PSC Delays Vote on Delmarva Reliability Plan

The Public Service Commission delayed a vote on Delmarva Power & Light’s infrastructure improvement plan until Exelon completes its acquisition of Delmarva’s parent company, Pepco Holdings Inc. PSC staff was critical of Delmarva’s five-year, $397 million plan to improve its distribution system, calling it too expensive, considering the utility’s good reputation for outage management. The commission said it would consider the plan three months after the merger’s close, which the companies anticipate in the second or third quarter of 2015.

More: The News Journal

ILLINOIS

Sierra Club Files New Challenge to FutureGen

More: Midwest Energy News

Fossil Plants to ICC: We’ve Done Our Part

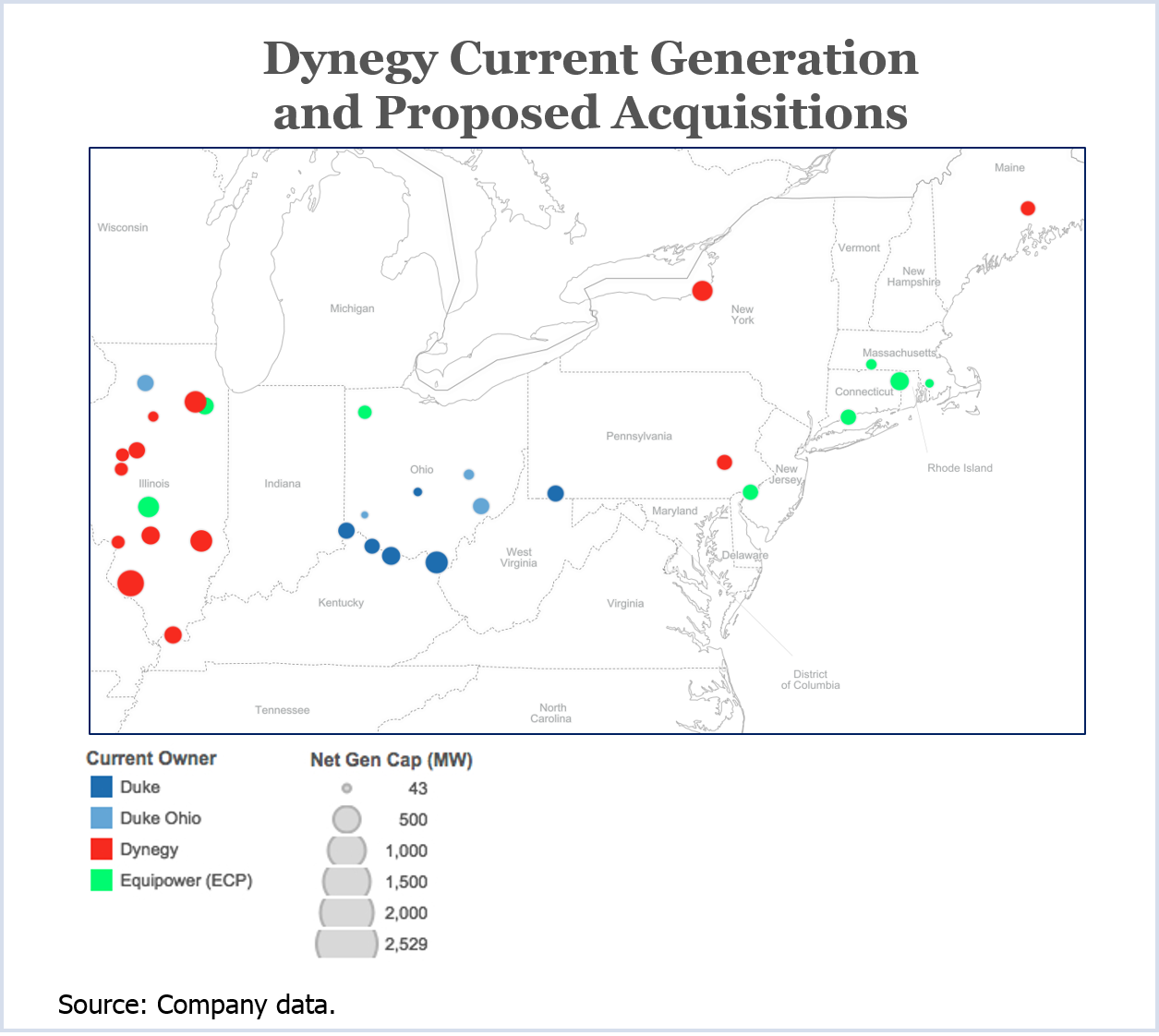

A group of owners of coal- and gas-fired power plants told the Illinois Commerce Commission that they’ve already taken about all the steps they can to reduce carbon emissions, and that the new Environmental Protection Agency’s carbon emission rule should be aimed elsewhere. Dean Ellis, a Dynegy official, said installing emissions-control equipment makes plants less efficient and isn’t the answer. An NRG official agreed. “A more cost-effective approach for Illinois is likely to include the voluntary [switch to natural gas] of inefficient coal plants, augmented by the competitive development of renewable energy, energy efficiency and distributed energy resources,” said Barry Matchett, NRG’s director of external affairs. The ICC is developing regulations to ensure that Illinois can meet the new EPA standards.

More: Chicago Tribune

INDIANA

IPL to Convert Aging Plant to Natural Gas

More: The Courier-Journal

KENTUCKY

Energy Secretary: Meeting EPA Rules will be Expensive

Energy and Environment Secretary Len Peters said the state’s draft answer to meeting new Environmental Protection Agency carbon emissions mandates will be expensive, if it’s even possible. Peters said current technology to capture carbon emissions is not yet economically feasible, undercutting the federal agency’s statements that the rules are reasonable. It is particularly challenging in Kentucky, he said, because much of the area’s generation is from burning coal. The EPA cap for coal-burning plants is 1,100 pounds of carbon dioxide per MWh. State officials say that the state’s best-performing plant emits 1,750 pounds per MWh.

More: Lexington Herald-Leader

MARYLAND

Exelon Asks for PSC Approval on Pepco

Exelon’s proposed acquisition of Pepco Holdings Inc. took another step forward last week when the Chicago-based energy giant filed its formal application with the Public Service Commission. The $6.8 billion merger would add PEPCO, Atlantic City Electric and Delmarva Power & Light to Exelon’s stable of utility companies it already owns: BGE, Commonwealth Edison and PECO. Exelon CEO Christopher Crane said the Maryland review could take up to 15 months. The acquisition also requires approvals by several other states and the Federal Energy Regulatory Commission.

More: The Washington Post

MICHIGAN

PSC Approves $89.5M in Low-Income Grants

The Public Service Commission awarded $89.5 million in energy-assistance grants to 13 organizations, including $30.2 million to DTE Energy and Consumers Energy. The two utilities will use the grant money to help low-income households with energy costs. The grants are funded by a commission-approved charge on utility bills and $40 million in Low Income Home Energy Assistance Program funds from the state Department of Human Services. Most of the grant money is provided during the winter heating months.

More: Public Service Commission

Clear Solar Panels? MSU Scientists Say Yes

“It opens a lot of area to deploy solar energy in a non-intrusive way,” Lunt said. “It can be used on tall buildings with lots of windows or any kind of mobile device that demands high aesthetic quality like a phone or e-reader. Ultimately we want to make solar harvesting surfaces that you do not even know are there.”

More: Michigan State University Today;Motherboard

NEW JERSEY

New PPL Tx Line Plan Facing Early Opposition

PPL’s ambitious plan to build a $4 billion to $6 billion transmission line to carry energy produced by new plants in Pennsylvania’s shale gas region is already attracting opposition. PPL bills the line, which would run from Pennsylvania to New York and New Jersey, and from Pennsylvania south to Maryland, as important to the company’s financial health and the regional power grid’s health. The proliferation of cheap shale gas has triggered a boom in new power plant construction, but the current transmission system isn’t robust enough to handle much more power.

The New Jersey Chapter of the Sierra Club says it will marshal forces to stop the line. “We have better places to invest our energy money” in or near New Jersey, state Sierra Club Director Jeff Tittel said. He said if money was spent on offshore wind, solar and energy-efficiency projects, “you wouldn’t need the power line.”

More: The New Jersey Herald

NORTH CAROLINA

McCrory Faces Heat Over Duke Stock Sales

Gov. Pat McCrory is facing criticism for failing to disclose that he owned Duke Energy stock during the start of the state’s coal ash spill controversy this past spring. McCrory, a former Duke employee, sold his stock in the days after more than 39,000 tons of toxic coal ash spilled into the Dan River. Although he has since filed updated ethics disclosures, the initial ethics forms didn’t note his Duke stock holdings or the sale.

McCrory’s attorney has said the failure to note the stock ownership and stock sale on the forms was an oversight. McCrory’s communications director, Josh Ellis, said the governor sold the stock in response to criticism from the media and environmental groups after the coal ash spill. “The stock was sold in response to repeated public requests via the media and to stop the constant, unfounded challenges of the governor’s character,” Ellis said.

More: News & Observer

NC to Duke: Give Us Coal Ash Cleanup Plans

The state Department of Environment and Natural Resources is pressuring Duke Energy to come up with a plan for removing coal ash from four plants. The request comes after Gov. Pat McCrory issued an executive order for Duke to file plans after the state legislature failed to approve an ash-disposal bill. The efforts come in the wake of a spill of 39,000 tons of coal ash from one of Duke’s ash ponds on the Dan River. The state ordered Duke to submit plans by mid-November for cleaning up ash retention areas at the company’s Asheville, Riverbend, Dan River and Sutton plants. Some environmental groups say the state’s action doesn’t go far enough, noting that Duke has ash sites at 10 other plants in the state.

More: The Charlotte Observer

OHIO

New Disclosure Rule to Show Renewables Cost

The Public Utilities Commission is working on a new rule to require electric utilities to include a distinct line item on customer bills that discloses the costs of renewable and energy-efficiency programs. The requirement was part of Senate Bill 310, which froze renewable energy standards for two years. The issue has pitted lawmakers against utility companies. A workshop is to be held this week to discusss how the rule will be implemented.

More: Columbus Business First

WEST VIRGINIA

Moundsville Power Gets Another OK for Plant

More: The State Journal