FERC’s December meeting was the last open meeting for both its longtime Secretary Kimberly Bose and Commissioner James Danly, both of whom were honored for their service.

Commissioner Danly came to FERC in 2017 ago and worked as its general counsel before being appointed commissioner and briefly was Chair near the end of President Donald Trump’s term. Danly also served as a U.S. Army officer in Iraq, where he earned the Bronze Star and Purple Heart.

“Commissioner Danly, on behalf of staff and all the colleagues here, I have to say thank you for your service to FERC,” Chair Willie Phillips said at the meeting. “Thank you for your service to this nation. And thank you for significantly adding to the discourse here.”

Danly’s output of dissents and concurrences was prolific, and his colleagues noted those legal arguments would outlive his tenure at FERC.

Commissioner Allison Clements often was on the other side of the argument from Danly, but she held up the one joint dissent they agreed to in a waiver being sought by Michigan State University.

“I think that’s one thing that we do share, which is a commitment to the law — and how we both interpreted that might be different — but I think he and his team have worked very hard over the years to expound upon that philosophy on the law,” Clements said. “And, certainly, there’s an impressive volume of writing to keep us on our toes and that will last beyond your time here at the commission.”

Commissioner Mark Christie noted that before he came to FERC, he reached out to former members to get a sense of the job and he was warned to never get into an argument with Danly on legal issues because he always would win.

“I probably never spent as much time arguing with somebody that I actually fundamentally agreed with,” Christie said.

Christie called Danly an “American hero,” reminding the audience that recipients of the Purple Heart are injured in conflict.

Danly, in what he said likely was the “longest speech” he ever gave at an open meeting (as a commissioner, he kept his words written more often than not), thanked his staff who made the thousands of pages of dissents he filed possible.

“I will simply end with the observation that the Commission does immensely important work,” Danly said. “We have a profound responsibility in overseeing the gas and utility systems of America. And it’s been an honor of a lifetime to serve these capacities and agency for which I have genuine affection.”

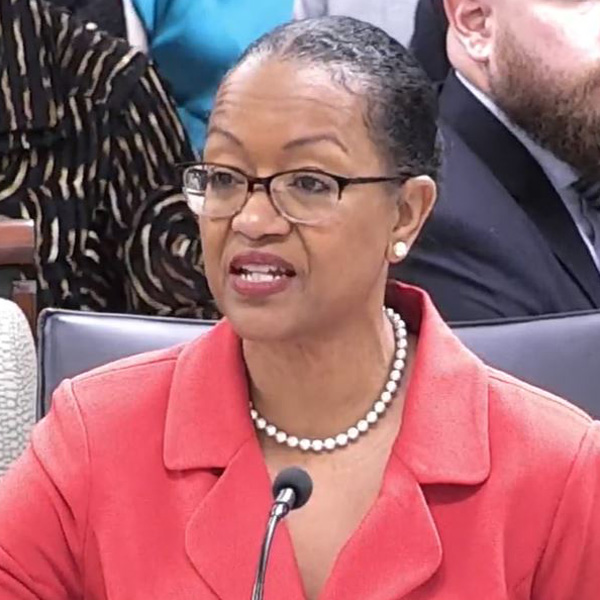

That work would grind to a halt without the Office of the Secretary, which handles the voluminous paperwork the regulatory agency produces and submittals it must process. Since Bose took the secretary job in March 2007, anyone who has spent time perusing FERC’s “e-library” has seen her name everywhere.

Danly said the Office of Secretary is the linchpin of FERC’s work, and actually puts out words on paper that people have to read in order to implement its rulings.

“Having a secretary who has the judgment that she has and the clarity of her office’s mission that Kim has had, and also, the fact that there is not a single person that’s ever encountered here that doesn’t think that she is acting with the best of goodwill and perfectly honorable intentions that is a reassurance that every commissioner has to have,” Danly said. “And ‘O-Sec’ is an institution that is utterly reliable and unimpeachable and that is because of Secretary Bose.”

Bose has been at FERC for 37 years, starting off as a legal intern, and in that time has gotten pretty much every award the commission gives to its staffers, Phillips said at the open meeting. He gave her two more: a Career Service Award and the Chairman’s Medal.

Both Bose and Phillips attended Howard University School of Law, and he said she has had a major impact on its alumni and Black attorneys generally.

“What I appreciate about Secretary Bose is the example that she has set for members of the Howard University community, in particular attorneys of color throughout the energy bar,” Phillips said. “If you wrote to the commission, any type of application, any kind of filing, you directed that to Secretary Bose.”

That means every FERC lawyer knew her by name. Phillips added that she was a good mentor for him personally.

Clements called Bose an inspiration, noting that when she started at FERC decades ago there was nobody at the commission’s dais (where commissioners and senior staffers sit) who looked like her.

“Absolutely to your point, Commissioner Clements, when I came in as a legal intern … I never did think that someone would sit at this horseshoe that looked like me, and even more so I never thought that we would see a Black chairman of the commission,” Bose said. “So, I am so grateful that you are here, and I am so grateful that I was here to see that.”