FERC Approves Cove Point LNG Port in Maryland

The Federal Energy Regulatory Commission yesterday gave Dominion Cove Point LNG the green light to build a natural gas liquefaction plant along the Chesapeake Bay.

FERC also approved parts of the project located in Virginia, including a compressor station and metering and regulating sites (CP13-113).

Dominion has said it will have the $3.8 billion Cove Point project in service by June 2017. Although hotly contested by some residents and environmentalists, FERC, with its ruling, has found that the project is in the public’s interest. The agency’s ruling comes after two years of analysis, three public meetings, 140 speakers and more than 650 comments.

Despite requests from U.S. Sens. Ben Cardin and Barbara Mikulski (both D-Md.), FERC Chairmain Cheryl LaFleur declined to schedule additional public meetings on the project or to extend the comment period by 30 days.

FERC has approved three other LNG export projects, all in the Gulf of Mexico: the Sabine Pass Liquefaction Project, the Freeport LNG Project and the Cameron LNG Project. Fourteen LNG export proposals are still pending.

More: FERC

NRC Considers ‘Graded’ Look at Foreign Nuke Ownership

The Nuclear Regulatory Commission is taking a fresh look at the implications of foreign ownership of U.S. nuclear generating facilities, a review that could allow a French company to build a third reactor at Maryland’s Calvert Cliffs plant. An NRC staff paper released this month recommended the commission replace its Cold War-era prohibition on foreign ownership with a “graded” approach.

The Nuclear Energy Institute praised the staff report, saying that the agency has been relying on an “unnecessarily restrictive interpretation” of the 1954 Atomic Energy Act, which prohibits foreign ownership of a U.S. nuclear station if such ownership could be a threat to the country. “Experienced foreign nuclear energy companies including AREVA, EDF, Toshiba and Mitsubishi have participated in the U.S. market for decades,” NEI Vice President and General Counsel Ellen Ginsberg said. “The U.S. nuclear industry and the U.S. economy benefit from both foreign financial investment and foreign construction and operating experience.”

France’s UniStar asked the NRC to reconsider the rule after the agency’s Atomic Safety and Licensing Board rejected its request to build a third reactor at the Maryland plant. UniStar is seeking a U.S. partner for its Calvert Cliffs project while waiting for the full commission to take action. Although the staff’s recommendation was prompted by the Calvert Cliffs plan, whatever the NRC decides could apply to all U.S. nuclear facilities.

More: Southern Maryland News; Nuclear Energy Institute; Pillsbury client alert

McCarthy: Don’t Believe Talk About States Resisting Rules

Environmental Protection Agency Chief Gina McCarthy said she’s not worried that states like Texas and West Virginia will refuse to implement the agency’s proposed carbon emission rule, despite public opposition from their governors.

“The public discussion may be a little bit different than the roll-up-the-sleeves discussion that we are actually having on a technical basis around these rules,” McCarthy told reporters on Friday at EPA headquarters. “And I’m really anticipating that those discussions will continue and that you will have many states see that the standards that we set were reasonable.

“I think the states know that we are within the Clean Air Act. The best thing they can do is to design their own plans and really create their own path forward that is in line with where they want to go economically and energy wise,” she added.

More: The Hill; McCarthy remarks at Resources for the Future

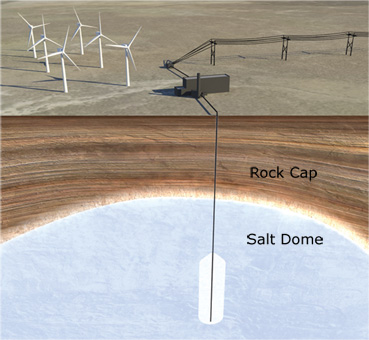

DOE Working to Build Taller Wind Energy Towers

The Department of Energy is investing $2 million in a study to find ways to build even taller wind turbines in an effort to reach higher winds.

Tower heights currently top out at about 260 feet, a limitation primarily of transportation constraints in moving components such as blades. But newer plans call for towers to reach nearly 400 feet. Such towers would allow blades to be powered by the stronger winds found at higher elevations. That could boost wind energy production by a factor of five at some sites.

More: NASDAQ

FERC Open Meeting Schedule Announced

The open meeting dates:

Jan. 15, Feb. 19, March 19, April 16, May 21, June 18, July 16, Sept. 17, Oct. 15, Nov. 19, Dec. 17.

More: FERC

Solar PV Cost-Effective for One-Third of Schools

At least one-third of the nation’s 125,000 schools could save money by installing solar PV systems, according to a study conducted for the Solar Energy Industries Association. The report found that solar systems would be cost-effective for 40,000 to 72,000 schools and that 450 school districts could each save more than $1 million over 30 years.

Solar installations nationwide have grown from 303 kW to 457,000 kW in the last decade. New Jersey schools ranked second nationally in solar capacity, behind only California. Pennsylvania, Ohio and Maryland ranked sixth, seventh and ninth, respectively.

“In a time of tight budgets and rising costs, solar can be the difference between hiring new teachers — or laying them off,” SEIA CEO Rhone Resch said.

More: Digital Journal