By Suzanne Herel

Federal regulators last week rejected a request by a natural gas distributor to relax restrictions on its sharing of non-public information received from electric utilities.

The Federal Energy Regulatory Commission dismissed National Fuel Gas Distribution’s request in two rulings. In one, FERC dismissed the company’s request for clarification on communication allowed under Order 787, saying it was beyond the purview of its rulemaking (RM13-17-002). The other rejected NFG’s rehearing request on rules adopted by PJM under the order (ER14-1469-002).

With Order 787, the commission in 2013 opened up the sharing of non-public operational information between interstate natural gas pipelines and public utilities, saying that increased coordination would benefit reliability. (See Talk among Yourselves: FERC Urges Gas-Electric Coordination.)

Impact on Local Distribution Companies

It did not codify, however, how utilities could share such information with local distribution companies, leaving the issue to RTOs and ISOs to address individually through tariff changes. Subsequently, FERC received filings from PJM and NYISO amending their rules. (See FERC OKs Gas-Electric Talk.)

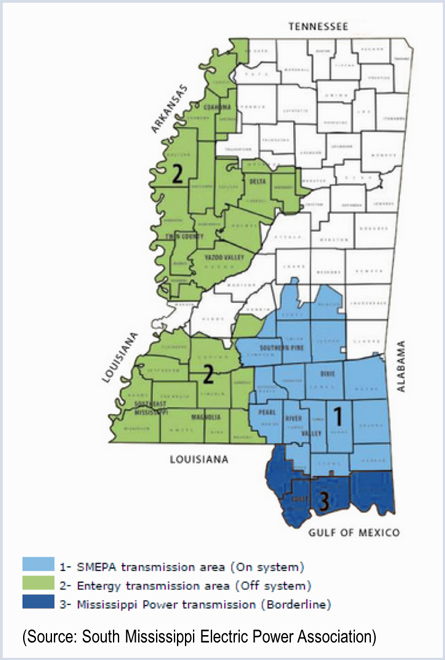

NFG is an LDC serving western New York and northwestern Pennsylvania.

FERC ultimately approved a PJM Operating Agreement change requiring LDCs and intrastate pipeline operators to promise not to disclose non-public, operational information received from PJM to third parties “or in an unduly discriminatory or preferential manner or to the detriment of any natural gas or electric market.” It also barred sharing of the information through a “conduit.”

No intervenors opposed PJM’s proposal, which was approved by FERC in July. But a month later, NFG came forward to say that a blanket restriction forbidding LDCs from disclosing such information to any third party “may inhibit appropriate sharing of operational data and discourage LDCs and intrastate pipelines from maximizing use of the data to improve reliability.”

It pointed out that “third parties” would include pipelines already qualified to receive information under Order 787 and others with whom LDCs need to coordinate to increase reliability.

For example, it said, if an expected increase in a generator’s use of natural gas in one part of the pipeline could affect a load pocket of the LDC, the company would want to be able to warn large customers in that area of an imminent capacity constraint.

NFG also took issue with the notion of requiring LDCs to guarantee their use of data would not be “to the detriment of any natural gas or electric market,” contending that “changing capacity use inevitably affects some retail customers negatively just as changing upstream supplies may affect market participants negatively.”

‘Very Broad’

In denying NFG’s request, FERC said it intentionally made the scope of information-sharing under Order 787 “very broad.” Quoting from the order, FERC added, “The commission is intentionally permitting the communication of a broad range of non-public, operational information to provide flexibility to individual transmission operators, who have the most insight and knowledge of their systems, to share that information [that] they deem necessary to promote reliable service on their system.”

It said that the potential for competitive harm under that broad scope warranted limiting it with a blanket authorization.

When Order 787 was announced, several commenters called the no-conduit rule too restrictive and offered modifications, including exclusions from the third-party restriction. FERC denied those requests.

“PJM states that it intended its restrictions on LDCs and intrastate pipelines to be an extension of the commission’s no-conduit rule to non-FERC jurisdictional facilities, applied in a manner that mimics, as closely as possible, those restrictions,” it said.

‘Untimely’

As for NFG’s request for a rehearing, FERC determined it “untimely and thus statutorily barred.”

It also noted that nothing in PJM’s Tariff precluded NFG or any other entity from sharing non-specific information needed to ensure the reliability of system operations.

“As long as NFG Distribution does not reveal, directly or indirectly, the non-public, operational information shared by PJM (e.g., information concerning a particular electric generator), NFG Distribution can request or direct its customers and operational counterparties to perform specific actions based on such information,” it said.