By Ted Caddell

The company is framing the issue as one of system reliability and consumer protection. However, there could be substantial financial benefits to Dynegy if its MISO generation were part of PJM, where capacity prices are far higher.

“MISO’s own forecasts show that it expects to be short of generation in the next few years,” Dynegy spokeswoman Katy Sullivan said. “The potential for consumer rate shock as the market moves across the vertical demand curve is high. Our point is that there are several ways for Illinois to address this concern and benefit all market participants.”

“Improving the MISO capacity construct is one,” she said, “moving to PJM is another.”

Dean Ellis, Dynegy’s managing director for regulatory affairs, first floated the potential move in an interview with Crain’s Chicago Business.

Why Switch to PJM?

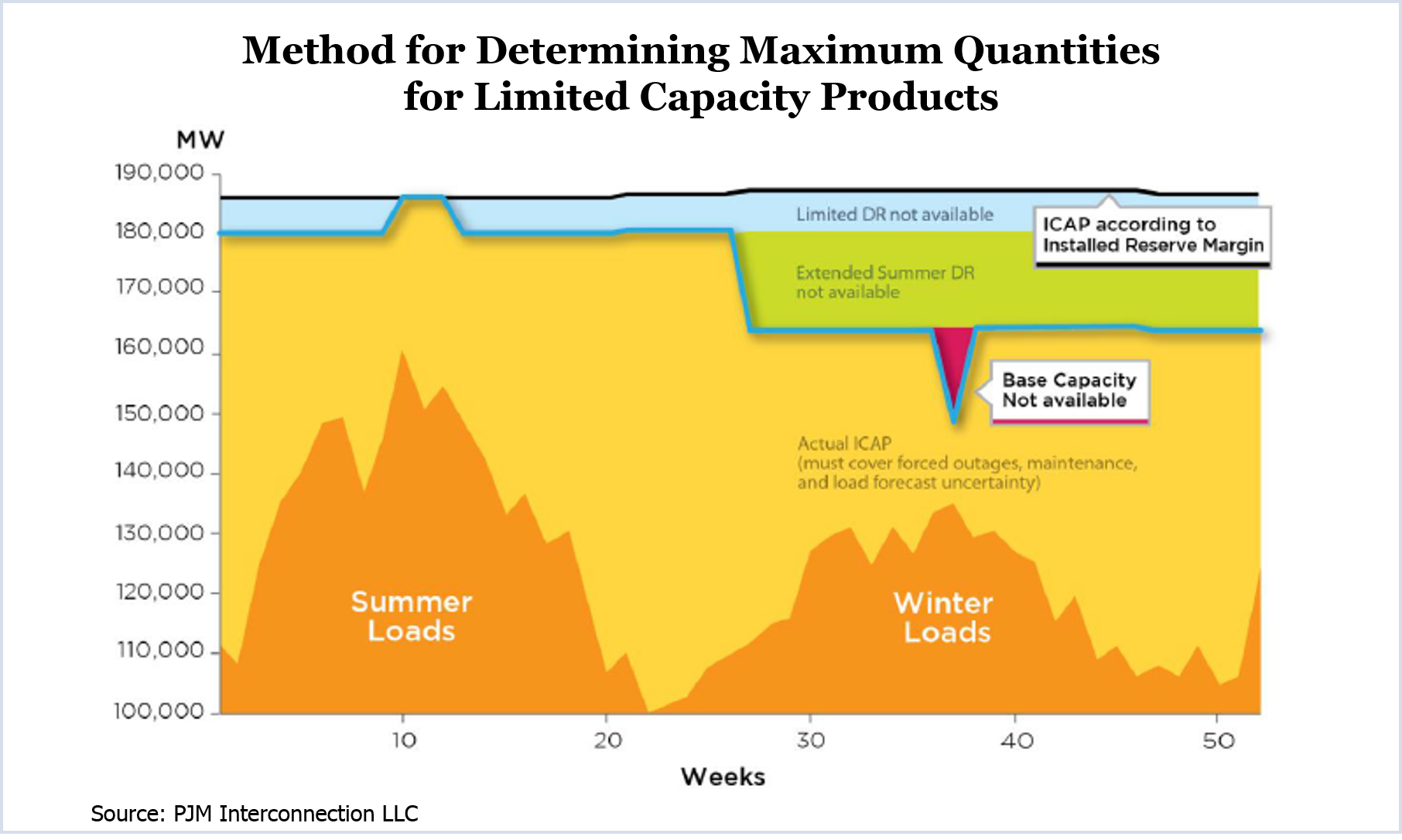

MISO’s voluntary capacity market uses a vertical demand curve and procures resources one year in advance. PJM’s mandatory market uses a sloped demand curve and obtains capacity three years ahead of delivery.

MISO has only conducted two auctions so far, for 2013/2014 and 2014/2015. The clearing price for the zone, including Dynegy’s Illinois generation, was $16.75/MW-day for the 2014/2015 delivery year. The PJM clearing price for the same period was $125.99/MW-day.

Critics say MISO’s construct makes it hard to attract capital investment and that its vertical demand curve causes excessive price volatility.

Among the critics is MISO’s Independent Market Monitor, whose 2013 State of the Market Report cited as flaws the vertical demand curve, “barriers to capacity trading with PJM and barriers to participation in the auction affecting units with suspension or retirement plans impacting the planning year.

“MISO’s economic signals in 2013 would not support private investment in new resources, which is partly due to the modest capacity surplus that currently exists in MISO,” the report said. “However, we believe the economic signals would continue to be inadequate even under little or no surplus because of the shortcomings of MISO’s current capacity market.”

The IMM said MISO’s 2013 replacement of its Voluntary Capacity Auction (VCA) with an annual Planning Reserve Auction (PRA) didn’t go far enough. “Though an improvement, the PRA continues to reflect a poor representation of the demand for capacity [or planning reserves], which undermines its ability to provide efficient economic signals.

“It will be critical to address these issues in the near future because increased retirements and capacity exports are projected to generate a capacity deficiency as soon as 2016. Improving the performance of the capacity market may play a pivotal role in ensuring that MISO will continue to have access to sufficient capacity.”

What Dynegy Has at Stake

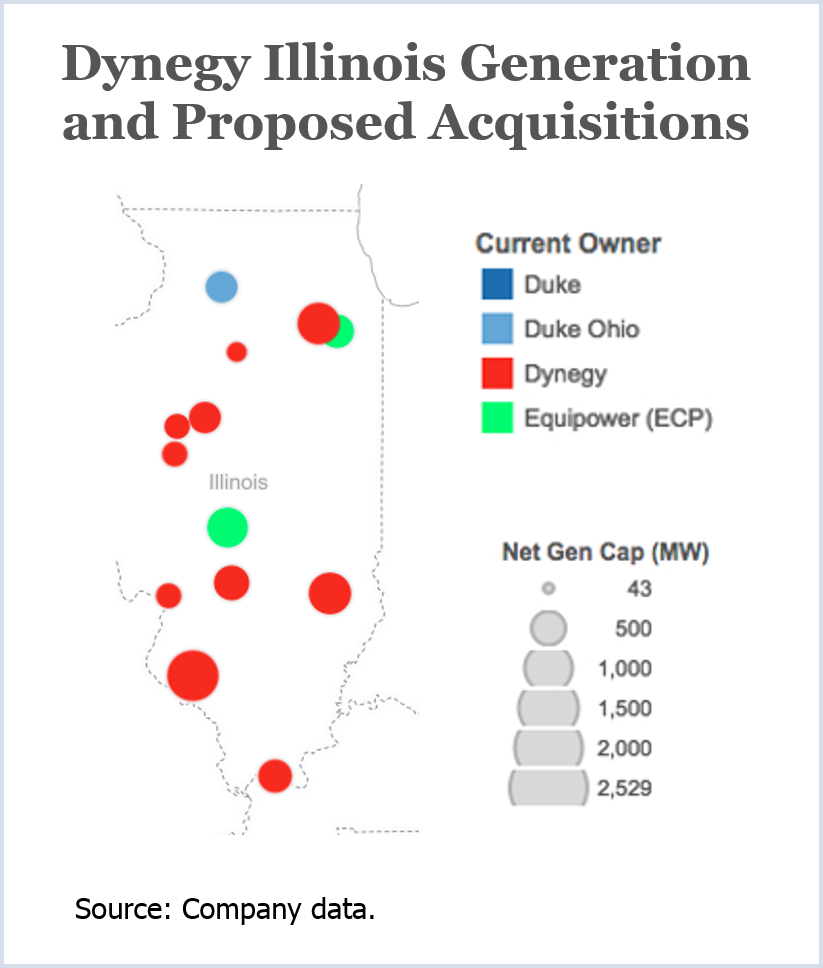

Dynegy currently has about 13,200 MW of generation, including 7,042 in MISO from five coal-fired plants it bought from Ameren last year.

Only Exelon, with its nuclear fleet of more than 11,000 MW, has more generation than Dynegy in Illinois.

Dynegy, which currently has 1,780 MW in PJM, would gain about 9,000 MW in the RTO if it wins approval for deals announced last month to purchase generation from Duke Energy and Energy Capital Partners. About 2,500 MW of that would be in Illinois’ PJM region.

MISO’s share of Dynegy’s total generation will fall to 29% from 53% as a result of the expansion in PJM and New England. But Dynegy CEO Robert Flexon said he was counting on Dynegy’s participation in MISO to be a plus for the company. The next several years, he said, “should be a really peak time for the MISO marketplace” due to plant retirements.

No filings have been made with the Federal Energy Regulatory Commission.

MISO declined comment when asked about Dynegy’s suggestion that it may leave the RTO. The Illinois Commerce Commission also declined to comment.

PJM spokesman Ray Dotter said the RTO “does not comment on the market positions and plans of individual members. We cannot speculate on Dynegy’s reported plans.”

Exelon, which has one nuclear generating station — the 1,078-MW Clinton Power Station — in MISO, has said in the past that Clinton’s economic viability is limited in part by MISO market rules.

“We agree that the MISO capacity market needs to be improved to protect the reliability of the system for Illinois electric consumers and the state’s economy,” the company said in a statement. “We have not seen Dynegy’s proposal and cannot comment on it.”

ComEd’s Departure

It wouldn’t be the first time companies switched from one RTO to another.

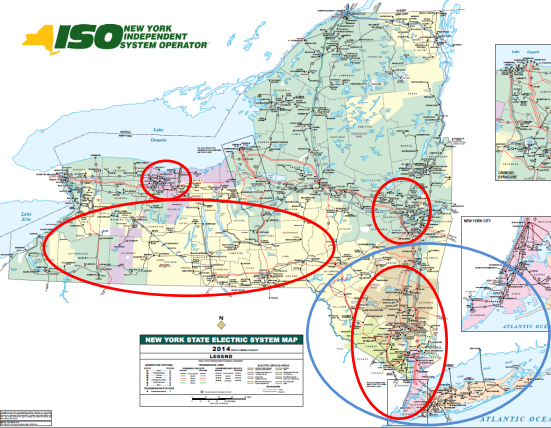

In 2002, Commonwealth Edison, and its parent company, Exelon, asked FERC for permission to leave MISO and join PJM. The move came after it was unable to reach agreement on new rate structures with MISO.

Exelon said most of its wholesale trading partners and suppliers and its strongest interconnections were to the east of ComEd. The integration was completed in 2004.

ComEd’s PJM zone was initially an island, separated from the rest of the RTO to the east, until American Electric Power and Dayton Power and Light joined later that year. Since then, Duquesne Light, Dominion Virginia Power and FirstEnergy in Ohio have also joined PJM.

To leave one RTO and join another could involve several steps, including showing that negotiations with the current RTO had been unsuccessful. Affected state regulatory agencies, in this case the ICC, could choose to intervene in the FERC case on one side or the other.

Dynegy is also eyeing other markets. In an interview last week with the Houston Business Journal, Flexon said that the portfolio of Energy Future Holdings — parent company of power generator Luminant, TXU Electric and transmission company Oncor — might be a nice addition to Dynegy’s growing portfolio. Energy Future Holdings’ operations are in the ERCOT market in Texas, and the company is going through bankruptcy proceedings now.

Although Dynegy’s headquarters is in Houston, it has no operations at all in Texas since emerging from its own bankruptcy. “If there ever were portfolios for sale in Texas, that could one day be something that Dynegy would have an interest in,” Flexon said.

“We want to operate in well-functioning markets, and that is what we are looking to do,” Dynegy’s Sullivan said.