LITTLE ROCK, Ark. — SPP’s Board of Directors has approved the grid operator’s “historic” $7.65 billion package of transmission projects but delayed a decision on a need date for two of the 89 projects after stakeholders pushed back on staff’s staging recommendations.

Stakeholders argued that the two projects in question be staged as soon as possible, with two working groups voting to classify winter-weather projects as persistent operational solutions in approving winter-weather need dates.

Staff recommended using analysis and staging methodology consistent with the tariff and transmission planning manual. They added a Year 2 winter-storm model late in the planning process to calculate December 2028 need dates for the two projects.

Following more than three hours of discussion over two days among themselves and with staff and stakeholders, the directors on Oct. 29 took a Solomonic approach by agreeing to delay a decision on the projects’ need dates to no later than their Dec. 9 board meeting. They rejected the original proposal to set the deadline before their February meeting.

Until then, stakeholders will continue the staging discussion in the working groups. The Markets and Operations Policy Committee (MOPC), which endorsed the 2024 Integrated Transmission Plan (ITP) with 95% approval, also plans to hold a conference call before the December board meeting.

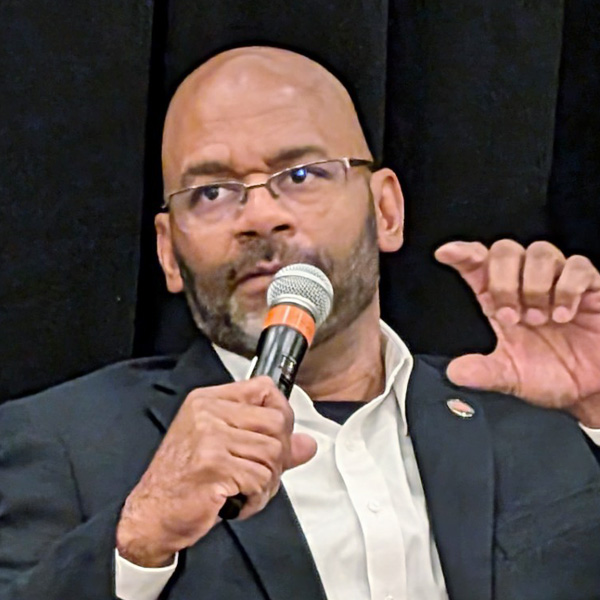

Evergy’s Derek Brown, chair of the Transmission Working Group, said the disconnect between staff and stakeholders emerged over the projects’ need dates. That led stakeholders to endorse the larger projects that make up much of the transmission package’s size.

“We have the models and the inputs, and we spent months building those to support the justification for when these projects are needed … and that got us to the five-year model,” he told directors and stakeholders. “We have projects coming in service. We have load growing. We have generation retiring. We need to look out at least five years to be able to right-size the solutions. So, when we looked at that five-year model, surprise! Things get worse.

“At least from a transmission planning standpoint, all those projects are part of the packaged solution, so they should all have need dates as soon as possible. If the system had shown things get better in Year 5 and we don’t need all of those projects, we wouldn’t be recommending them today.”

“Nothing’s ever easy, and it probably shouldn’t be with this large of a portfolio,” said SPP’s Casey Cathey, vice president of engineering. He noted that the Integrated Transmission Planning (ITP) manual does not have processes for creating historical winter weather models or to determine a need date for projects from past events.

Because staff’s winter-weather models were based on previous extreme conditions during February 2021 and December 2022, stakeholders voted to stage projects as persistent operational projects.

“It became apparent about two months ago that not only is the winter-weather staging not outlined in the manual … but it’s not easily defendable when you look at the governing language,” Cathey said, pointing to multiple sections in the manual and tariff. “If you map all of that, you have to use a Year 2 model to interpolate and determine what the staging needs are.”

The two projects in question are the Tobias-Elm Creek 345-kV transmission line on the western side of SPP’s footprint, an 85-mile segment valued at $887.46 million, and the 154-mile, $484.09 million Buffalo Gap-Delaware 345-kV line from Kansas into Southwest Missouri. The projects were identified in the Winter Storm Uri and Elliott models, respectively.

The first project is expected to increase transfer capability from SPP North to SPP South and decrease the chances for load shed. The second brings a new EHV source into Missouri to support system voltage and transfers from SPP.

Three other projects related to the winter storm projects were given need dates of December 2025 or upon being issued a notification to construct.

The 2024 ITP portfolio is SPP’s largest in both size and value in its 20 years as a transmission planning coordinator, it said. The plan includes 89 transmission projects, representing 2,333 miles of new transmission and 495 miles of rebuilds — including 1,900 miles of the RTO’s first 765-kV lines — to address increasing load growth and changes in the region’s generating fleet. SPP expects the portfolio’s benefits to exceed costs by a ratio of at least 8-to-1.

Despite the package’s cost, MOPC approved the ITP with 95% approval and little discussion of staging. The issue has since bubbled up in the working groups. (See SPP Stakeholders Endorse Record $7.65B Tx Plan.)

The Members Committee approved the board’s motion to delay the staging date for the two projects in their advisory vote, 17-5 with one abstention, with renewable interests providing the opposed votes. They also cast four votes against the portfolio’s approval, expressing concern over the lack of transparency into delayed projects.