PJM officials are developing contingency plans for their 2015 capacity auctions in the wake of last week’s stay of the D.C. Circuit Court of Appeals’ EPSA ruling.

PJM General Counsel Vince Duane said it will be at least next spring before the Supreme Court decides whether to review the D.C. Circuit’s ruling (Electric Power Supply Association v. Federal Energy Regulatory Commission) throwing out the Federal Energy Regulatory Commission’s Order 745.

On Monday, the D.C. Circuit granted a stay until Dec. 16 on its ruling in order to give U.S. Solicitor General Donald B. Verrilli Jr. time to file a petition for certiorari on FERC’s behalf. If Verrilli files the petition, the stay will remain in effect until the Supreme Court rejects the request, or accepts it and decides the case on its merits.

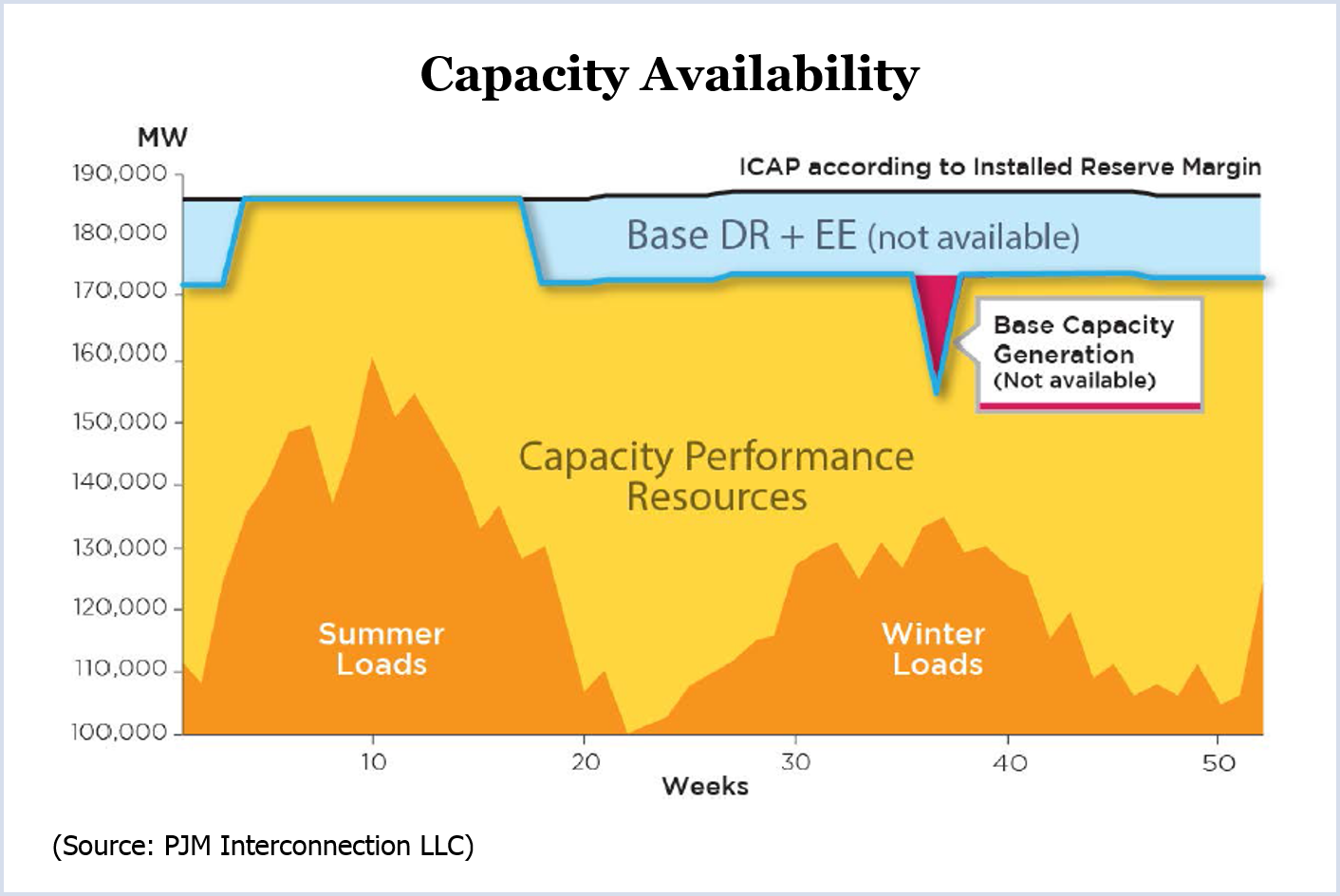

Although the D.C. Circuit’s May 23 ruling explicitly concerned FERC’s jurisdiction over demand response in energy markets, some believe it also jeopardizes the inclusion of DR in FERC-regulated capacity markets. To avoid legal vulnerabilities, PJM on Oct. 7 proposed eliminating DR as a capacity supply resource and instead having load-serving entities offer DR and energy efficiency to reduce their capacity obligations.

Duane said the stay does nothing to provide additional certainty regarding the May 2015 Base Residual Auction.

“If [the Supreme Court justices] take the case, you have another year of not knowing what the rules for DR participation are,” Duane said in an interview last week.

“If cert isn’t granted, that’s the walk-off home run. That’s the end of it. There’s no more appeals,” he added. “And we are right on the eve of a capacity auction and the question then is what rules can apply now that EPSA is the law of the land and we have Tariff sheets that are kind of antiquated.”

As a result, Duane said, PJM is considering contingency plans, based on the Oct. 7 ‘Poof’ Goes the Demand Response?)

EPSA Response

Electric Power Supply Association CEO John Shelk responded to the stay with a statement calling on PJM to assume the D.C. Circuit’s ruling stands.

“EPSA remains confident that the D.C. Circuit’s decision will stand and that Order 745 will eventually be vacated,” Shelk said. “The key now is moving forward on plans for an orderly transition that take into account not only what the decision requires with respect to demand response participation as supply in the energy markets but also its implications for the capacity markets. Even lawyers who disagree with the court’s conclusion that FERC lacks jurisdiction agree that the ruling’s legal rationale logically means that demand response cannot be a supply-side resource in capacity markets.”

ISO-NE Response

ISO-NE spokeswoman Marcia Blomberg said Friday that the ISO is continuing with its plans to seek FERC approval for rules allowing DR to provide operating reserves and participate in the Forward Reserve Market effective June 2017.

“However, given the legal uncertainty regarding the future of Order 745, and the fact that the full integration of demand response into energy and reserve markets will require two years of work to modify software and system infrastructure, the ISO will decide in early 2015 whether to begin devoting resources to meet the June 1, 2017, implementation date, or to ask for a delay until the legal questions are resolved,” Blomberg said.

FirstEnergy Complaint

The court ruled that Order 745, which required PJM and other RTOs to pay DR resources market-clearing prices, violates state ratemaking authority.

FirstEnergy Solutions filed a complaint with FERC within hours of the May 23 ruling, demanding that PJM throw out the DR that cleared in the May BRA for delivery year 2017/18.

On Wednesday, PJM filed a response in opposition to the FE complaint, saying that FE’s demand that PJM recalculate the 2014 auction results without DR would be “extremely damaging to the market certainty that is critical to sustaining investment in electricity infrastructure.” (EL14-55)

Instead, PJM said it will submit Tariff revisions around New Year’s that will seek to minimize litigation risk by proposing that:

- Load-serving entities be permitted to submit price-responsive bids into the capacity auction beginning with the May 2015 BRA, as outlined in the white paper;

- Demand response capacity commitments already made for the 2014/15 through 2017/18 delivery years be honored “subject to an orderly, voluntary exit path for capacity demand resources that anticipate losing their energy market compensation as a result of EPSA”; and

- Changes be made to incremental capacity auction rules to support a transition, including a provision precluding any new demand resource offers in RPM auctions by retail end users or by aggregators of retail customers.

“PJM expects to ask the commission to accept these changes to serve at least as a ‘stop-gap measure,’” the RTO wrote, “perhaps to be effective only until such time as the commission and industry stakeholders have had an opportunity, once jurisdictional questions are finally resolved, to consider and develop generic and more considered options for demand response participation in organized wholesale electricity markets.”

In its own response, PJM’s Independent Market Monitor told FERC it opposed recalculating the 2014 auction but “generally supports the objective of” the FE complaint.

“Granting this objective as it pertains to future [capacity] auctions would permit the correction of faulty rules that have interfered with the efficient performance of the PJM capacity market design,” the Monitor wrote.

Praise from LaFleur

Because FERC’s direct authority to initiate legal action ends at the D.C. Circuit, FERC Chairman Cheryl LaFleur said that the decision whether to seek a Supreme Court hearing will be made by Verrilli. “That office has the exclusive authority to make that decision for the U.S. government — all the agencies. As with other agencies, we work behind the scenes with them,” she said during a keynote address at PJM’s Grid 20/20 conference Tuesday.

LaFleur said she was unable to talk about the pending FirstEnergy complaint. But she praised PJM’s “very thoughtful” white paper.

“I appreciate your contributing to the discourse on this,” she said. “Because we have a pending complaint before us on how we treat demand response in the markets right now, I haven’t been able to be a part of that discourse, but I’m glad it’s going on.”