PJM UTC Trades at Issue in High-Profile Case

By Ted Caddell

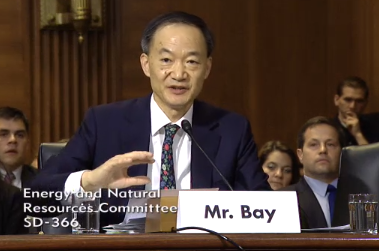

After nearly four years of investigation, the Federal Energy Regulatory Commission Tuesday publicly accused an energy trading firm of market manipulation in a case that dogged FERC enforcement chief Norman Bay through his confirmation as commissioner.

The staff “notice of alleged violations” accuses Houlian (Alan) Chen and the Powhatan Energy Fund LLC of engaging in “manipulative” up-to-congestion trades in PJM in 2010.

The notice was issued the day after Bay was sworn in as a FERC commissioner and his deputy at the commission’s Office of Enforcement, Larry Gasteiger, was named acting director. Bay’s handling of the Powhatan case was cited during his Senate confirmation hearing in May as evidence of what critics said was his unit’s harsh and unfair tactics.

[Editor’s Note: An earlier version of this article inaccurately stated that FERC had “charged” Powhatan. The notice is merely a public disclosure of a previously non-public investigation.]

Powhatan, based in West Chester, Pa., is a private investment fund headed by portfolio manager Kevin Gates and his twin brother Rich. FERC staff says Powhatan and a predecessor fund netted $4.7 million in profits in 2010 by taking advantage of a loophole for making low-risk up-to-congestion trades to profit from line loss refunds.

The investigation was disclosed under a policy approved by FERC in December 2009 to balance “the need to protect the subject’s confidentiality in the early stages of an investigation with the public interest of promoting additional transparency during investigations.” It allows the Director of Enforcement to authorize a Preliminary Notice of Violations “after the subject of the investigation has had the opportunity to respond to staff’s preliminary findings letter.”

“In our experience, once staff provides its preliminary conclusions to a subject, the existence of the investigation is likely to become public in any event, through a negotiated settlement, an order to show cause, or, in the case of a publicly traded company, a securities filing,” the commission said in approving the policy. “The absence of disclosure means that a greater amount of time passes before the public becomes aware of potential violations that enforcement staff is investigating.”

Kevin Gates on Tuesday issued a statement vowing to fight the allegations. “We’ve read it and it makes no sense. We will aggressively fight their allegations. We can only speculate on FERC’s motives,” he wrote. “When a regulator is not concerned with the facts or the law, then traders can become easy targets if it has a political agenda.”

It is unclear what, if anything, FERC will do next. FERC staff advised Powhatan of its preliminary findings in August 2013 and Powhatan responded with its rebuttal in October. Powhatan said it has rejected an earlier settlement offer from enforcement staff.

“This is an acknowledgement that an investigation is going on,” FERC spokeswoman Mary O’Driscoll said today. “This is not an indication of whether the commission is going to go to court. There is no other step at this point.”

The case has drawn widespread attention and was highlighted in a Wall Street Journal op-ed penned by former FERC general counsel William Scherman. In it, Scherman accused Bay of driving Wall Street banks out of energy trading with heavy-handed enforcement tactics.

Republicans grilled Bay on the case and his management of the enforcement unit during his confirmation hearing. Bay declined to comment on the Powhatan case, which was then “non-public,” but dismissed Scherman’s allegations of due process violations as untrue.

Gasteiger responded to charges that FERC was unfairly targeting traders during a panel discussion at an Energy Bar Association conference earlier this year. “We take these cases extremely seriously, whether it’s individuals or companies,” he said. “We won’t take on a case unless we think we have an extremely solid case to present to the commission and if necessary to take it to a hearing before an [administrative law judge] or a district court proceeding.”

Tuesday’s notice alleges that Chen, trading on Powhatan’s behalf, placed “millions of megawatt hours of offsetting trades between the same two trading points, in the same volumes and the same hours — an intentional effort to cancel out the financial consequences from any spread between the two trading points while capturing large amounts of MLSA [Marginal Loss Surplus Allocation] payments.” FERC charges this was “wash trading,” which is illegal.

The Gates brothers said it was savvy trading and legal until the “loophole” was closed later in 2010.

After being under investigation by Bay’s enforcement unit for more than three years with no charges filed against them, the Gates brothers went on the offensive. In March, they released documents they say prove they have been unfairly hounded. The fund enlisted testimonials from an all-star team, including Susan J. Court, Bay’s predecessor as enforcement chief, Harvard professor William Hogan and John N. Estes III, a prominent defense attorney. (See PJM Trader Calls FERC on Manipulation Probe.)

The Gates brothers filed a Freedom of Information Act lawsuit to obtain agency records relevant to their case, lobbied the Senate to block Bay’s confirmation and lurked behind Bay during his confirmation hearing. In a letter to the editor published in The News Journal days before Bay’s confirmation hearing, Richard Gates said they were offered a settlement by FERC.

“While that would have been the easier and cheaper thing to do, Powhatan declined,” he wrote. “Instead, we planned for protracted litigation against the federal government.”