New Jersey’s Senate Environment and Energy Committee endorsed a sweeping revision of how clean energy connections to the grid are funded and advanced legislation that would give tax credits to help install electric vehicle charging stations and retrofit warehouses for rooftop solar projects.

The five-member committee on Feb. 5 unanimously supported S209, which would make warehouse retrofit projects eligible for corporate business tax credits of the lesser of $250,000 or half the cost of the project for buildings of at least 100,000 square feet. The bill sets a cumulative total of $25 million awarded in credits under the bill.

The panel voted 4-1 in favor of a second bill, S210, that would provide a tax credit of the lesser of half the cost or $1,000 to pay for an EV charger at a taxpayer’s business, trade or occupation, or at a location where it could be used by tenants or guests of a multifamily or mixed-use property.

The bill also would offer a tax credit for the purchase of a commercial zero emission vehicle that would equal half the additional cost of buying a clean energy vehicle rather than one powered by fossil fuel. The bill would allow for a tax credit of up to $25,000 for a vehicle weighing less than 14,000 pounds, $50,000 for a vehicle weighing between 14,000 and 26,500 pounds, and $100,000 for a vehicle weighing more than 26,500 pounds.

Preparing the Grid

Other bills met more resistance in the committee, which handles much of the state’s clean energy legislation.

The Democrat-controlled committee voted 3-2 along party lines for a bill, S212, that would revise the regulations that set interconnection standards for Class 1 renewable energy sources, crafting them in line with standards written by the Interstate Renewable Energy Council (IREC).

The changes would include the introduction of fixed, one-time “grid modernization fees” to be paid by the project owner to defray the cost of connecting to the grid, “including, but not limited to, costs related to administrative tasks, studies, infrastructure upgrades and grid upgrades carried out by the electric utility.” The fees would be based on the number of kilowatts of energy to be produced by the project, with a limit of $50 per kilowatt for projects less than or equal to 10 kilowatts.

Connection costs not covered by the developer fees would be recovered by the utility from the ratepayers.

Sen. Bob Smith (D), the committee chairman and a bill co-sponsor, said the legislation is aimed at strengthening the state’s ailing grid, which is considered inadequate to handle a surge of new clean energy projects.

“We have a grid that is the equivalent of toothpicks and chewing gum,” Smith said, adding there are lengthy delays before a project can get connected, during which the project often “dies as a result.”

Lyle Rawlings, president of the Mid-Atlantic Solar & Storage Industries Association, said the urgency of the initiative can be seen in his agency’s estimate that on a clear day, solar projects provide 35% of the state’s load between 10 a.m. and 3 p.m. The state has reached an “inflection point,” and the improvements funded by the bill are essential, he said.

“We’re almost in a crisis where the grid is shutting down to new solar,” he said.

But Brian O. Lipman, director of the New Jersey Division of Rate Counsel, in a Feb. 1 letter to the committee, urged senators to hold the bill because it would create “avoidable and expensive electric system upgrades that will be foisted onto captive ratepayers.”

Lipman said the current “beneficiary pays principle” means that developers and the utilities make “efficient siting decisions” because projects for which the connection costs are too high won’t go ahead. “The risk is better handled by the interconnection customer than captive end-use customers,” he said.

Subsidizing Storage

Lipman also opposed S225, which would create an incentive program to support new energy storage systems. New Jersey, like other states, sees an extensive storage capacity as key to creating a renewable energy system that is reliable. But the state has little storage capacity. It failed to reach a legislative goal of installing 600 MW of storage by 2021 and now aims to install 2 GW of storage by 2030. (See New Jersey Offers Plan to Boost Lagging Storage Capacity.)

S225, which the committee approved in a 3-2 vote, would require the New Jersey Board of Public Utilities (NJ BPU) to develop a pilot — and later permanent — program that would award up-front incentives paid in dollars per kilowatt-hour based on the installed capacity of the storage system. The incentive would cover up to 40% of the project cost.

The program would pay a “performance incentive to compensate the owner of a customer-sited energy storage system or front-of-the-meter energy storage system” for the cost of providing “capacity, demand response, load shifting, generation shifting, locational value and voltage support,” according to the bill. It says the cost of the incentives would be “apportioned” to ratepayers.

Lipman, in a Feb. 1 letter to the committee, expressed concern the bill would “impose significant costs on New Jersey’s electric ratepayers, while impairing the state’s ability to leverage other sources of funding for energy storage.” He estimated the incentives would cost the state’s societal benefits charge program $60 million.

But Evan Vaughan, executive director of the Mid-Atlantic Renewable Energy Coalition, said he believed it would “help the market take off in the state.”

“We have numerous front-of-the-meter storage companies in our membership that are eager to develop projects in New Jersey,” he said. “But they need this legislation in order to make those projects pencil.”

Discussion Dispute

Two bills discussed by the committee in order to solicit input, but not voted on, drew vigorous opposition from the business community, while drawing support from environmental groups.

SCR11 would amend the state constitution to prohibit the construction or reconstruction of any new power station that would burn coal, natural gas, oil or petroleum. If approved by the legislature, the proposed prohibition would need voter support in a ballot initiative to be enacted.

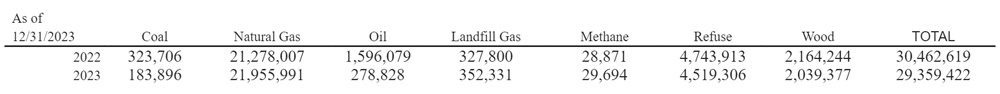

Smith, the bill sponsor, said about 35% of the state’s electricity is generated by nuclear plants and 7% comes from solar projects. The remaining 55% comes from carbon-emitting plants, mostly natural gas.

Michael Egenton, executive vice president at the New Jersey Chamber of Commerce, said changing the constitution over the issue is excessive, and added that prohibiting the plants would stifle the state’s ability to grow and keep businesses.

“We have to make sure that we have reliable, affordable, sustainable energy — and I’m talking about energy all across the board,” he said.

Tina Weishaus, co-chair of the DivestNJ Coalition, and a member of Empower New Jersey, which opposes fossil fuel projects, said that given the health damage to nearby communities, operating such plants is “morally wrong.”

“We cannot live in a world that continues to burn fossil fuels, and create greenhouse gases and toxic pollutants, that are killing us,” she said.

Business groups also opposed S198, which would prohibit the state pension funds and annuity funds from investing in the “200 largest publicly traded fossil fuel companies,” and require the funds divest from any such companies in the existing portfolio.

The divestment should be done “in accordance with sound investment criteria and consistent with their fiduciary obligations,” the bill states. It also gives the director of the State Division of Investment the power to reinvest in fossil fuel companies and funds or continue investing in them if “within a reasonable period of time” the value of the state retirement funds drops to 99.5% or lower of the “hypothetical value had no divestment occurred.”

Smith rejected the suggestion that the state’s divestment would be of no consequence to big fossil fuel companies that do “trillions of dollars of business.” He said they do listen to “governments and institutions in society that stand up and say, ‘You’re going in the wrong direction.’”

But Ray Cantor, a lobbyist for the New Jersey Business and Industry Association, said pension fund managers have a fiduciary responsibility to make decisions that generate as high a return as possible. The state should “not be looking to use our pension funds as a lever to enact public policy,” he said.

Scot Mackey, a lobbyist for the American Petroleum Institute, said the industry is trying to address climate change. Penalizing investment in the industry would penalize the investments “that they’re making in the future, as they try to change and they try to grow into what the future is going to look like,” he said.