By Rich Heidorn Jr.

Talen Energy announced its first post-spinoff acquisition Monday, agreeing to spend $1.175 billion to purchase 2,500 MW of combined-cycle generation that expands the company’s presence in ISO-NE and marks its entry into NYISO.

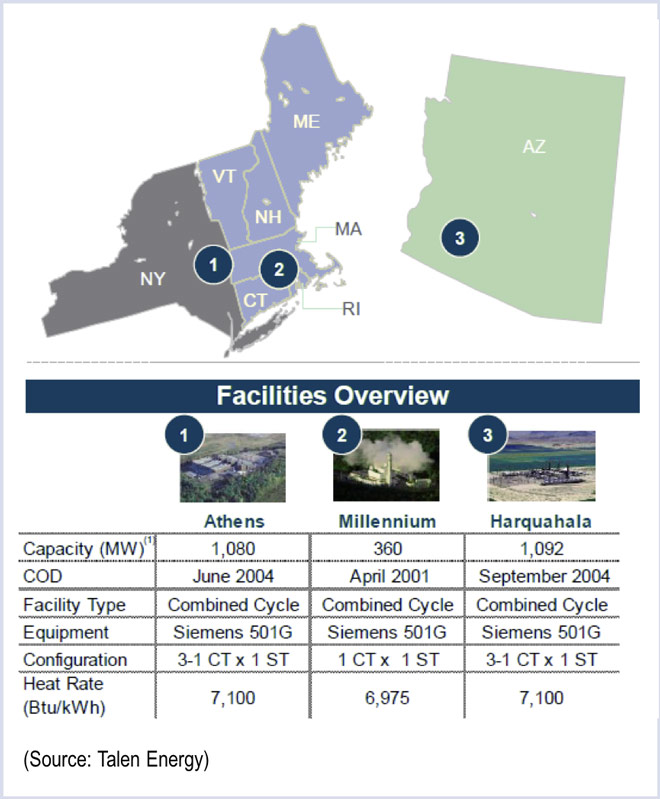

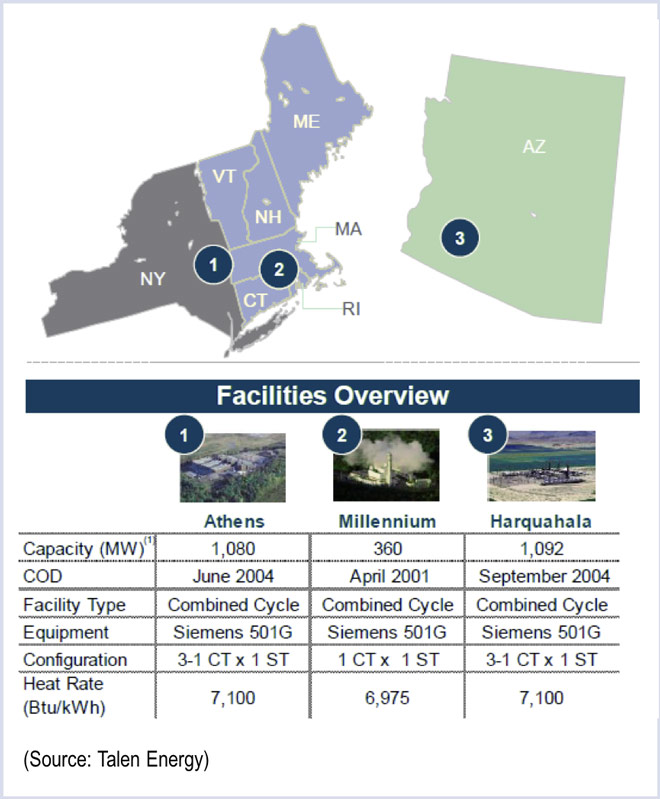

The company, which completed its spinoff from PPL and Riverstone Holdings on June 1, announced it will acquire three generators from MACH Gen: the 1,080-MW New Athens plant in Athens, N.Y.; the 360-MW Millennium plant in Charlton, Mass.; and the 1,092-MW New Harquahala plant near Tonopah, Ariz.

The key to the deal for Talen is the two plants in NYISO and ISO-NE, regions in which the company had previously said it was setting its sights. The acquisition will increase its geographic diversity, reducing PJM’s share of its fleet from 83% to 71% while doubling ISO-NE’s share to 2%.

It also reduces its dependence on coal and nuclear power, with coal’s share of the fleet dropping from 40% to 34% while natural gas increases from 22% to 33%.

All of those numbers will change as a result of the company’s need to divest 1,300 MW to meet market power concerns. Pre-divestiture, the company’s fleet would total 17,600 MW. (See PPL, Riverstone Accept FERC Mitigation Plan on Talen Spinoff.)

Immediately Accretive

Talen said the acquisition brings substantial tax benefits and will be immediately accretive to earnings despite poor “market dynamics” that have limited the Arizona plant to less than a 20% capacity factor, resulting in losses. All three plants are powered by Siemens 501G engines installed between 2001 and 2004.

Talen also said it expects the economics of the Athens plant to improve with the completion of pipelines that will give the plant access to low-cost Marcellus shale gas and electric transmission improvements expected to reduce congestion in NYISO’s Zones F and G.

‘Powder’ for Future Deals

Importantly, said CEO Paul Farr, the deal will retain flexibility to make additional acquisitions. “We still have dry powder given the mitigation process underway,” Farr said in a conference call with stock analysts.

The purchase will be financed with a combination of debt and cash but the precise mix would depend on interest rates and the status of its divestiture efforts, Talen said. The company said earlier this month that it had a $1 billion “war chest” for future acquisitions.

The company is believed to be considering the acquisition of American Electric Power’s merchant fleet in Ohio and Indiana, which AEP announced in January it was putting on the block. (See AEP Considering Sale of 8,000 MW in Ohio, Indiana.)

UBS Investment Research says there is a 50% probability Talen will purchase AEP’s assets. It said Talen could swallow AEP’s assets even after the MACH Gen deal because an AEP deal is not likely to occur until late 2015 or early 2016 because of pending Ohio regulatory proceedings.

Arizona Plant a Throw-In

It appears that taking on the money-losing Arizona plant was a condition for acquiring the assets Talen did want. Talen, which has no other assets in the region, said it may move the plant elsewhere or sell it for parts.

MACH Gen, which was owned by affiliates of Credit Suisse Group and Bank of America among others, filed for Chapter 11 bankruptcy protection in March 2014, saying it had assets of $750 million and liabilities of $1.6 billion. The company said it had a net loss of $120 million on $350 million in operating revenue in 2013.

The company said the Federal Energy Regulatory Commission’s rejection of its plan to sell the Harquahala plant had undermined its efforts to cut its debt. FERC said the sale — to investors that also owned two of the four natural gas generating units in Gila Bend, Ariz. — would have harmed competition within the Arizona Public Service balancing authority area (EC13-11).

The company said most of its creditors had agreed to a prepackaged reorganization that would give its second-lien debt holders 93.5% of the restructured company and reduce about $1 billion of debt. FERC approved the restructuring in April 2014 (EC14-46).