SPP senior management rolled out its top 2024 corporate goals for its Board of Directors and stakeholders, cautioning they don’t reflect all the important work the grid operator will take on this year.

“While we believe that every one of these goals [either is] … mission critical or [provides] significant strategic value, we’ll also strive to be as affordable as we can be as we undertake these efforts,” COO Lanny Nickell told the board and Members Committee Feb. 6 during their virtual meeting.

Topping the list, of course, is resource adequacy — “one of our greatest risks,” Nickell said —and mitigating those risks. “We’re continuing to see increasing amounts of intermittent generation,” he said. “At the same time, we’re seeing thermal generation being retired, [and] we’re experiencing extreme load growth, and also an increasing threat of extreme weather.”

SPP has listed 15 initiatives that reflect the priorities the Resource and Energy Adequacy Leadership (REAL) Team established in 2023. They include a winter resource adequacy requirement, value-of-lost-load metrics and usage policy, an improved outage policy, and winter and summer planning reserve margin (PRM) revision requests. (See ‘Therapy Session’: SPP REAL Team Reviews Draft LOLE Study.)

Nickell noted the three severe storms that swept across the SPP footprint during the past four winters and said it should not be a surprise the grid operator wants to “continue to enhance our readiness for extreme weather” as its second goal.

He said reports filed after winter storms Uri and Elliott contain 33 recommendations for improvements. Staff plans to close out the remaining open items from the reviews and bring back a final report to the board next January.

“We expect that will complete development of our market policies and will enhance our transmission planning processes to address extreme weather scenarios,” Nickell said.

The other three goals are:

-

- optimizing the generator interconnection (GI) queue’s processing;

- advancing innovative transmission policies; and

- continuing the western expansion’s progress.

All five goals come with specific milestones designed to chart progress and gauge success at year’s end.

“We know priorities will likely change throughout the year. … These could very well get rearranged as we go through the year,” Nickell said. “We know that some of these are going to take years in order to fully effectuate and realize the benefits of the policies and requirements that are being proposed.”

To drive the message home to staff, CEO Barbara Sugg said SPP has, for the first time she could remember, developed a theme for the year: EMBRACE 2024. It’s an acronym for Expansion, Mission, Branding, Reliability, Affordability, Community and Engagement.

“EMBRACE is an acronym, because it’s the world we live in,” she said. “We’re going to see the word ‘EMBRACE 2024’ plastered throughout the [SPP headquarters] building. We really want the employees at every level of the organization to come together under this particular theme as we work on addressing the challenges and the opportunities that we face in 2024.”

Congestion-hedging Policies’ Implementation

SPP’s board and regulators approved the implementation of a package of eight congestion-hedging policies they signed off on in July 2023. The proposals are designed to increase equity, fairness and financial transmission rights awards among market participants. (See SPP Board/Members Committee Briefs: July 24-25, 2023.)

Stakeholders have since added language for the annual long-term congestion rights (LTCRs) analysis performed during each round of the auction revenue right (ARR) nomination process. This ensures nominated candidate ARRs do not violate any transmission-line thermal ratings under normal system conditions.

They also revised the policies to distribute ARR surplus. This includes an iterative approach to the ARR allocation’s first round and the distribution of excess auction revenues. Once approved by FERC, SPP would allocate 50% of the excess revenue in one year under the old method and 50% under the new method. After that, the new process would take over.

Board votes are not disclosed, but the Regional State Committee approved RR591 by a 10-2 vote, with South Dakota’s and North Dakota’s commissioners both casting dissenting votes.

North Dakota’s Randy Christmann said some members have invested the time to make the policies work for them, while others “maybe did less of that.”

“So now we’re just going to socialize it, and I just don’t find that right,” he said.

The board also approved without discussion RR583, which allows SPP to nominate LTCRs for federal service exemption and grandfathered agreement carveouts to further mitigate the load’s exposure to the day-ahead market’s congestion costs.

The rule change became necessary when SPP added the northern portion of the Western Area Power Administration, a federal power marketing agency. WAPA brought with it grandfathered transmission rights that caused some loss of congestion opportunities for other market participants.

“This is certainly not a fix to congestion-hedging issues, but it’s a good small step forward,” said Minnesota Commissioner John Tuma, the RSC’s chair.

Sarah Martz, a member of the Iowa Utilities Board, cast the lone opposing vote against the change during the RSC meeting over concerns it will create more scarcity of LTCRs should congestion-hedging rights be reset.

Compliance Deadline Met

The board and directors approved urgent proposed tariff changes (RR606) setting the PRM to meet a FERC compliance deadline. The change includes explanations of the loss-of-load expectation study methods, assumptions and approval process, and the timeline for the PRM’s approval and implementation process.

Staff met the deadline with a Friday filing, asking for an effective date of April 10.

The proceeding stems from FERC’s rejection in 2023 of several members’ attempt to overturn SPP’s 2022 tariff change raising the PRM from 12% to 15%. The commission in September 2023 denied a rehearing request, modified the discussion and directed the grid operator to make a compliance filing (EL23-40). (See FERC Rejects Protest of SPP PRM Increase.)

American Electric Power, Oklahoma Gas & Electric and Xcel Energy are the SPP members that protested the original order. Stacey Burbure, an AEP vice president, said AEP doesn’t believe the tariff change goes “quite far enough” and is not certain it “fully complies with a directed revisions directed by FERC and its order.”

“Our concern has always been, and remains, having an appropriate level of detail and the tariff to ensure that the process is transparent,” she said. “We fully support the need for flexibility and increasing the planning reserve margin to meet reliability needs, but we also recognize that there needs to be an appropriate balance with respect to the level of the detail and the tariff.”

AEP and Arkansas Electric Cooperative Corp. opposed the measure, which passed the Members Committee’s advisory vote 16-2, with three abstentions. AECC’s Andrew Lachowsky said the cooperative already is adding a 900-MW generating resource but is worried the PRM will be increased again before the unit goes online.

During the RSC’s discussion of RR606, Oklahoma Corporation Commission Chair Todd Hiett offered an amendment that, should the PRM need to be increased by more than a percentage point, the new value would not be effective until at least a year after the regulators’ and directors’ approval.

“Just to ensure we don’t do too much too fast,” Oklahoma Municipal Power Authority’s Dave Osburn said.

The amendment failed, 2-10. The RSC then unanimously approved the measure.

Board Approves Appeal

The board approved renewable interests’ appeal of a revision request (RR592) approved in January by the Markets and Operations Policy Committee, siding with their request to endorse an amendment that failed during that meeting.

The Advanced Power Alliance and nine other members asked directors in a letter to reduce the risk of further GI study delays by adopting the amendment or adding a later cluster study. The amendment would have approved RR592, effective with 2022 and 2023 Phase 2 studies. Instead, MOPC endorsed a fuel-based dispatch adjustment beginning with a 2021 Phase 2 study.

Transmission Working Group Chair Derek Brown, with Evergy, told the board MOPC’s decision could add six to 18 months to the GI backlog mitigation effort. As passed by MOPC, RR592 includes nonfirm, nonlegacy Integrated Transmission Planning generators as prior-queued in steady-state analysis dispatch tables.

David Kelley, SPP’s engineering vice president, said staff supported implementing the measure with the 2022 study.

“It gives us more time to work on any issues that we may see and allows us to complete [the 2021 study], and it wouldn’t prevent us from hopefully completing the goal that we’ve set for completing 2022 [studies] this year,” he said. “I think that sufficiently buys us enough time that we would be comfortable as staff if the board were to adopt the amendment.”

The Members Committee’s advisory vote to the board endorsed the appeal, 10-8, with three abstentions.

Western Expansion ‘Ramping Up’

Bruce Rew, SPP’s senior vice president of operations, said during the quarterly joint stakeholder briefing that the RTO’s western expansion is “ramping up” and “continuing to move forward.”

He said staff has completed drafting tariff changes for RTO West and created 15 revision requests. The first six tariff changes were approved unanimously by the Markets and Operations Policy Committee during January’s meeting, and the full package, including membership agreements and bylaw changes, will be brought to the board’s April quarterly meeting.

Several of the seven utilities in the Rocky Mountains region that are interested in joining the RTO have embedded entities within their balancing areas. SPP is working with the entities to determine how they would participate in the market or pseudo-tie out of the system to join another BA. Staff are preparing the entities to declare their intent by April 1, Rew said.

SPP plans to file its tariff changes May 31, even as systems development begins in April. Go-live is targeted for April 2026.

“We’re pleased with the progress so far,” Rew said.

SPP RTO West could add four states to SPP’s footprint: Arizona, Colorado, Utah and Wyoming.

3rd 100-year Storm in 4 Years

“What would the new year be if we hadn’t already had some kind of an extreme weather event?” Sugg asked rhetorically. “We all know that they’re no longer called 100-year storms when you have three of them in four winters. We might start calling them holiday storms, though, because they all are tied to some national holiday.”

Sugg said SPP experienced its highest 24-hour winter load during the January winter storm and its sixth-highest overall, just missing a seasonal peak by about 400 MW. The grid operator was able to import 6.7 GW from its neighbors at one point, exceeding the 6 GW of imports during the February 2021 storm.

“We were certainly thankful for our interconnections and our interregional transfer capacity,” Sugg said, thanking the RTO’s neighbors. “There is no way that we could have been successful with that winter event if not for our member companies and your system operators.”

Consent Agenda Passes

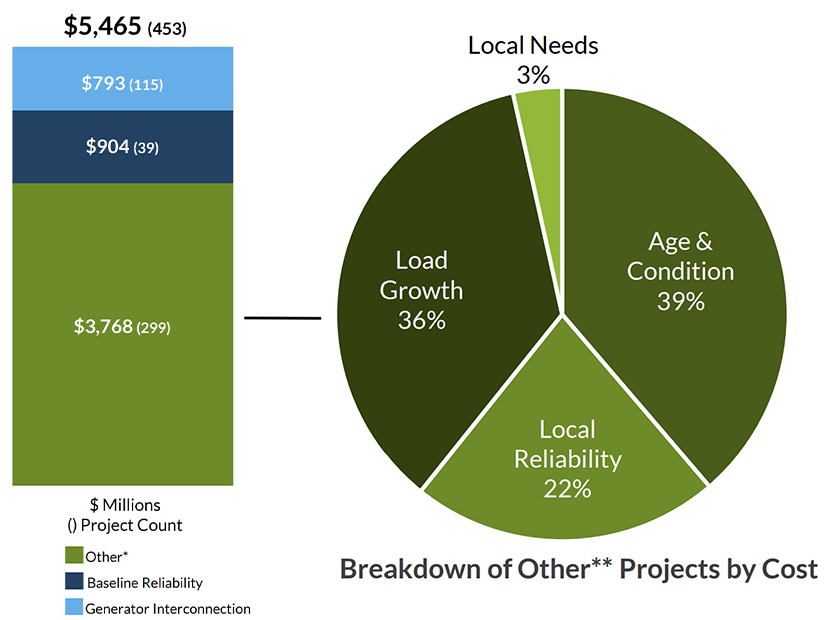

The board’s consent agenda approval included the Corporate Governance Committee’s review of stakeholder group rosters to ensure members’ expertise and geographic locations yield a “widespread and effective representation of the membership”; modification of a notification to construct (NTC) issued to Western Farmers Electric Cooperative for a 20-MVAR capacitor bank; withdrawal of an NTC issued to Southwestern Public Service Co. for a $1.1 million, 115-kV line upgrade; an out-of-cycle re-evaluation of a Northwestern Energy 115-kV project after a new power plant was added to models; the 2024 Transmission Expansion plan; and the 2023 Integrated Transmission Plan’s (ITP) short-term reliability project report.

The consent agenda also included three RRs that:

-

- RR560: move operating criteria language to the system operating limits (SOLs) methodology.

- RR597: document the day-ahead market’s high-level process used for effective limit application.

- RR598: remove planning criteria portions outlining the methodology to develop SOLs and interconnection reliability operating limits in the planning horizon. This aligns with NERC’s retirement of Mandatory Reliability Standard FAC-010-3.