By Chris O’Malley

CARMEL, Ind. — News that MISO is reconsidering a market congestion project in Southern Indiana sparked renewed complaints from developers over the RTO’s transmission planning processes.

MISO officials told the Planning Advisory Committee on Wednesday that they were considering swapping one Southern Indiana project for a second one on which PJM has offered to assume more than one-third of the cost.

Despite a potential $29 million in savings for MISO, transmission developers accused the RTO of disregarding its transmission planning process and not giving stakeholders enough time for review.

The new development came as some stakeholders were still simmering over the way in which MISO approved Entergy’s $187 million out-of-cycle upgrade near Lake Charles, La. Only a few hours before MISO’s presentation to the committee, PAC participants were discussing ways to restructure the out-of-cycle review and approval process to address their concerns. (See Ideas to Reform MISO Out-of-Cycle Process Emerge.)

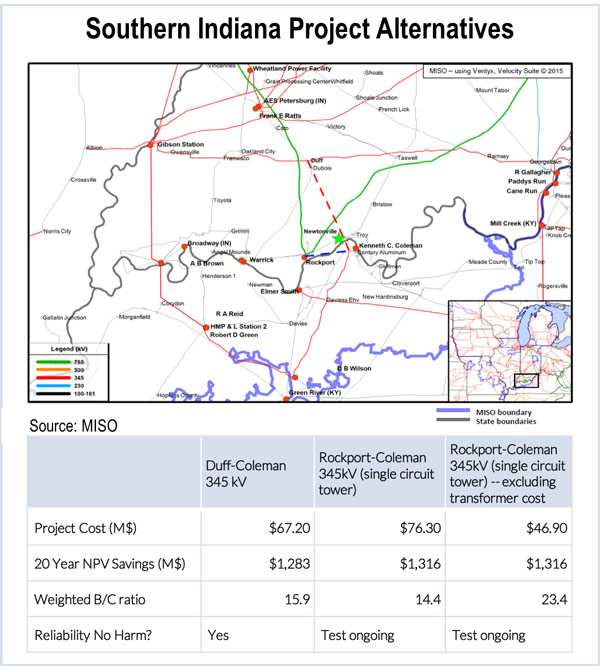

But it seemed that any goodwill created by potential out-of-cycle reforms had evaporated by the afternoon, when MISO proposed replacing the Southern Indiana project that was judged as having the highest benefit-cost ratio among proposed market congestion projects in the North-Central region: the 345-kV Duff-Coleman project, estimated to cost $67.2 million.

MISO staff said they are considering replacing Duff-Coleman with the project with the second-highest cost-benefit ratio, the $76 million 345-kV Rockport-Coleman line.

PJM recently proposed picking up the cost of a 765/345-kV transformer connecting the Rockport substation. “This would potentially reduce the total MISO cost by $29 million and make Rockport-Coleman 345-kV … the project with the highest B/C ratio,” according to the presentation.

Stakeholder Feedback Loop

George Dawe, vice president at Duke American Transmission Co., was incredulous.

“What you’re saying is that this needs to be done quickly. And we’ve already heard about the cost estimation process [this morning] and how there’s supposed to be a stakeholder feedback loop and [yet] there’s a whole bunch of things that tend to need to happen at the last minute [without stakeholder review or process], just before the System Planning Committee needs to get a recommendation. And we scurry around to try to find answers,” he said.

‘Rigidity of Process’

Jeff Webb, MISO’s director of planning, denied that the RTO was “flipping gears” or that it was suddenly committing to Rockport-Coleman. Webb said MISO is only exploring the idea because PJM came to the table with an idea that provided potential cost savings.

“The only thing we don’t want to happen is the rigidity of the process, George, to interfere with progress in doing the right thing. And I don’t think [the Federal Energy Regulatory Commission] would want that either, unless in doing so that we are somehow egregiously creating an inequity for someone.”

Dawe complained that, while he had seen a lot of cost information about the Duff-Coleman project, “I haven’t seen anything on Rockport.”

Digaunto Chatterjee, MISO senior manager of economic studies, countered that the RTO has been evaluating both Southern Indiana projects since at least the beginning of the year, and thus it is not comparable to an out-of-cycle project request. “This isn’t a brand-new project. We’ve been studying it.”

‘Smells Like’ Cross-Border

Dawe and other stakeholders questioned whether PJM’s financial assistance made Rockport-Coleman an interregional project subject to review by the Interregional Planning Stakeholder Advisory Committee (IPSAC).

“My issue is that it looks and smells like a cross-border project. And it’s not following that cross-border project process,” Dawe said.

Flora Flygt, strategic planning and policy advisor at American Transmission Co., echoed Dawes’ concern. “We’re now taking what is part of an [market efficiency project] process and now we’re turning it into [a multi-value project], an interregional MVP, basically.”

Chatterjee disagreed, saying it is not an interregional project as defined in the RTOs’ joint operating agreement.

“We’ve been through the IPSAC and it has resulted in no projects,” Webb added. “We’re looking for a way to get something to result in projects.”

During its annual meeting in June, MISO said it will reevaluate metrics used in evaluating market efficiency transmission projects (MEPs) because of concerns they are unduly conservative and prevent viable solutions to congestion. (See MISO to Reevaluate Metrics on Market Efficiency Tx Projects.)

Delays Feared

Chatterjee said MISO will soon discuss the matter further with PJM and make a recommendation — likely at the next PAC meeting.

Flygt said she feared the review could result in delays, with the next PAC not until Aug. 19 and the MISO Transmission Expansion Plan (MTEP) is scheduled to go to the board Dec. 10. “We’re sitting here at the end of July,” she said.

Webb insisted the review would not cause delays, and PJM’s Chuck Liebold assured the committee that his RTO could quickly analyze an interconnection request.

“The first thing I said [to PJM] was if this keeps us from taking an MEP to the MISO board in MTEP 15, it’s a show stopper,” Webb said. “If there’s a delay we’re doing Duff-to-Coleman, OK? If we can get this done and we can show ourselves and stakeholders that this is a better deal for MISO, we certainly want to let MISO know that.”

11th Hour Concerns

Flygt said that FERC Order 1000 requires transparency at every point in the process. “When you’re in a competitive market and you’ve got these processes to follow, I think it’s more important to follow the process than the implication that we’re getting here.”

PAC Chairman Bob McKee said he was concerned that, after all the analysis, the proposed alternative was only coming up now. “Why are we getting all this shuttle diplomacy and all of this right at the 11th hour, right before we’re to go to the board?”

Webb replied that PJM became aware of the potential for a win-win solution, albeit “late in the game.”

“I think it’s unfortunate that the awareness came late and I think that’s a process issue. That’s the point I’m raising,” McKee said.

No Violation of MISO Process

Kip Fox, director of transmission strategy and grid development at American Electric Power, said MISO identified three projects with similar benefit–cost ratios. “In my mind, this is the way the process is supposed to work. I don’t see a lot of process change. These projects have been talked about ever since we went through the [market congestion planning study] process.”

McKee wasn’t buying it. “I would say I respectfully disagree that this is how the process should work. The reason why I say this is that, look at all the confrontation that we’ve had,” he said.

Webb said if a plan is presented to MISO stakeholders that produces more benefits to the RTO at a lower cost, but the stakeholders rejected it because it didn’t follow a certain process that they were comfortable with, “I think we will want to make that clear so that FERC at the end of day can react to that too.”

If MISO stakeholders demonstrate that the project doesn’t follow the process and can’t be done, “then that’s probably the way it will end up,” he added.

Webb said that it was “a little murky” to him about what part of the process MISO is violating.

“We had the [Rockport-Coleman] project here already. The only thing new is that the entity that we already had studied, that we were going to connect to [PJM], said, ‘Yeah, that’s a great idea. … That’s the only change so I’m not sure that’s a big process change.”