FOLSOM, Calif. — CAISO CEO Elliot Mainzer thinks interregional coordination is key to Western states meeting their goals around climate policy and grid reliability in the face of a changing resource mix and increasingly volatile weather conditions.

And getting to that level of cooperation will be most efficient inside the footprint of a single electricity market to serve the broad region, Mainzer said in a Feb. 13 interview with RTO Insider.

“How do you bring different parts of the West together, respect their differences and their desires, interests, policies, preferences, etc., but link them together to really harness the physics and the economics so that everybody can save money and do this reliably and efficiently?” Mainzer said.

The Western Energy Imbalance Market’s (WEIM) role in helping the West respond to extreme weather events provides proof that having just one regional wholesale electricity market would be crucial to meeting decarbonization goals reliably and economically, Mainzer said. The transmission connectivity enabled by the WEIM has allowed entities across the West to share energy in times of need.

“It’s a basic principle of portfolio diversification that the broader the footprint and the deeper the pool of diversity and transmission connectivity … your chances of an economically efficient and reliable solution are better,” he said.

Mainzer and CAISO are pushing to further expand WEIM’s footprint and capabilities by rolling out the Extended Day-Ahead Market (EDAM), which FERC approved in December. (See CAISO Wins (Nearly) Sweeping FERC Approval for EDAM.)

“Our hope would be to try to make sure that everybody that’s currently in EIM would also join our Extended Day-Ahead Market,” he said. “A market footprint that does not optimize that natural transmission connectivity and resource diversity across the West is going to be less optimal for consumers at large in terms of both economics and reliability.”

Mainzer said the ISO is less focused on the markets debate among Western stakeholders than on getting the first tranche of new EDAM members into the market, ensuring that market rules and stakeholder processes are as solid as possible. EDAM so far has commitments from six-state utility PacifiCorp and the Balancing Authority of Northern California, with an announcement from the Los Angeles Department of Water and Power likely pending. (See LADWP Poised to Join CAISO Day-ahead Market After Board OK.)

Long-Term, Interregional Transmission Planning Crucial

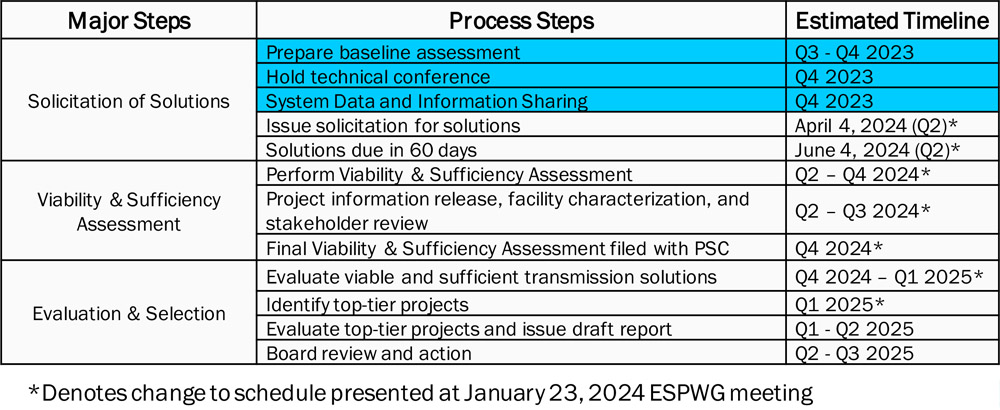

CAISO is also looking to improve long-term, interregional transmission planning, Mainzer said.

The ISO faces the challenge of onboarding roughly 7,000 MW of capacity a year for the next two decades to meet the climate goals set out by California’s Senate Bill 100, he said. To do so, it is prioritizing long-term transmission planning via partnerships with regulatory agencies, utilities and other entities throughout the Western Interconnection to expand transmission interconnectivity.

“We certainly think that both the economic value proposition and the reliability benefits of the Extended-Day Ahead Market will be significantly enhanced by bringing even greater transmission connectivity to the Western system,” he said.

CAISO’s 2022-2023 Transmission Plan provides a 10-year blueprint, and its 20-Year Transmission Outlook, released in May 2022, looks further into the future, forecasting the connectivity needed to meet increasing demand over the next two decades.

The ISO is also developing several interregional transmission lines, including the Ten West Project, which will enable delivery from 1,000 MW of renewables into California from the Southwest while also increasing CAISO’s export capability in the opposite direction. The line is under construction and is expected to be in service by this May.

CAISO last year approved the Southwest Intertie Project-North (SWIP-N), a 285-mile, 500-kV line in Nevada that will allow access to 2,000 MW of Idaho wind resources. The line is expected to be in service by the end of 2026. (See CAISO Board Approves Nevada Transmission Line to Access Idaho Wind.)

Three other interregional transmission lines are in the works as well.

Looking to the Future

While transitioning the grid to non-emitting resources is no easy feat, Mainzer is optimistic about the direction the industry is headed.

“When I think back to where things were when I was first coming in in the late ‘90s and I think about where things are now today in terms of just the sheer amount of renewable resources on the grid and the new technology and the level of market sophistication that we have — we could have never imagined it,” he said.

Mainzer came to CAISO in 2020 when the ISO’s fleet contained only 250 MW of battery storage. The current figure is 7,000 MW and climbing. The grid operator is also integrating more long-duration energy storage, including rapidly evolving batteries that can hold up to 100 hours of storage.

And Mainzer expects to see much more innovation around clean, dispatchable generation in the next 10 to 15 years. He considers himself “energy agnostic,” believing portfolio diversity is key to the energy transition.

“The growth curves are amazing,” he said. “That will bring additional capabilities and allow us to be even less and less dependent on the gas fleet, but certainly for the next few years … we’ll continue to rely on those resources under the most extreme conditions.”

Load flexibility will be important in responding to volatile weather, Mainzer said, particularly with demand response, virtual power plants and other types of adjustable capabilities.

“When we get into these crazy-hot days in the summer and we’re 5 to 10% away from problems, just having 5 to 10% load reduction capability that would be automated and embedded into people’s thermostats to be able to back off that super-peak consumption would be a huge difference maker,” he said.

‘Fabulous Success Story’

Historical tensions between California and the rest of the West, including around the 2000/01 energy crisis, largely stemmed from “immature” resource adequacy programs, Mainzer said, and so CAISO is also focusing on strengthening RA in partnership with other state entities.

“When we don’t take care of business in terms of resource adequacy, our markets go sideways and it becomes very divisive,” Mainzer said. “RA success is the foundation of healthy partnership.”

Mainzer hopes industry participants can look beyond historical friction to enable stronger collaboration in the energy transition.

“I think we tend to focus far too much on the small number, literally handful, of issues that we’ve run into together over many, many years of partnering,” Mainzer said. “I believe that when you look at the facts, when you look at the economic value that’s been created from the partnership between California and its neighbors through transmission optimization, bilateral and market trade, and supporting each other through reliability events, it’s been a fabulous success story.”