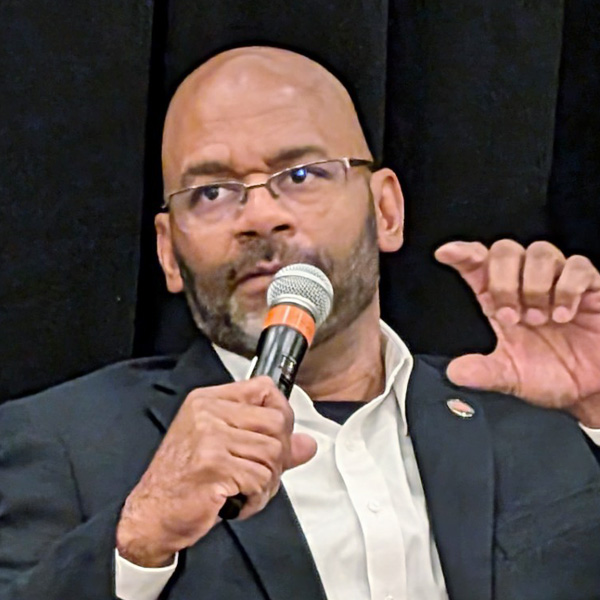

CHARLOTTE, N.C. ― Mississippi Public Service Commissioner De’Keither Stamps has the results of this year’s presidential election all figured out, he told the audience at the Southeast Renewable Energy Conference on Oct. 29.

“If former President Trump wins this election, a bunch of folks will lose their mind,” Stamps said. “If Vice President Harris wins this election, a bunch of folks will lose their mind. Sit back and prepare for a bunch of folks to lose their mind.”

With early voting underway in many Southeastern states, the upcoming election loomed large over the three-day event, with many viewing it as potentially the most consequential ever for the renewable energy industry.

“There’s more excitement about this election than I can remember in my lifetime. More people are paying attention,” agreed Keith Martin, a partner at Norton Rose Fulbright who specializes in tax and renewable energy policy. “Maybe ‘excitement’ is the wrong word; maybe it’s anxiety, which makes it hard to understand this phenomenon of the undecided voter. These two candidates could not be more different.”

Martin’s yearly presentations on the current state of federal tax and energy policy are considered a highlight of the conference, and his predictions on the fate of the Inflation Reduction Act and other federal energy policies were blunt and to the point.

If Kamala Harris wins, “the Inflation Reduction Act should remain a very strong tailwind for the renewable sector,” he said.

But should Donald Trump take back the White House, “look for a Day 1 order telling executive agencies to stop issuing guidance and to stop spending money on the [IRA].”

Further, should Republicans take control of both houses of Congress, Martin expects them to “cannibalize parts of the Inflation Reduction Act to pay for extending the 2017 Trump tax cuts that expire at the end of next year.”

After lobbying by House Republicans whose districts have benefited from the IRA, House Speaker Mike Johnson has said rolling back the law would be done with a scalpel, not a sledgehammer. “However, if we see a Trump wave … there’ll be a lot of testosterone in the room, and it could be more of a hammer rather than a scalpel,” Martin said.

“Congress is facing a serious math problem next year,” he said. “Extending the 2017 tax cuts will cost $4.6 trillion,” but even if the IRA were repealed in full, it would only provide about $630 billion.

Martin’s list of the IRA funds most at risk included the tax credits for new and used electric vehicles and $60 billion that the Internal Revenue Service has been slated to receive to modernize computers and hire more staff.

Funding for the Department of Energy’s Loan Programs Office will also be a target, Martin said. “Expect to see a halt in that program, although they will fund commitments that have already been made.”

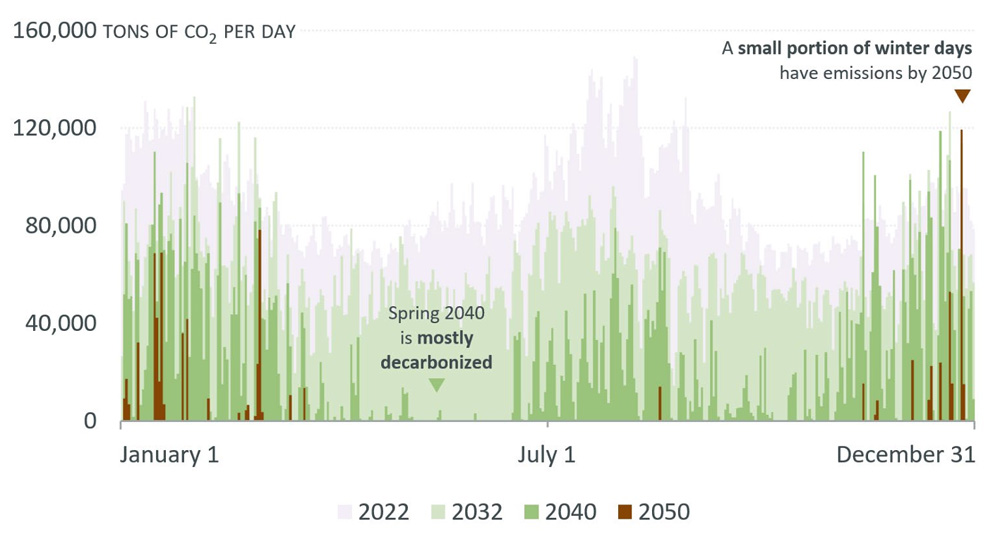

But the most consequential for the industry could be Republican efforts to accelerate the phaseout of the IRA’s investment and production tax credits for solar, wind, energy storage and other forms of clean energy. “Those tax rates are not expected to currently start phasing out until some time in the mid-2040s,” Martin said. “There’s a lot of speculation in Washington that if the Republicans are in charge, those phaseout dates would start sometime in the 2020s.”

To “Trump proof” projects, developers must start construction “on as many projects as possible by year’s end in order to put themselves in the position to be able to claim tax credits on projects under the existing tax code sections,” Martin said. “This only works if projects are completed by the end of 2028.”

Those who can’t start construction this year should at least have a binding contract, which could allow their projects to be grandfathered in, or essentially protected, from any changes to the law, he said.

Martin said any rollback of the IRA would probably have to be done through a Republican budget reconciliation bill, similar to the one the Democrats used to pass the law in 2022. Such bills only require a simple majority in the Senate to pass, as opposed to the 60 votes typically required for controversial legislation.

Trump and Transformers

With such uncertainty ahead, many tax equity investors ― key players in the financing of large renewable energy projects ― are “starting to demand protection against changing law risk,” Martin said. “Many of the provisions we’re seeing require the deal [to] be repriced if there’s an adverse change in law as late as February 2026. Most people think that’s when this process will have played out.”

Martin further cautioned that Trump could reinstate his 2020 executive order making it illegal for U.S. companies to import equipment used on the bulk power system if the secretary of energy, in consultation with other key administration officials, decides such equipment could harm the grid. Biden let the order lapse, but a reinstatement could affect the supply chain for critical equipment, such as transformers, Martin said.

The U.S. has been experiencing a major shortage of transformers, with utilities and power generators seeing wait times of two to four years, according to a recent report from the National Infrastructure Advisory Council. In 2023, Canada, Mexico, China and other Asian nations led a World Bank list of countries that are selling electric transformer components to the U.S.

The election could also affect IRA tax credits ― such as the 45V production tax credit for green hydrogen ― that the IRS has yet to finalize or that require further clarification. Martin expects the IRS to issue “some sort of signaling document” on 45V in November, but a final rule is not expected until January.

Qualifying for the credit could mean that starting in 2028, electricity used for making green hydrogen will have to be renewable and matched hour for hour with production. “That’s not really possible to do at this point, so it’s hard to finance anything,” he said.

The conference balanced this federal uncertainty with the momentum building in Southeastern states for the growing link between renewable energy and economic development, including clean energy manufacturing and data centers.

Commissioner Stamps again provided a concise analysis of what’s going to happen after the election. It’s not about red or blue states or saving the planet, he said. Businesses coming into Mississippi want a diversified mix of generation, with renewables, which could mean tripling or quadrupling renewable energy in the state.

“You don’t get economic development without renewables,” he said.