The 781-page report was ordered when the license for the facility was still under consideration, back in 2008. Since then, the Obama Administration halted work on the project, about 100 miles northwest of Las Vegas.

The National Association of Regulatory Utility Commissioners welcomed the report and urged the administration and Congress to support the continued review of the facility’s license application. NARUC noted that consumers of nuclear energy have contributed billions of dollars over the past 30 years to fund a repository. “Our government owes it to them to finish the job.”

But opponents said the report did not fully consider all the probabilities that could affect safety. “It’s a pretty meek endorsement,” said Robert Halstead, director of the Nevada Agency for Nuclear Projects.

More: Las Vegas Review-Journal; NARUC

Duke Files for FERC Approval of NCEMPA Asset Purchase

Duke Energy Progress has asked the Federal Energy Regulatory Commission to approve its $1.2 billion buyout of the North Carolina Eastern Municipal Power Agency’s shares of several Duke power plants.

NCEMPA is selling its stakes in four Duke Energy Progress power plants — about 700 MW at two coal-fired plants and three nuclear units. If the deal is approved, Duke will be the sole owners of the Roxboro Unit 4 and Mayo Unit 1 coal plants, and the Brunswick Units 1 and 2 and Harris Unit 1 nuclear stations. All of the plants are in North Carolina.

Duke also entered into a 30-year power-purchase agreement to supply wholesale power to the 32 municipalities represented by NCEMPA. The terms of that agreement were not released.

Duke will also need regulatory approval from North Carolina, South Carolina and the Nuclear Regulatory Commission.

More: Market Watch

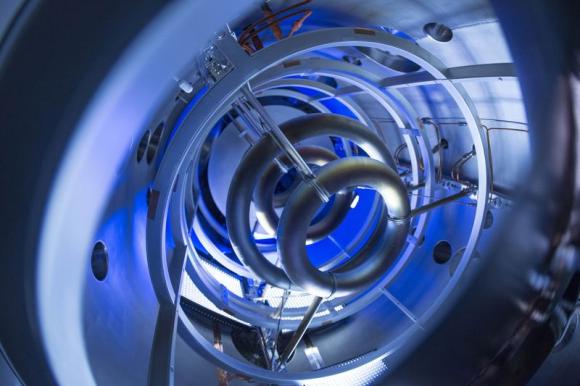

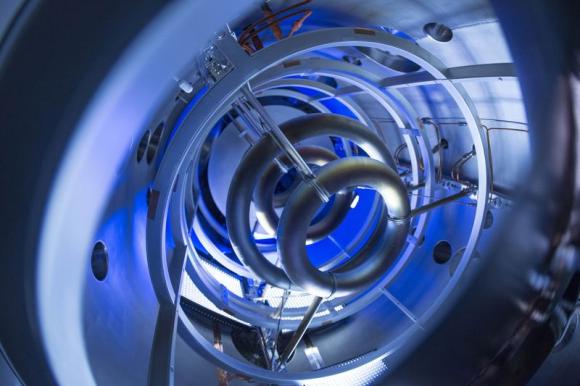

Lockheed Martin Claims Breakthrough in Fusion Power

Defense contracting giant Lockheed Martin made big waves last week when it announced it had made a technological breakthrough in creating a power source based on nuclear fusion. It said the first reactors — small enough to fit in the back of a truck — could be ready in a decade.

The Lockheed research team, headed by Tom McGuire, has been working on the project at the company’s Skunk Works, its top secret research facility in California. McGuire told Reuters that its designed 100-MW reactor would be about 10 times smaller than current reactors.

The company said it planned to build and test a fusion reactor in the next year, and then construct a prototype within five years. The method, long sought after by researchers, attempts to capture the energy released during nuclear fusion, rather than nuclear fission. Nuclear fusion occurs when atoms combine into more stable forms and is inherently safer. Fusion reactors would use a deuterium-tritium fuel and not produce any radioactive waste.

More: Reuters

EPA Fines DOE for Missing Hanford Cleanup Deadlines

The DOE had agreed to start the storage basin clean-up by Sept. 30 at the nation’s most contaminated nuclear site, where plutonium was produced. But it missed the deadline, blaming federal budgeting issues. The EPA said it will start the fine at $5,000 for the first missed week before fining the department $10,000 for each additional week of delay.

The DOE had requested a deadline extension but was denied by the EPA.

More: The Seattle Intelligencer

Last 44M Acres in Gulf Opened to Energy Exploration

The lease sale, to take place in New Orleans in March, will mark the seventh such sale under the Obama Administration’s five-year Outer Continental Shelf Oil and Gas Leasing Program. The first six sales offered more than 60 million acres and produced $2.4 billion in federal revenue.

The blocks to be leased off Louisiana, Mississippi and Alabama run from 3 to 230 miles offshore, in water from 9 feet to 11,000 feet deep. The bureau estimates the 44 million acres could produce 460 million to 894 million barrels of oil and 1.9 trillion to 3.9 trillion cubic feet of natural gas.

More: Bureau of Ocean Energy Management

Baran Sworn in as New NRC Commissioner

Jeff Baran was sworn in as a member of the Nuclear Regulatory Commission and will serve until June 30, 2015, the remainder of William Magwood’s term. Magwood accepted a position with the Paris-based Nuclear Energy Agency.

NRC Chairman Allison M. Macfarlane administered the oath of office. “We have substantial work ahead of us and I am confident that Jeff will make a valuable contribution to our mission,” she said. Baran was staff director of Energy and Environment for the U.S. House Committee on Energy and Commerce, and had NRC oversight duties in that position.

More: PennEnergy

Cove Point Opponents File Rehearing Request with FERC

A group of environmental and customer advocates filed a motion seeking a rehearing of the Federal Energy Regulatory Commission’s approval of the Cove Point LNG export terminal, saying the agency’s OK was based on an inadequate environmental review.

Earthjustice, representing groups such as the Sierra Club, Lower Susquehanna Riverkeeper and the Chesapeake Climate Action Network among others, also filed a motion to stay, hoping to stop initial construction at the site on the Chesapeake Bay in southern Maryland.

“In neglecting to prepare a thorough review of the environmental impacts of Dominion’s controversial project, FERC is prioritizing the desires of a powerful company over the health and safety of the people of Calvert County, Marylanders and communities throughout the Marcellus Shale region,” Earthjustice Associate Attorney Jocelyn D’Ambrosio said.

More: Earthjustice

TVA Builds First U.S. Nuclear Backup Facility

The Tennessee Valley Authority has completed the nation’s first nuclear backup facility built in response to the 2011 disaster at Japan’s Fukushima Daiichi facility.

The fortified facility, serving the TVA’s Watts Bar Nuclear Plant in Spring City, Tenn., is an $80 million bunker protecting pumps and generators. It was built on bedrock with 18-inch concrete walls and designed to withstand earthquakes, fires and even a missile attack.

The TVA is the first U.S. utility to finish a backup center. Many other nuclear sites in the U.S. are either planning such facilities or already building them, in response to orders from federal regulators.

More: Chattanooga Times Free Press

DOE Funds Combined Heat, Power Project at Aberdeen

The Department of Energy is helping to fund a 7.9-MW combined heat and power (CHP) project to replace the aging steam plant at the Army’s Aberdeen Proving Ground in Maryland. CHP, also known as cogeneration, uses a single station to provide both electricity and heat, usually in the form of steam.

The DOE will replace the facility’s steam plant, which is being decommissioned in 2016, with a CHP plant that will provide 86% of the site’s steam needs and 50% of its electricity. The project will also develop standard protocols — including design, air permitting and electrical interconnection — that can be replicated at other defense facilities.

Other projects included in the DOE’s $2 million in funding are a 13.7-MW plant at NASA’s Johnson Space Center in Houston and the National Science Foundation’s Arctic Program at Thule Air Force Base in Thule, Greenland.

More: Air Conditioning, Heating & Refrigeration News

Low-Carbon Energy System Could Save Trillions, Study Says

Transitioning to a low-carbon energy system could free up trillions of dollars of investment capital, spurring economic growth, according to a report by the Climate Policy Initiative.

The report estimates the worldwide cost of building and maintaining low-carbon energy systems and transportation systems. A second section of the report calculates the economic costs of decommissioning existing fossil fuel assets. It concludes the transition could free up $1.8 trillion for investment between 2015 and 2035.

It said concentrating the phase-out on coal assets could provide the largest emissions cuts with the least financial loss.

“Our analysis reveals that with the right policy choices, over the next 20 years governments can achieve the emissions reductions necessary for a safer, more stable climate and free up trillions for investment in other parts of the economy,” CPI senior director David Nelson said. “This is even before taking into account the environmental and health benefits of reducing emissions.”