Future historians of the U.S. electricity sector one day might conclude the development of an RTO (or RTOs) in the West hinged on two separate but interrelated events occurring July 14, 2023.

On that date, a group of utility commissioners from Arizona, California, New Mexico, Oregon and Washington issued a letter launching the West-wide Governance Pathways Initiative (WWGPI), an effort to build the framework for an independently governed RTO that could encompass the entire Western Interconnection, with the express aim of including CAISO.

Backers of the initiative also envisioned that the ISO, whose real-time Western Energy Imbalance Market (WEIM) already covers about 80% of the West’s electricity load, would be the RTO’s market service provider. (See Regulators Propose New Independent Western RTO.)

A key objective of the proposal: to overcome the California grid operator’s historic inability to fully regionalize its operations because of objections to its governance structure, which is subject to oversight by California’s government.

But the initiative’s more immediate goal appeared to be supporting CAISO’s efforts to win participants for its Extended Day-Ahead Market (EDAM) as it faced increasing competition from SPP’s day-ahead offering, Markets+, which by late spring had become a serious challenger to EDAM, particularly in the Pacific Northwest. (See In Contest for the West, Markets+ Gathers Momentum — and Skeptics.)

‘Momentum’

The timing of the release of the WWGPI proposal was curious because July 14 also marked the first of a series of stakeholder workshops hosted by the Bonneville Power Administration to determine which of the two day-ahead markets it would join.

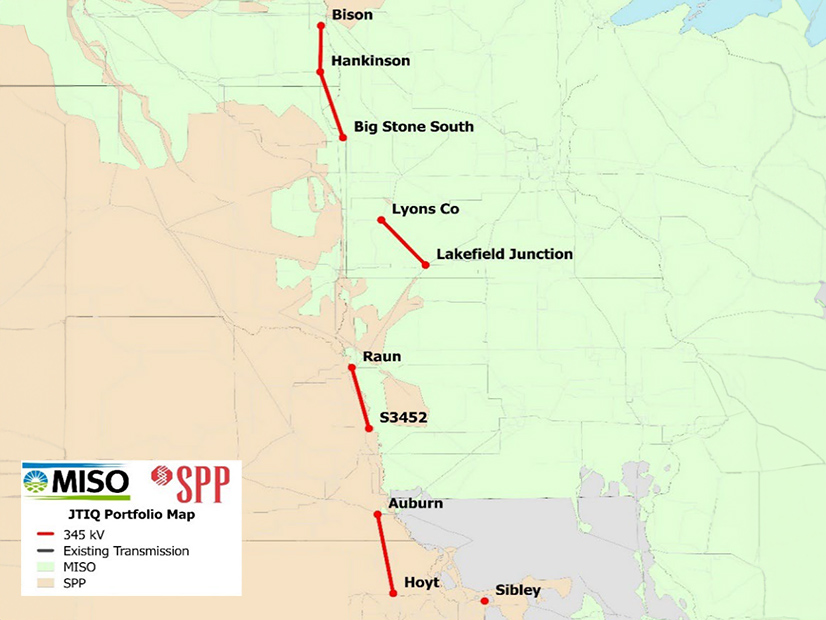

As the operator of 15,000 miles of transmission and nearly 17,500 MW of generating capacity in the Northwest, BPA’s decision will carry significant weight. And officials from the federal power marketing agency made clear during that first workshop at its Portland, Ore., headquarters that BPA’s day-ahead decision likely would set the course for future RTO membership.

For BPA, CAISO’s state-run governance has long been a hurdle for deepening the relationship between the two entities. The federal statute governing BPA prohibits the agency from being subject to the oversight of a state.

“One of the things we think about [regarding] governance, market design etc. is which options create the opportunity to create more verticality, potentially going to an RTO or adding these functions as part of it, and which ones have had that sort of limitation,” Russ Mantifel, BPA’s director of market initiatives, told participants at the July 14 workshop.

Mantifel said the workshop process would be “open-ended” and that BPA had not decided on a market. The agency said it would issue a “policy direction” on a market in February or March of 2024, but some stakeholders in the region told RTO Insider they thought the agency already was leaning heavily toward Markets+.

Among the factors favoring SPP, they said, was more favorable treatment for hydroelectric generation in Markets+, a CAISO bias in favor of California load that restricts wheel-throughs in the ISO during critical periods and the unresolved CAISO governance issue.

One staffer at a Northwest utility not authorized to speak on behalf of their organization at the time commented on momentum that seemed to be building for SPP. “They may not beat WEIM to a day-ahead market, but they have more momentum for a Western RTO,” the staffer said.

“I think if there was one word to describe the Markets+ zeitgeist, it’s ‘momentum,’” Scott Miller, executive director of the Western Power Trading Forum (WPTF), told RTO Insider in an interview in July.

“SPP is making a lot of progress,” he said. “Its stakeholder process has so charmed people that it’s added to that momentum.”

But some stakeholders weren’t so caught up in the zeitgeist.

“I can’t see how we can have two markets in the West, particularly with PacifiCorp going with EDAM — and possibly [Portland General Electric],” a representative of one environmental group told RTO Insider. They also pointed out that two competing markets would put “a big seam” in the West, echoing the concerns of other such groups that hope the geographic diversity of a single market would maximize the use of the region’s renewables and reduce curtailments.

‘General Positivity’

The heavy turnout at an August CAISO-hosted forum to celebrate the filing of the EDAM tariff with FERC signaled that the ISO was gathering some momentum of its own. About 240 electric industry stakeholders — including top utility executives — showed up at the event in Las Vegas, with an additional 300 attending online, according to the ISO. (See Forum Turnout, Tone Could Signal Growing Support for EDAM.)

The conference kicked off with the Balancing Authority of Northern California (BANC) announcing it would be the second entity to commit to joining the EDAM, after PacifiCorp. With 5,000 MW of load, BANC is the third-largest balancing authority in California, and it functions as the system operator for the Sacramento Municipal Utility District (SMUD), Modesto Irrigation District (MID), Roseville Electric, Redding Electric Utility (REU), Trinity Public Utility District (TPUD) and City of Shasta Lake. Its footprint also includes the Western Area Power Authority’s Sierra Nevada region transmission grid. (See BANC Moving to Join CAISO’s EDAM.)

BANC General Manager Jim Shetler said the organization’s decision really came down to geography, an assessment that could foreshadow the decisions of other utilities.

“I think the main driver for any market decision is what … your transmission capabilities [are] and who you’re interconnected with, and we have tremendous interconnection capability with the ISO through our footprint,” Shetler said. “And it just made sense for us when we did our evaluation, both from a cost standpoint [and a] potential benefits standpoint, that EDAM came out as a clear winner.”

WPTF’s Miller said he was impressed by what he saw at the EDAM forum.

“This really changes the calculus of my thinking around” Western markets development, Miller told RTO Insider immediately after the event concluded.

“It was the general positivity — even from CEOs whose folks are involved in Markets+ — that struck me as interesting,” he said.

Pathway to Independence

The Las Vegas forum also gave backers of the Pathways Initiative a platform to demonstrate the seriousness of the project and explain how quickly they intended to proceed with their mission. (See Backers of Independent Western RTO Seek to Move Quickly.)

“I think there’s a lot of work in front of us to make sure that stakeholders are widely engaged, that public power has a seat at the table, [and] that the [investor-owned utilities], the public interest organizations, the consumer advocates are all invited into that conversation and that it moves with all urgency,” Oregon Public Utility Commissioner Letha Tawney, a signatory of the July letter, said at the forum.

Another signatory, California Public Utilities Commission President Alice Reynolds, made clear that the initiative was intended to remove CAISO governance from the equation and examine what an independent RTO “needs to look like.”

Supporters of the initiative hit the ground running shortly after the forum, but the effort still faces some fundamental challenges, foremost being how it will be funded in a way that alleviates concerns about its own independence. In September, the Idaho Public Utilities Commission voted unanimously not to join the effort, saying the initiative “has been less than transparent concerning its creating and funding.” (See Idaho PUC Declines to Join Western RTO Governance Effort.)

At a Nov. 17 public meeting of the WWGPI’s Launch Committee, Shetler, co-chair of the committee’s Administrative Work Group, acknowledged the need for an “unbiased source of funding.” He said the group was pursuing $800,000 in grants through a Department of Energy Funding Opportunity Announcement (FOA) to support operations over two years. (See Western RTO Group Seeking $800K in DOE Funding.)

“This funding is necessary for major Pathways support functions — development of informational materials; outreach to key stakeholders; regular convenings through virtual and in-person gatherings; and facilitation to ensure meaningful participation by those who wish to engage,” the group said in a concept paper it submitted with its grant application.

If awarded, the money would arrive by the middle of 2024 at the earliest, Shetler said.

During the November meeting, the Launch Committee also discussed the formation of “work groups” to tackle other issues related to creating an independent entity. One of those groups is charged with the complex matter of addressing legal questions associated with creating a market structure that integrates CAISO, including minimum changes to California law needed to alter the ISO’s governance and operations. (See West-Wide Governance Pathway Group Digs into its Work.)

“Our goal is to define a range of solutions — or pathway options — that are related to tariff management for the markets and other services [and] what the governance structure looks like for a potential new regional entity,” said Spencer Gray, executive director of the Northwest & Intermountain Power Producers Coalition (NIPPC) and co-chair of the Launch Committee’s Priority Functions and Scope Work Group.

The Launch Committee in December outlined five governance options for an independent Western RTO, stopping short of calling them proposals or recommendations and instead saying they should represent a starting point for discussions. The options sit between two “bookends,” ranging from one in which CAISO’s Board of Governors and WEIM’s Governing Body would continue to hold shared authority over market rules but eliminate the CAISO board’s veto rights to one in which a new “regional organization” would fully absorb the ISO’s staff and operate the market itself — with variations in between. (See Western RTO Initiative Outlines Governance Options.)

The Pathways Initiative also is working quickly achieve other key objectives for its governance early this year, including establishing a nominating committee for a foundational board of directors in January, then identifying and seating board members in March.

Milestones Met

December saw CAISO and SPP both hit important milestones in their day-ahead market efforts.

CAISO’s was by far the most significant, with FERC approving nearly every portion of the EDAM tariff in a 181-page order issued Dec. 21 (ER23-2686). The approval covered creation of a set of Day-Ahead Market Enhancements (DAME), market products intended to reduce load imbalances between the ISO’s day-ahead and real-time markets, as well as EDAM implementation measures. (See CAISO Wins (Nearly) Sweeping FERC Approval for EDAM.)

The only aspect of the filing rejected by FERC dealt with a temporary measure intended to compensate transmission operators for losses incurred during a BA’s transition into the EDAM, something CAISO considered “severable” from the rest of the proposal. Even so, the commission made clear the rejection was without prejudice and opened the door for CAISO to resubmit a revised version of the measure.

SPP scored a success Dec. 7 when the stakeholder-led Markets+ Participants Executive Committee approved the market’s governance plan, an important step on the road to filing a tariff in February. But the approval was somewhat marred by a disagreement ahead of the vote over the voting structure of the “Independents” sector. That left the plan passing with just 73% in favor in the face of “no” votes from independent power producers and environmental and clean energy groups. (See SPP’s MPEC Approves Markets+ Governance Plan.)

The Interim Markets+ Independent Panel (IMIP), which consists of three SPP independent directors, stamped its approval on the governance plan during a call Dec. 19. (See IMIP Approves SPP Markets+ Governance Tariff Language.)

‘Extreme Pressure’

With the new year underway, Western stakeholders are closely following BPA as it approaches its decision point. At the agency’s most recent day-ahead markets workshop in November, BPA officials said they intend to stick to their original timeline of issuing a policy direction by the end of the first quarter. They also indicated there would be a shift in the content of that decision. In response to concerns expressed by some of BPA’s public power customers, the decision now is likely to deal with the agency’s statutory authority to join a day-ahead market, while also conveying a “leaning” on what market it is favoring at the time, Mantifel said during the workshop.

“I think it’s fair to expect that that policy direction will establish our authority to join a market and will establish the business case for pursuing a market,” Mantifel said.

During that meeting, BPA officials also suggested that the leaning could be subject to change based on further developments. Mantifel noted that any expected action after issuance of the leaning is “still up in the air.”

“The processes for joining the markets themselves are still somewhat fluid, as opposed to EIM,” he said.

BPA Senior Vice President of Power Services Suzanne Cooper acknowledged that some Northwest stakeholders want the agency to hold off on a final decision to evaluate more thoroughly the “cost advantages” of a single market in the West. She said the agency will continue to monitor the progress of the Pathways Initiative, a process in which it is not directly participating.

“We have heard and definitely acknowledge the requests that we’ve heard for taking some more time for additional analysis and to allow the Pathways concept to develop,” Cooper said. “We’ve heard also from many entities, including within our public power customers, that desire for BPA to maintain our current timeline.”

One non-BPA participant in the stakeholder process told RTO Insider in December: “The subtext is we [BPA] are announcing our decision in Q1, but they are saying there’s room to move in phase 2 [of Markets+ development] in case something drastic happens.”

That participant also said BPA is under “extreme pressure from many angles” to move quickly on a decision. They said the pressure is being applied both internally and externally — the latter referring to the agency’s public power customers, who are “dividing into two camps” over which market to join.

Whatever the specific outcomes, the momentum toward a Western RTO — or two — will continue to build in 2024.