ISO-NE is recommending a one-year delay of Forward Capacity Auction 19 (FCA 19) to implement resource capacity accreditation (RCA) changes and determine whether to move to a prompt and seasonal capacity market, the RTO told the NEPOOL Markets Committee on Tuesday.

Since June, the RTO has been taking stakeholder feedback on the best path forward for FCA 19 following a delay caused by a software issue in the RCA process, as well as on a potential move to a prompt and/or seasonal market. (See NEPOOL Debates Options for FCA 19.) FCA 19, scheduled for February 2025, corresponds with Capacity Commitment Period 19 (CCP 19), which runs from 2028 to 2029.

After laying out a series of options in previous meetings, ISO-NE endorsed “option 2A,” which would provide some extra time to finish the RCA process for FCA 19 and further discuss the merits of capacity market changes.

Chris Geissler of ISO-NE said this option “recognizes the importance of simultaneously implementing a revised capacity accreditation framework that coincides with the elimination of the minimum offer price rule (MOPR) for FCA 19.”

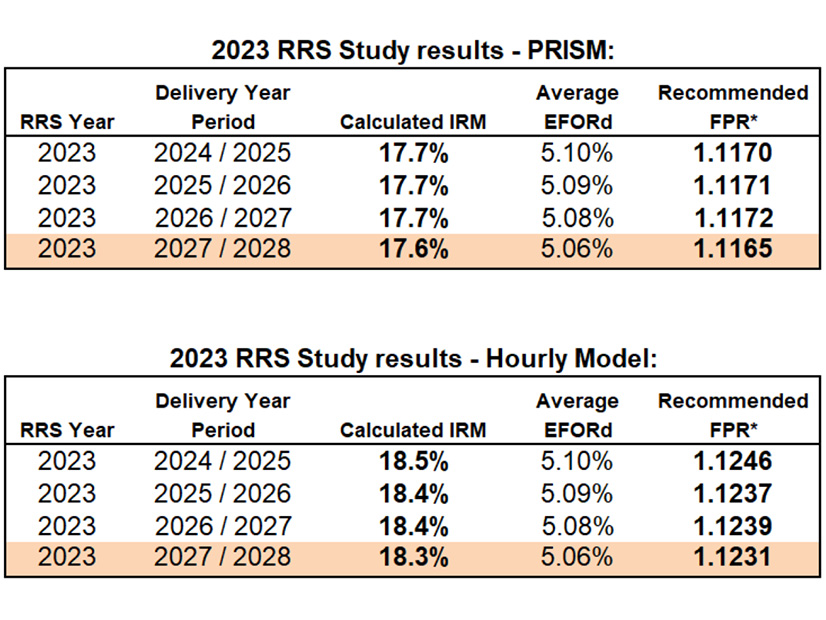

The RCA project is intended help the organization “more accurately reflect resource contributions to resource adequacy.” ISO-NE has expressed its desire to time the implementation of these changes with the scheduled elimination of the MOPR. (See FERC Accepts ISO-NE’s MOPR Transition Plan.)

“While some stakeholders prefer maintaining the status quo (FCA 19 without RCA), the ISO is concerned it may not adequately prepare the region for the changing resource mix and expected clean energy system,” Geissler said.

Clean Energy Stakeholders Weigh in

A range of clean energy stakeholders outlined questions, comments and concerns about the potential capacity market changes. The comments highlight the lack of consensus among various renewable energy groups, along with uncertainty about how a prompt seasonal market would affect resources.

Deepwater Wind Block Island, a subsidiary of Ørsted, supported implementing RCA changes and moving to a prompt and seasonal capacity market for CCP 19, writing that the move would limit uncertainty for long-term investments while helping reliability. The company added that ISO-NE’s preliminary analysis of the RCA design indicated it would enable offshore wind resources to clear more capacity.

“The combination of incorporating RCA and the removal of the MOPR in CCP 19 will enable offshore wind resources the opportunity to compete with other existing resources on a more even playing field,” wrote Eric Wilkinson of Ørsted. “Ratepayers will benefit from these changes by increasing the amount of capacity being provided from clean energy resources.”

In contrast, representatives of New Leaf Energy and SYSO Inc. expressed their opposition to delaying the auction and supported holding it under the current rules without RCA changes. The companies argued that any delay of the auction would introduce uncertainty and hurt new resources looking to connect to the grid, because new generators rely on the forward capacity market to secure capacity rights.

“Postponing the FCA without a replacement process for generators to secure these rights will prevent new resources from knowing whether they can access the capacity market, threatening the financial viability of these projects, as well as the pace of the clean energy transition,” the memo said.

The companies added that delaying the auction could lead to a backlog of projects in the interconnection queue once a new process is implemented.

ISO-NE told the Markets Committee it might need to separate the interconnection process from the capacity market to comply with FERC Order 2023 no matter which capacity market design ultimately is chosen (RM22-14). (See FERC Updates Interconnection Queue Process with Order 2023.)

“To address FERC Order 2023, the ISO will be required to migrate to a single annual cluster process, with equal queue positions and shared upgrade cost allocation within the cluster, for studying new interconnections,” ISO-NE noted.

In an August letter to ISO-NE, Advanced Energy United, which advocates for clean energy policies on behalf of its member companies, wrote that there are significant “information gaps” surrounding the effects of ISO-NE’s stated options for CCP 19 on new resources, retirements, the RCA process and subsequent capacity commitment periods.

“We do not feel stakeholders can make informed decisions without further explanation addressing these information gaps,” Advanced Energy United wrote. “While we appreciate the time constraints driving ISO to move quickly to land on a preferred path forward, we believe the significance of the decision necessitates a fulsome exploration of the implications of each pathway, and we are not yet satisfied that ISO-NE and NEPOOL have completed such an exploration.”

Aleks Mitreski of Brookfield Renewables expressed concerns in a presentation to the Markets Committee on Tuesday relating to the entry and exit of resources, along with transmission upgrades. Mitreski added that some of the issues with the forward capacity market likely could be fixed without overhauling the entire market design.

Next Steps

ISO-NE proposed making an initial FERC filing by the end of this year to delay the auction, followed by another filing next year to either finalize the one-year delay including the RCA changes or to create a new schedule to implement a prompt auction for FCA-19, which would be held in 2028.

ISO-NE will present the detailed tariff revisions at the October MC meeting, followed by a November MC vote and a Participants Committee vote in December.

Also at the October MC meeting, ISO-NE will resume discussion on the RCA proposal, which likely will extend into next year. The RTO is targeting an August 2024 vote on the proposal.

ISO-NE also has commissioned the Analysis Group to conduct a qualitative and quantitative analysis of the potential effects of moving to a prompt and/or seasonal market. The consulting firm will need to work on a tight schedule, as ISO-NE expects it to present to the MC the scope of its work in October, the methodology in November and results in December.