An unexpected geomagnetic disturbance (GMD) March 17 caused brief spikes on PJM’s grid but no operational problems, RTO officials told the Operating Committee last week.

The National Oceanic and Atmospheric Administration, which normally provides one to three days’ advance notice of such events, didn’t warn PJM and other grid operators until the morning of the 17th, said Chris Pilong, manager of dispatch.

NOAA predicted “a glancing blow” centered at 50 degrees latitude — near Winnipeg, Manitoba. As it turned out, the solar storm was a bit more intense than expected and centered a bit farther south, Pilong said.

Still, the incident did not pass PJM’s threshold for initiating conservative operations — a rise of 10 amps for more than 10 minutes. Pilong said the longest spikes lasted no more than four minutes.

“This is the highest measurement I can recall seeing in some time and we saw no impact on the system,” he said.

NOAA initially predicted a G-3 (strong) event for three hours beginning at 8 a.m. ET. It upgraded the storm to a G-4 (severe) with a lower latitude of 45 degrees — near Montreal — and a six-hour duration.

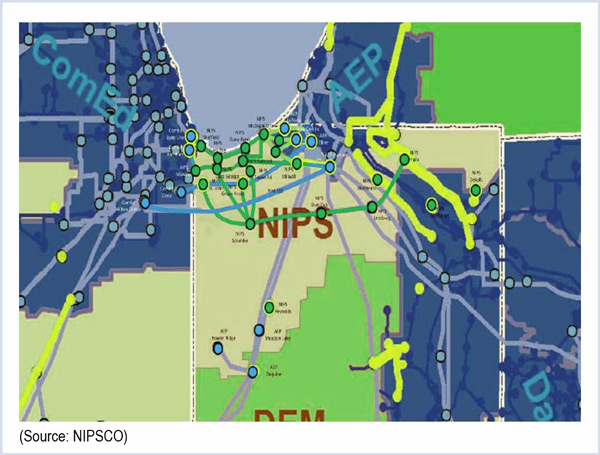

The GIC meters recorded their biggest spikes between 9 and 10 a.m. and 7 and 7:30 p.m. (See graphic.)

The incident came less than two weeks before the North American Electric Reliability Corp.’s Geomagnetic Disturbance Operations Standard (EOP-010-1) took effect on April 1. The standard requires reliability coordinators to review the GMD operating procedures or processes of transmission operators (TOPs) within their areas to mitigate the effect of GMDs on the grid.

The Federal Energy Regulatory Commission approved the standard, the first phase of rules to protect the grid from GMDs, last June. (See FERC OKs GMD, Training Standards; Proposes Modeling Rule Change.)

PJM: New Rule on Lost Opportunity Costs Would Exclude 1/5 CTs

About 20% of PJM’s combustion turbines, representing 30% of its CT capacity, would be barred from receiving lost opportunity costs under a rule change awaiting a shareholder vote, PJM officials told the OC last week.

Adam Keech, director of wholesale market operations, said PJM conducted the analysis after the Markets and Reliability Committee last month tabled voting on the proposal.

The delay came after some stakeholders complained that the changes — which would generally limit lost opportunity costs to units with start-up and notification times of no more than two hours and minimum run times of two hours or less — were too restrictive. (See PJM Tables Rule Change on CT LOCs.)

Keech said that if the minimum-run-time threshold were increased to four hours from two, only 10% of CT units and capacity would be excluded from lost opportunity costs.

PJM officials told the OC they had no operational concerns about the changes.

One generation operator, who declined to be quoted by name, said the new rules would create “perverse incentives” for generator operators, resulting in some units running under self-schedules for an additional hour after the two-hour limit. “I will submit a schedule that meets your payment parameters, but on operations I need to do what I need to do,” he said.

“Instead of using a carrot approach, you’re using a stick approach,” he added.

Keech said that the change, which is supported by PJM and the Independent Market Monitor, was intended to eliminate incentives at odds with PJM’s needs. Under the current rules, he said, “you get paid more if you don’t run [in real-time] than if you do.”

Louis Slade, a senior policy manager for Dominion Resources, questioned whether PJM’s data would be accurate in the future, saying most new CTs are 150 MW or larger and have minimum run times of longer than two hours. “Two hours potentially puts a lot of the newer CTs outside of that range,” he said.

Director of Stakeholder Affairs Dave Anders said the Energy Market Uplift Senior Task Force, which overwhelmingly approved the proposed change in February, may consider “friendly amendments” at its April 17 meeting.

The MRC is expected to vote on the issue at its next meeting, April 23.

Too Much of a Good Thing? PJM Concerned Fast Response Regulation Crowding Out Traditional Resources

PJM operators are concerned that fast response regulation resources are taking too large a share of the RTO’s overall regulation response.

PJM’s Danielle Martini presented a proposed problem statement on the issue to the OC last week.

Fast-responding RegD are providing more than 42% of total response on average, with shares as high as 70% during some events, Martini said. That leaves less room for slower-responding RegA resources.

“Too much RegD looks like it hurts performance because it affects how much RegA we procure,” Mike Bryson, executive director of system operations, explained after the meeting.

PJM is considering whether to use a different regulation signal for energy-limited resources such as participating in the regulation market.

“This scenario is seen most frequently when the RTO experiences high or low [area control error] during periods of rapid load changes during the morning and evening periods,” the problem statement said. “During these times, the regulation signal is utilized to maintain ACE control if the load ramp briefly and instantaneously ‘slows down’ or ‘speeds up.’ During these times, larger sized units are coming on line and offline (hydro, CTs, etc.) to keep up with the load, and regulation is critical in correcting for the instantaneous changes in load and generation.

“When the regulation signal ‘times out’ for RegD resources and there is a large amount (>42%) of RegD providing the regulation service, the dispatcher is left with limited resources with which to maintain control of the system. This may lead to increased periods of ACE/BAAL excursions and increased reliance on synchronized reserves to supplement the temporarily depleted regulation reserves.”

PJM Ponders Expansion of Winter Generator Testing

PJM is considering stakeholder suggestions that it expand the winter generator testing it initiated last winter.

That testing was voluntary and limited to units that hadn’t run for the prior two months. It was credited with reducing generator outages to a peak of 10% in January 2015, compared with a high of 22% a year earlier.

Mike Bryson, executive director of system operations, told the OC that some stakeholders have suggested the testing be made mandatory.

In early November, PJM identified about 55,000 MW of generation that was eligible for testing because it had not operated for the prior two months. The number dropped to about 44,000 MW after some of the units were dispatched during an early November cold spell.

Owners of about half of the remaining units submitted them to PJM for testing, but the RTO ended up testing only about 9,000 MW because of a 1,000-MW cap on tests per day and because warm weather prevented testing on some days.

The temperature threshold “knocked most of the days out” for testing in the Dominion zone, Bryson said.

PJM officials plan to discuss the issue internally before bringing a proposal to stakeholders, Bryson said.

New Info on Planned Outages to be Shared

PJM plans to start posting additional information on scheduled transmission outages in its OASIS system in response to requests for such details.

Beginning with the third-quarter eDart release in September, the following information will be available: the queue number; the time that the outage equipment can be returned to service at PJM’s request; and a “questionable approval” indicator, which will inform market participants that the outage may not be approved by PJM.

— Rich Heidorn Jr.