MISO has released a new edition of its Reliability Imperative report, with the latest version containing an urgent call to action for all MISO players.

“We have to face some hard realities,” MISO CEO John Bear prefaced the refreshed report. “There are immediate and serious challenges to the reliability of our region’s electric grid, and the entire industry — utilities, states and MISO — must work together and move faster to address them.”

The report emphasized that all three must coordinate at once to avoid a “looming mismatch” between retiring baseload generation and an influx of weather-dependent generation. MISO said members should temper retirements to retain some dispatchable “transition resources” as “reliability insurance.”

MISO first published its Reliability Imperative report in 2020 and has updated it periodically since. It describes the RTO’s risk profile and the steps MISO, members and state regulators should take to mitigate threats.

In a Feb. 21 press release accompanying the report, MISO said that in addition to “significant changes to the generation fleet, the electric power industry is facing an increase in extreme weather events, large load additions, electrification, supply chain issues, permitting delays and fuel assurance issues.”

Members have cut carbon emissions by about 30% since 2005, and Bear said the footprint could cut them by more than 90% in coming years.

“Studies conducted by MISO and other entities indicate it is possible to reliably operate an electric system that has far fewer conventional power plants and far more zero-carbon resources than we have today. However, the transition that is underway to get to a decarbonized end state is posing material, adverse challenges to electric reliability,” Bear warned. He said that until new technologies become viable, MISO will continue to need dispatchable resources.

“We’re seeing traditional generators being replaced by resources that aim to meet clean energy goals but that do not have the same reliability attributes as those they are replacing,” Bear said.

MISO said supply chain and siting and permitting issues outside of MISO’s control are hampering new generation projects that will be crucial to reliability. The grid operator also said the footprint is increasingly housing single-site, large load additions like data centers that planned and existing generation might not be able to accommodate, especially when considering new pressure on the grid from electric vehicles and other electrification.

MISO reported that its South region is experiencing an industrial renaissance and soon could add manufacturing plants producing steel, hydrogen, liquefied natural gas and other heavy industry totaling 1 GW in new demand.

MISO said diminishing generation and load growth over the past decade-plus already have depleted its surplus reserves.

“Since 2022, MISO has been operating near the level of minimum reserve margin requirements,” it said.

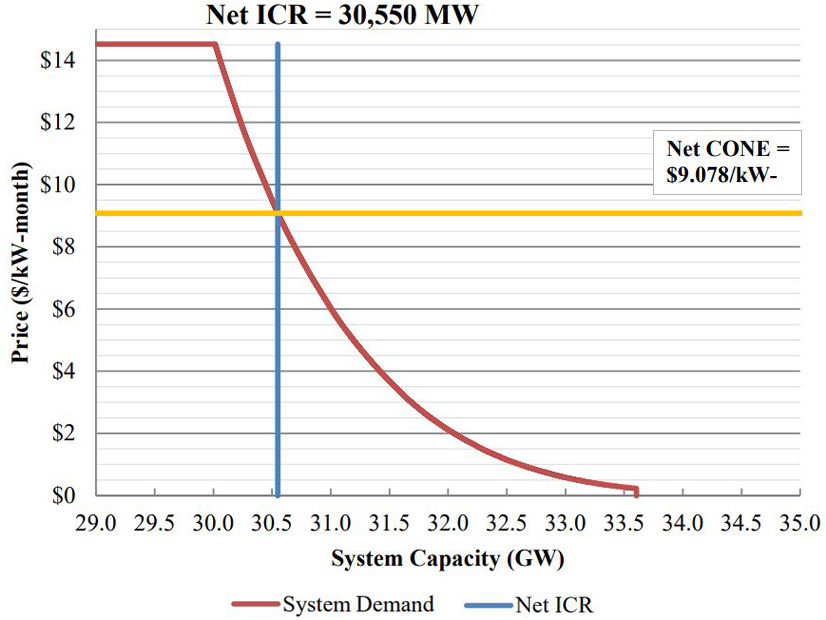

The RTO said ongoing initiatives into 2024 like applying a sloped demand curve in capacity auctions, introducing a capacity accreditation that’s more reflective of actual generator availability and planning a second long-range transmission portfolio should help the footprint make progress toward a more reliable transition.

MISO President Clair Moeller said MISO sees “very little risk of overbuilding the transmission system; the real risk is in a scenario where we have underbuilt the system.”