PJM Polling Members on Next Step

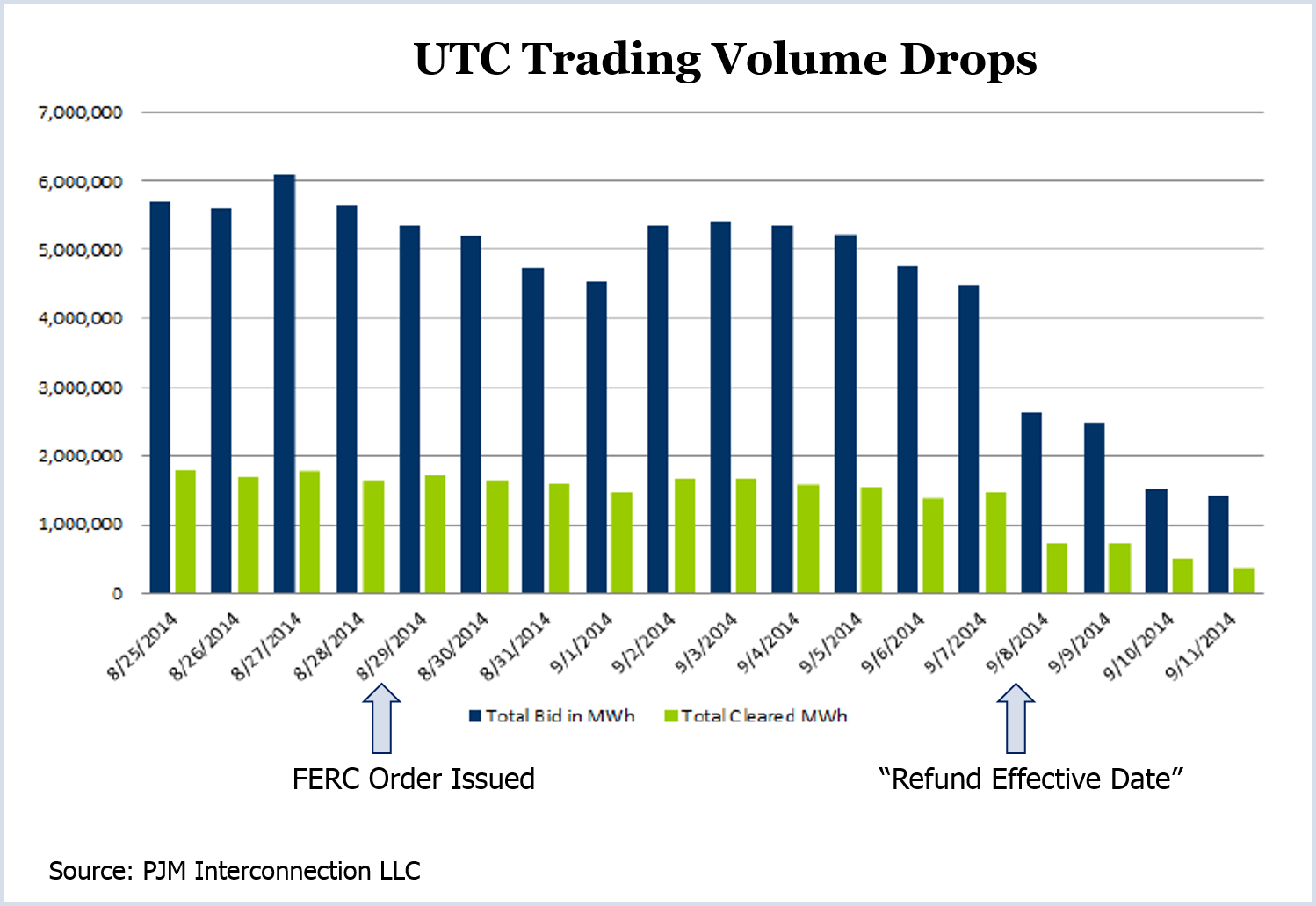

Up-to-congestion trading plummeted by about two-thirds this week following a Federal Energy Regulatory Commission order that could result in sharply increased costs for traders.

On Aug. 29, the commission ordered a Section 206 proceeding to determine whether PJM is improperly treating UTCs differently than increment offers and decrement bids in the interpretation of a forfeiture rule and in the application of uplift charges.

PJM saw both the volume of bids and MWh offered and cleared drop. Less than 500,000 MWh cleared yesterday, down from about 1.8 million the day before FERC’s order.

Attorney Ruta Skucas, who represents the Financial Marketers Coalition, had predicted the drop last week, saying that the market faced months of uncertainty while the case is pending.

The commission, which ordered — but did not schedule — a technical conference on the issue, said it expects to rule within five months after post-technical conference pleadings are submitted.

At a meeting of the Energy Market Uplift Senior Task Force yesterday, some stakeholders said the uncertainty could stretch out for years as occurred in MISO before it won FERC approval for its uplift rules, the Revenue Sufficiency Guarantee.

One trader told the task force he may have to resort to layoffs due to the uncertainty. “We’re not going to hemorrhage money waiting around” for a ruling, he said.

“Our traders have stopped trading as of yesterday,” said another.

But there was no consensus on how to avoid what one stakeholder called “the four years of paralysis” that MISO suffered.

Adam Keech, director of wholesale market operations, said PJM would like stakeholders to reach consensus on the UTC uplift issue so that the RTO can make a Section 205 filing before FERC weighs in. “We have this opportunity here to try to get ahead of it and try to influence FERC’s long-term interpretation on cost allocation,” he said. “I think that would be PJM’s preference.”

Some stakeholders, however, warned that in attempting a narrow Tariff filing, stakeholders might lose the opportunity for trade-offs that would be necessary for a broader, long-term solution.

Barry Trayers of Citigroup Energy said the task force should continue to follow the work plan it had before FERC’s order. “These are big questions and it’s very interwoven,” he said.

Noha Sidhom, general counsel for Inertia Power, said she was doubtful stakeholders would be able to reach a narrow agreement quickly, noting previous stakeholder efforts on the issue had been time-consuming and “very contentious.”

FERC’s order (EL14-37) came in response to a PJM filing in June defining UTCs as virtual trades and seeking to subject them to the RTO’s Financial Transmission Rights (FTR) forfeiture rule.

Assistant PJM General Counsel Steven Shparber said FERC’s “refund effective date” of Sept. 8 could apply to any rule changes regarding the FTR forfeiture rule. “Another plausible reading is that it also could apply to any uplift payments” later allocated to UTCs, he said.

Shparber said PJM does not plan to ask FERC for clarification on what would be covered under the refund. But he said “that could change” depending on the impact on market activity.

Lacking consensus, PJM will poll members beginning today on how they want to proceed. The options will range from seeking an expedited 205 filing to suspending EMUSTF’s work pending the outcome of FERC’s inquiry.