By Chris O’Malley

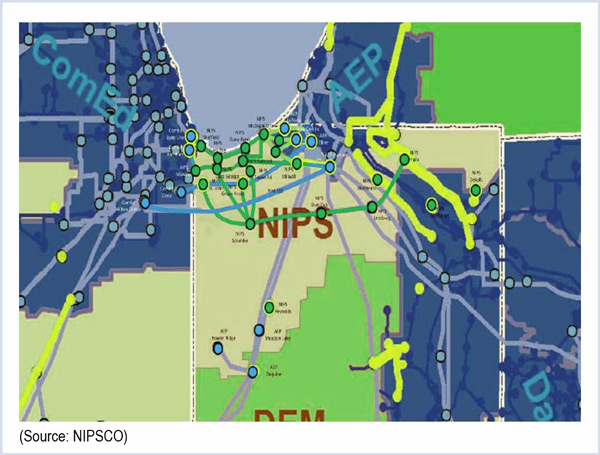

Northern Indiana Public Service Co., which filed a complaint in 2013 over its frustrations with MISO and PJM’s interregional planning process, says nothing much has changed since then.

“Close to one and one-half years have passed since NIPSCO filed its complaint in this docket, and the same pattern of a great deal of process with no results appears to be holding,” the utility said in a March 31 filing with the Federal Energy Regulatory Commission.

More than a decade after the MISO-PJM seam was formed, no cross-border projects have been approved and built, while hundreds of millions of dollars in market-to-market payments have been made, NIPSCO said, “including approximately $500 million since 2008.”

NIPSCO’s filing was one of almost a dozen responses FERC received from MISO and PJM stakeholders in response for its request for comments on six rule changes proposed by NIPSCO. (See related story, FERC Floats Possible Orders on PJM-MISO Seam.)

FERC posed the questions as preparation for a yet-to-be-scheduled technical conference on the issues raised in NIPSCO’s complaint (EL13-88).

Three-Step Process

NIPSCO wants FERC to order the MISO-PJM cross-border transmission planning process to run concurrently with, rather than after, the RTOs’ regional transmission planning cycles.

Without such a change, NIPSCO said, it would take more than three years for a beneficial market efficiency project to navigate its way through the three independent processes currently in place.

As an example, NIPSCO pointed to its proposed Reynolds-Wilton Center project, which had been part of the market efficiency study process in MISO’s Transmission Expansion Plan (MTEP13).

Proposed in May 2012, the project was found by MISO to have a strong benefit-to-cost ratio and would have had significant benefits for PJM, NIPSCO contends.

The project was put on hold until it could be studied in the Interregional Planning Stakeholder Advisory Committee process. It didn’t pass; MISO re-evaluated the project a year later, but it didn’t pass MISO market efficiency metrics.

Had it passed IPSAC, however, it would have taken 42 months, NIPSCO estimates.

As it stands, a project would first have to pass through one regional process, with its specific metrics and an independent model built for that study year. Then it would have to pass an interregional process with specific metrics. Lastly, it would have to pass the final regional process again with its specific metrics and model, NIPSCO said.

“Over 10 years of history have verified that no developer has had the necessary foresight or fortitude to successfully run the gauntlet of the MISO-PJM interregional process. NIPSCO, therefore, does not believe that it is possible for a project to navigate all three existing processes.”

NIPSCO is not alone in that view. Southern Indiana Gas & Electric also faulted the three-step process in its response to FERC’s questions.

Other Views

But other stakeholders, including ITC Transmission, said they don’t believe that forcing the cross-border and regional transmission planning processes to run concurrently is the most effective approach. ITC recommends that FERC require MISO and PJM to eliminate the three-step approval process altogether.

Instead, ITC said that projects approved in the coordinated system plan under provisions of the MISO-PJM Joint Operating Agreement should automatically be recommended for approval by both RTOs for cost allocation in their respective regional transmission plans.

“MISO and PJM should also establish a new project category for ‘interregional projects’ in their respective regional planning processes,” ITC said.

Among other stakeholders weighing in is AEP, which maintains that modifying the JOA to conduct concurrent joint and regional studies with identical criteria “is simply untenable.”

AEP said each RTO has planning criteria to address its regional needs, plus has to coordinate with other transmission systems whose regional planning criteria may differ. AEP also said FERC Order 1000 specifically recognizes that regional differences are valid.

As for cross-border market efficiency projects, AEP suggests that each RTO use its regional study process to quantify its regional market efficiency needs and congested flowgates. They also should invite stakeholders to submit both regional and interregional proposals.

“If the sum of each RTO’s portion meets or exceeds the total cost of the interregional proposal, then the proposed interregional project would be included in the list of finalists from which the most efficient and cost-effective projects would be selected,” AEP said.

Cost apportionment of approved cross-border projects would be in proportion to the market efficiency benefits that each RTO derives, AEP said.

RTOs: Process is Improving

MISO and PJM rejected assertions that their regional transmission planning cycles are impeding cross-border projects.

In joint comments to FERC, the RTOs say they already have a “highly aligned” interregional planning cycle.

In a joint 2014 study, both RTOs evaluated cross-border transmission issues and identified opportunities for more than 80 projects “using a single model with a single set of mutually agreed upon assumptions.”

“Although no project passed the interregional or regional criteria, any interregional projects would have had timely approval in both the regional and interregional processes,” the RTOs said. “Accordingly, the respective planning cycle timing and synchronization was not an issue; rather, the fact that projects did not pass the cost/benefit analysis exclusively relates to the criteria themselves rather than any mismatch in the timing or lack of coordination between the interregional planning analysis and the respective RTEP and MTEP processes.”

‘Quick Hit’ Projects

Since NIPSCO’s complaint, the RTOs noted, they have proposed to build at least 26 “quick hit” transmission projects that could be done quickly and cheaply on lower voltage flowgates to address constraints on both sides of their seam. (See MISO, PJM Ponder List of ‘Quick Hit’ Upgrades).

PJM officials told the Transmission Expansion Advisory Committee last week that the projects could eliminate $280 million of the $400 million in annual congestion at the top 38 historical market-to-market constraints.

PJM’s Chuck Liebold said the quick-hit effort resulted after planners asked themselves, “Are we missing something that would be easy to do?”

“We’re trying to do the right thing,” he said. “We’ve had studies that haven’t produced any projects.”