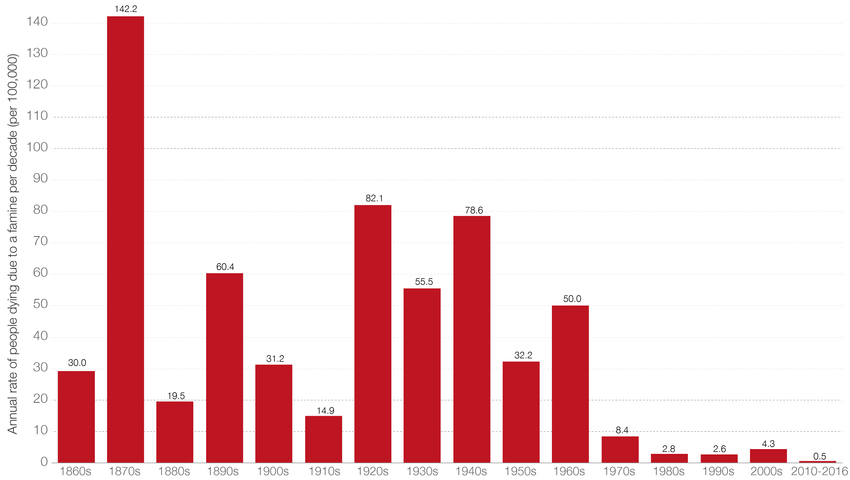

Here’s a graph showing global famine mortality over the decades.[12]

Did Live Aid help, or more generally, did the human sentiment leading up to and highlighted by Live Aid help? I’d like to think so. Not to diminish in any way the importance of the Green Revolution and Norman Borlaug’s role in it.[13]

Here are three more charts we should toast this season.

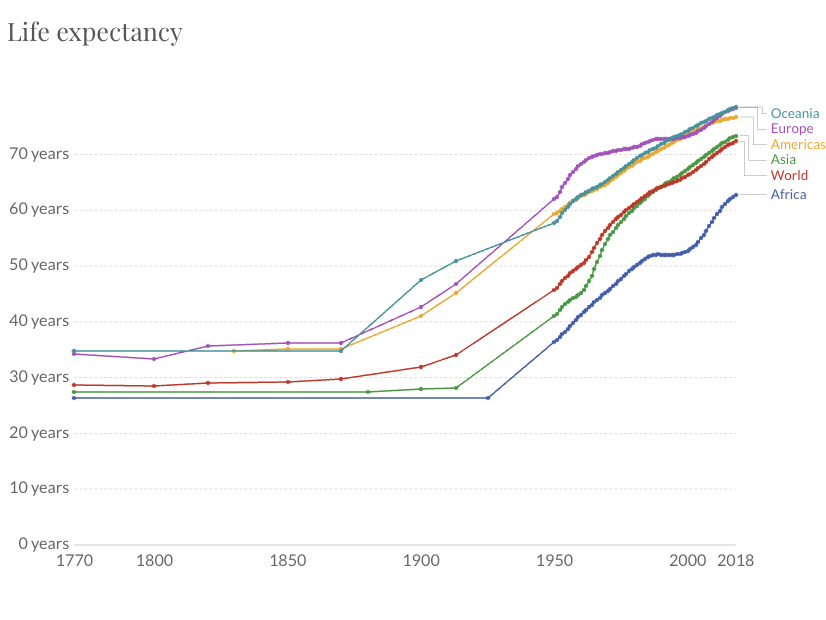

Global Life Expectancy

Global average life expectancy has basically doubled over the last 100 years. A miracle.[14]

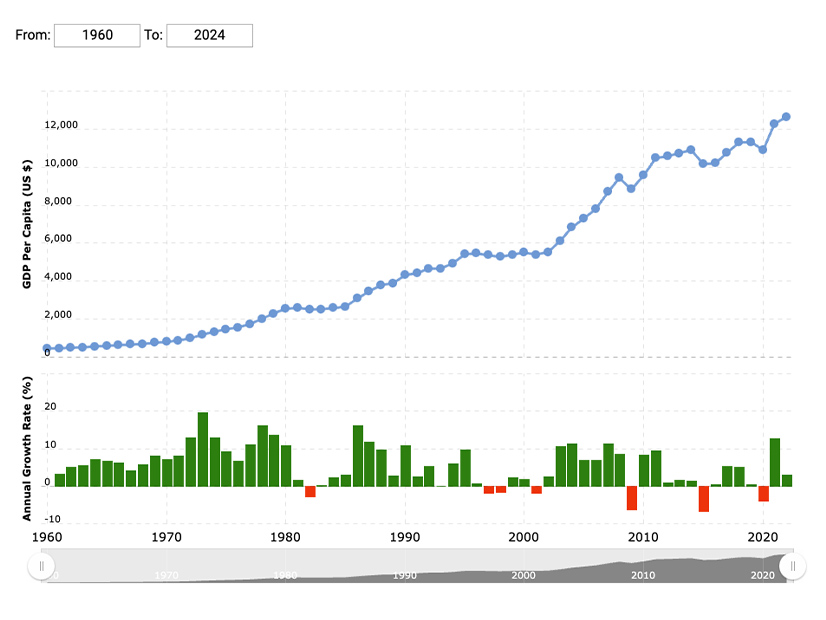

Global Average Income

How about global average income from 1960 to date?[15]

In current U.S. dollars, global gross domestic product (GDP) per capita increased from $457 in 1960 to $12,647 in 2022. That is incredible.

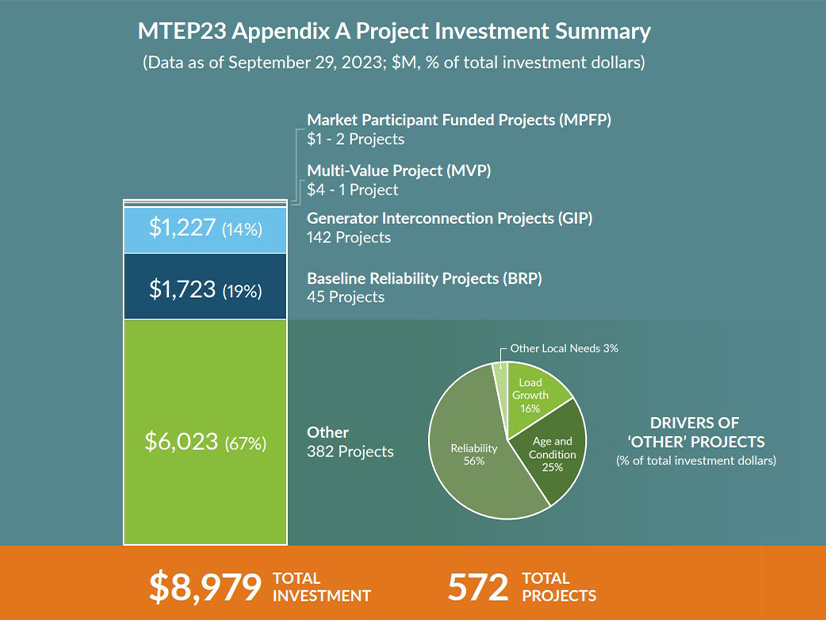

Electricity Access

And apropos of our industry, global access to electricity has gone from 73.4% in 1998 to 91.4% in 2021 — little more than 20 years — as the chart at the top of this story illustrates.[16]

Holiday Cheer

It’s understandable to be concerned with the state of the world these days, but let’s take some comfort in these points of light. We’ll get through this.

I wish you and yours the happiest of holidays.

Columnist Steve Huntoon, principal of Energy Counsel LLP, and a former president of the Energy Bar Association, has been practicing energy law for more than 30 years.

[1] Elton John and George Michael together are here, https://www.youtube.com/watch?v=ECN_wgw55lc.

[2] https://www.youtube.com/watch?v=u0Lx3supRTQ. Dylan at first says he doesn’t know where they are. Then Dylan breaks a string and Ronnie hands him his guitar. How cool is that?

[3] https://www.youtube.com/watch?v=PMxwPOoZm_c

[4] With a little help from his friends, https://www.youtube.com/watch?v=CSoYvI9t3ug

[5] The Beach Boys sing background vocals on “Roll with the Changes,” https://www.youtube.com/watch?v=YsvXe0vKmxA. How cool is that?

[6] I just learned that their song “I Don’t Like Mondays” is traced to a school shooting in 1979 where the 16-year old perpetrator had given “not liking Mondays” as her reason. https://www.economist.com/business/2023/12/07/why-monday-is-the-most-misunderstood-day

[7] https://www.youtube.com/watch?v=-GiS6yMxGlA (video posted in 2020).

[8] https://www.youtube.com/watch?v=Gifrd7ljNL4

[9] https://www.youtube.com/watch?v=00OeznNG4hM. Led by Lionel Ritchie and Harry Belafonte. Patti LaBelle hits the high notes. The spectacular studio version with even more rock royalty is here, https://www.youtube.com/watch?v=9AjkUyX0rVw.

[10] There are a few videos missing from YouTube, like Bryan Adams’ songs, but at least one is on Facebook, https://www.facebook.com/RockandRollNation1/videos/bryan-adams-cuts-like-a-knife-broadcast-of-live-aid-from-mtvjuly-13-1985/2218823795025652/.

[11] https://www.amazon.com/Live-Aid-4-Disc-Set/dp/B0002Z9HT8/ref=sr_1_1?crid=YHCBG819DNNL&keywords=live+aid+concert+dvd+1985&qid=1702070340&sprefix=live+aid+d%2Caps%2C154&sr=8-1

[12] https://ourworldindata.org/famines. https://sites.tufts.edu/wpf/files/2021/05/1_Famine_mortality_decade.pdf. Deaths from hunger and malnutrition continue, but the Global Hunger Index, which measures this, has declined from 28.0 in 2020 to 18.3 in 2023. https://www.globalhungerindex.org/

[13] https://www.nobelprize.org/prizes/peace/1970/borlaug/biographical/

[14] https://upload.wikimedia.org/wikipedia/commons/9/9a/Life_expectancy_by_world_region%2C_from_1770_to_2018.svg

[15] https://www.macrotrends.net/countries/WLD/world/gdp-per-capita.